OPEN-SOURCE SCRIPT

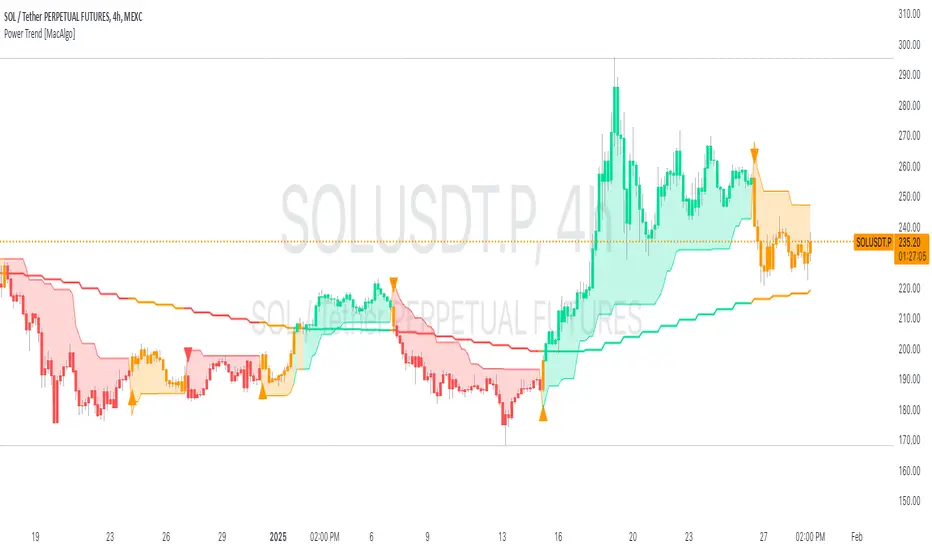

Power Trend [MacAlgo]

Description:

The Power Trend Indicator is a sophisticated technical analysis tool that overlays on your trading charts to identify prevailing market trends. It utilizes a combination of ATR-based trend calculations, moving averages, volume analysis, and momentum indicators to generate reliable buy and sell signals. Additionally, it offers customizable settings to adapt to various trading styles and timeframes.

Key Features:

How it Works:

1. ATR-Based Trend Calculation:

2. Moving Averages:

3. Volume Analysis:

4. Momentum Indicators:

5. Signal Generation:

Customization Options:

Tailor the Power Trend Indicator to your specific trading needs with the following settings:

Visual Components:

Alerts:

Stay informed with customizable alerts that notify you of important market movements:

How to Use:

Important Notes:

Disclaimer:

This indicator is intended for educational purposes only and does not provide financial advice or guarantee future performance. Trading involves risk, and past results are not indicative of future outcomes. Always conduct your own analysis and risk management.

The Power Trend Indicator is a sophisticated technical analysis tool that overlays on your trading charts to identify prevailing market trends. It utilizes a combination of ATR-based trend calculations, moving averages, volume analysis, and momentum indicators to generate reliable buy and sell signals. Additionally, it offers customizable settings to adapt to various trading styles and timeframes.

Key Features:

- Adaptive ATR Calculation: Automatically adjusts the ATR (Average True Range) period and multiplier based on the selected timeframe for more accurate trend detection.

- Dynamic Trend Lines: Plots continuous trend lines with color-coded bars to visually represent bullish and bearish trends.

- Buy/Sell Signals: Generates standard and power buy/sell signals to help you make informed trading decisions.

- Volume Analysis: Incorporates average buy and sell volumes to identify strong market movements.

- Multiple Timeframe Support: Automatically adjusts the indicator's timeframe or allows for manual selection to suit your trading preferences.

- Highlighting: Highlights trending bars for easy visualization of market conditions.

- Alerts: Customizable alert conditions to notify you of potential trading opportunities in real-time.

How it Works:

1. ATR-Based Trend Calculation:

- ATR Period & Multiplier: Calculates ATR based on user-defined periods and multipliers, dynamically adjusting according to the chart's timeframe.

- Trend Determination: Identifies trends as bullish (1) or bearish (-1) based on price movements relative to ATR-based upper (up) and lower (dn) trend lines.

2. Moving Averages:

- EMA & SMA: Calculates exponential and simple moving averages to smooth price data and identify underlying trends.

- AlphaTrend Line: Combines a 50-period EMA and a 30-period SMA on a 4-hour timeframe to create the AlphaTrend line, providing a robust trend reference.

3. Volume Analysis:

- Buy/Sell Volume: Differentiates between buy and sell volumes to gauge market strength.

- Average Volume: Compares current volume against average buy/sell volumes to detect significant market movements.

4. Momentum Indicators:

- RSI, MACD, OBV: Incorporates Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and On-Balance Volume (OBV) to assess momentum and confirm trend strength.

5. Signal Generation:

- Standard Signals: Basic buy and sell signals based on trend crossovers.

- Power Signals: Enhanced signals requiring multiple conditions (e.g., increased volume, momentum confirmation) for higher confidence trades.

Customization Options:

Tailor the Power Trend Indicator to your specific trading needs with the following settings:

- ATR Period: Set the period for ATR calculation (default: 8).

- ATR Multiplier: Adjust the ATR multiplier to fine-tune trend sensitivity (default: 3.0).

- Source: Choose the price source (e.g., HL2, Close) for calculations.

- Change ATR Calculation Method: Toggle between different ATR calculation methods.

- Show Buy/Sell Signals: Enable or disable the display of buy and sell signals on the chart.

- Highlighting: Turn on or off the bar highlighting feature.

- Timeframe Adjustment: Choose between automatic timeframe adjustment or manually set

- the indicator's timeframe.

- Manual Indicator Timeframe: If manual adjustment is selected, specify the desired timeframe (default: 60 minutes).

Visual Components:

- Trend Lines: Continuous lines representing the current trend, color-coded for easy identification (green for bullish, red for bearish, orange for neutral).

- Bar Coloring: Bars are colored based on the current trend and its relationship to the AlphaTrend line.

- Buy/Sell Triangles: Triangular markers appear on the chart to indicate buy and sell signals.

- Power Signals: Larger triangles highlight strong buy and sell opportunities based on multiple confirming factors.

- Highlighting: Transparent overlays highlight trending areas to enhance visual clarity.

Alerts:

Stay informed with customizable alerts that notify you of important market movements:

- SuperTrend Buy/Sell: Alerts when standard buy or sell signals are generated.

- Power Buy/Sell Alerts: Notifications for strong buy or sell signals based on comprehensive conditions.

- Trend Direction Change: Alerts when the trend changes from bullish to bearish or vice versa.

How to Use:

- Add to Chart: Apply the Power Trend Indicator to your preferred trading chart on TradingView.

- Configure Settings: Adjust the input parameters to match your trading style and the timeframe you are analyzing.

- Analyze Trends: Observe the trend lines, bar colors, and AlphaTrend line to understand the current market trend.

- Follow Signals: Look for buy and sell signals or power signals to identify potential entry and exit points.

- Set Alerts: Enable alerts to receive real-time notifications of significant trading opportunities.

- Adjust as Needed: Fine-tune the settings based on market conditions and your trading experience.

Important Notes:

- Backtesting: While the Power Trend Indicator is built using robust technical analysis principles, it's essential to backtest and validate its performance within your trading strategy.

- Market Conditions: The indicator performs best in trending markets. In sideways or highly volatile markets, signal reliability may vary.

- Risk Management: Always employ proper risk management techniques when trading based on indicator signals to protect your capital.

Disclaimer:

This indicator is intended for educational purposes only and does not provide financial advice or guarantee future performance. Trading involves risk, and past results are not indicative of future outcomes. Always conduct your own analysis and risk management.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.