OPEN-SOURCE SCRIPT

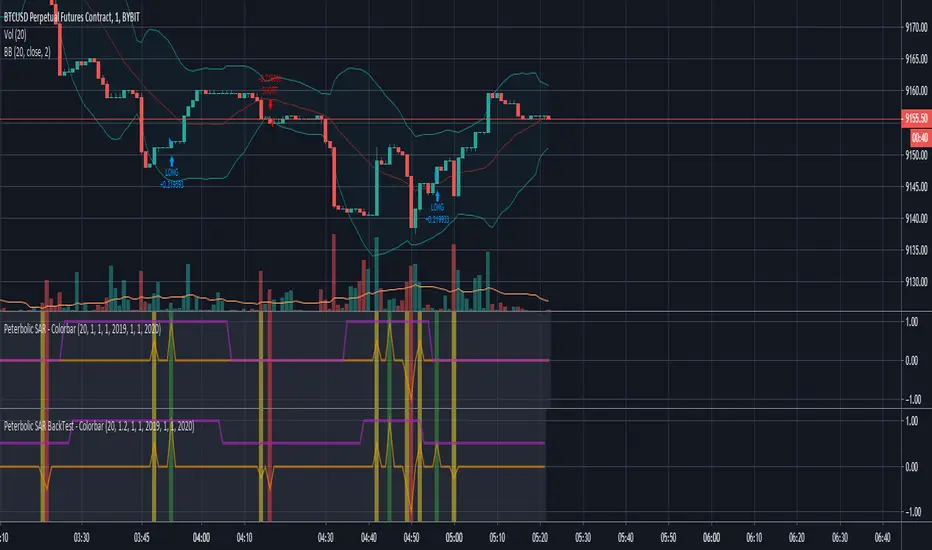

Aggiornato PB SAR BackTest - Colorbar

Indicator with buy/sell alerts for setup/trigger conditions

Built upon Peterbolic SAR current version as of publishing

Built upon Peterbolic SAR current version as of publishing

Note di rilascio

Forgot you have to manually calculate the Heiken Ashi candle values to get the proper signals on normal candles for this oneNote di rilascio

Improved the way the script calculates the plot and what colors to useFixed the alerts to use the original signals that the plot is draw from so no mishaps occur (Pine script and/or Tradingview can get touchy about how you set your alert conditions)

Added a blue indicator line for if we're considered in an uptrend or not based on the current indicator levels

You can usually tell based on the previous values/colors but it's easier to spot immediately at any point when viewing a chart

Note di rilascio

Add option to use Heiken Ashi values (or not) instead of hard setting them, results can vary depending on different time frames and this should help with more strategiesNote di rilascio

AS AN EXAMPLE YOU CAN RUN FOR YOURSELF:BTCUSD

Comparison: 1D and 12H

Flip Heiken Ashi values on and off for both and compare

1D is profitable using HA, but 12H is MUCH more profitable using normal values instead (like 3-4x more)

Comparison: 1m

Flip Heiken Ashi values on and off

HA makes scalping less profitable, but smooths things out so there are less trades and potentially less fees depending on where you're trading

(Usually HA has 60% of the trade count compared to using normal candles)

Note di rilascio

Added offset for limit order placement target based on BBand average between top and bottomMultiplier = 2

Lookback = 20 (default, can be changed)

Offset = (Top - Bottom) / Lookback / Multiplier

Ex:

Top: 10,000

Bottom: 9,000

Lookback: 20

25 = (10,000 - 9,000 ) / 20 / 2

Limit order price = CURRENT + 25

That example would theoretically be a pump or just a high TF if the BBands are that wide

This should give a reasonable entry point based on the TF or current market volatility

WHY? To make your order more likely to get hit and prevent slippage while not getting dinged for fees by using market orders!

In case you're asking, "Why might you not want to use market orders?"

A quote from our large friend Coinbase

"Coinbase Pro is beloved by many for its incredibly low fees, ranging from 0.1% to 0.25% for taker trades, and no fees at all for maker trades."

"Taker" means you're market ordering to take liquidity

"Maker" means you're limit ordering to provide liquidity

If you can take 0% fees on all your trades instead of 0.1% on EVERY trade you make, it's almost a no brainer.

(Some exchanges even do NEGATIVE fees on maker trades which means they PAY you to use limit orders and provide them liquidity!!!!!)

I would also recommend using the same BBand calculation performed above as an order point for other strategies, it can work quite well on many things

Credit for the BBand calculations goes to Noldo:

Note di rilascio

Added Bolinger Band Normalizer value to increase/reduce the offset of order placement based on the volatility at that point in time.Changed the blue line to purple and multiplied it with the BBand Average value to give a visual representation of how much volatility is going on inside the indicator.

The spikes on the orange line will also be larger when the volatility is higher in the same way the purple line does

Note di rilascio

Whoops, forgot to fix the backtesting offset for entry/exit values based on the normalized BBand averageNote di rilascio

Offset was not calculating as needed due to round() going to 0 for all values <0.5Setup so 0.5 should be the default offset from a setup that hits a trigger, because trigger candles have to EXCEED the setup candles in the direction of the trend

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.