OPEN-SOURCE SCRIPT

Whale VWAP Heatmap

What it does

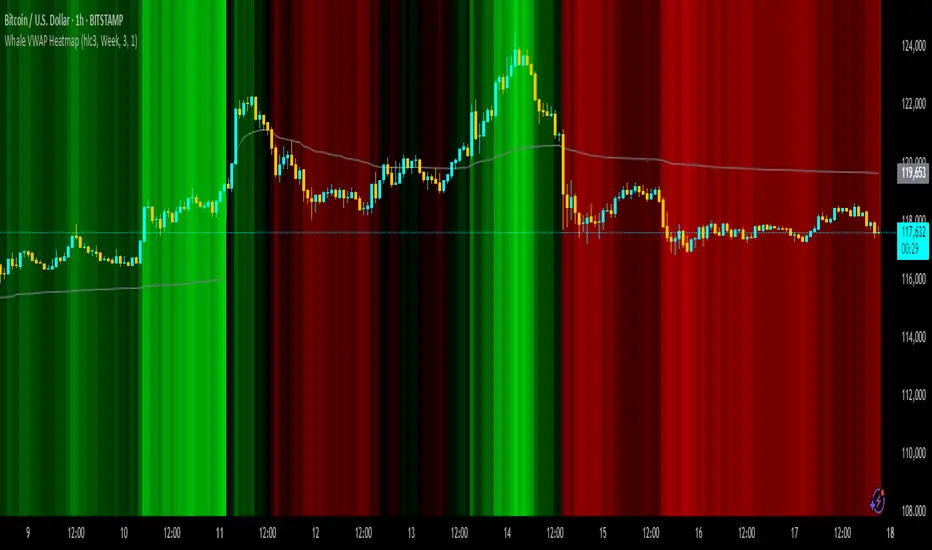

This indicator paints a heatmap around an anchored VWAP to make market context obvious at a glance.

Above VWAP → cyan background

Below VWAP → amber background

The farther price is from VWAP (in %), the stronger the color intensity.

How it works

Uses an anchored VWAP that resets on the period you choose (Session / Week / Month / Quarter / Year / Decade / Century / Earnings / Dividends / Splits).

Computes the percentage distance between price and VWAP, then maps that distance to background opacity.

Optional VWAP line can be shown/hidden.

Inputs (Settings)

Anchor Period — choose when VWAP resets (Session→Year, plus E/D/S options).

Source — price source (default hlc3).

Hide on D/W/M (Session only) — hides the script on Daily/Weekly/Monthly when anchor=Session (avoids NA behavior).

Enable Heatmap — turn background coloring on/off.

Max distance for full color (%) — at/above this % from VWAP, color hits full intensity (typical 0.5–2% depending on volatility).

Show VWAP Line / Line Color/Width — visual preference.

How to read it (quick playbook)

Context first: color tells you if price is trading above/below “fair value” (VWAP).

Intensity = how stretched price is from VWAP.

Use it to frame bias (above/below VWAP) and to avoid chasing extended moves.

Notes & limitations

Requires volume (VWAP is volume-weighted). If the data vendor doesn’t provide volume for the symbol, the script will stop.

For intraday, Session anchor is common. For swing/context, try Week or Month.

This indicator paints a heatmap around an anchored VWAP to make market context obvious at a glance.

Above VWAP → cyan background

Below VWAP → amber background

The farther price is from VWAP (in %), the stronger the color intensity.

How it works

Uses an anchored VWAP that resets on the period you choose (Session / Week / Month / Quarter / Year / Decade / Century / Earnings / Dividends / Splits).

Computes the percentage distance between price and VWAP, then maps that distance to background opacity.

Optional VWAP line can be shown/hidden.

Inputs (Settings)

Anchor Period — choose when VWAP resets (Session→Year, plus E/D/S options).

Source — price source (default hlc3).

Hide on D/W/M (Session only) — hides the script on Daily/Weekly/Monthly when anchor=Session (avoids NA behavior).

Enable Heatmap — turn background coloring on/off.

Max distance for full color (%) — at/above this % from VWAP, color hits full intensity (typical 0.5–2% depending on volatility).

Show VWAP Line / Line Color/Width — visual preference.

How to read it (quick playbook)

Context first: color tells you if price is trading above/below “fair value” (VWAP).

Intensity = how stretched price is from VWAP.

Use it to frame bias (above/below VWAP) and to avoid chasing extended moves.

Notes & limitations

Requires volume (VWAP is volume-weighted). If the data vendor doesn’t provide volume for the symbol, the script will stop.

For intraday, Session anchor is common. For swing/context, try Week or Month.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.