EPMA % Impulsive| QuantEdgeB

🔍 What Is EPMA % Impulsive?

A volatility‐standardized impulse oscillator built on a forward-projected, low-lag moving average baseline. It transforms raw price into a 0–100% “impulse meter” by:

1. Trend Projection: Smoothing price with a double-EMA and fitting a short-term regression line that’s extended forward to anticipate direction.

2. Volatility Normalization: Wrapping that projected level in dynamic standard-deviation bands, then scaling price within those bands to a percentage scale.

3. Impulse Thresholds: Offering fixed, percentile-based, or rolling-volatility triggers to distinguish genuine bursts from noise.

💡 Why It’s Special

• Forward-Looking Base: By projecting the regression line forward, it reduces lag and “chases” trends intelligently.

• Noise-Aware Scaling: Volatility bands adapt in real time—quiet markets tighten bands, explosive markets widen them—ensuring the % reading always reflects true impulse, not random jitter.

• Flexible Thresholds: Static levels for simplicity, percentile ranks for regime-aware signals, or full standard-deviation bands for a purely data-driven approach.

• Dual Signal Styles: “Impulsive” mode for raw crossovers; “Smooth” mode for filtered breakouts that favor trend persistence.

⚙️ Key Components (High-Level)

1. DEMA Regression Engine

o Smooths price with double-EMA, fits a rolling regression, then projects it forward.

2. Volatility Bands

o Computes ±N × SD around the projected line to capture current turbulence.

3. % Scaling & Smoothing

o Maps price into a 0–100% range within those bands, then applies a final EMA to stabilize.

4. Impulse Triggers

o Crosses of the % line vs. your chosen thresholds generate long/short flags.

5. Visualization & Alerts

o Color-coded candles, threshold lines, zone fills, arrow markers, plus alert conditions on crossover/crossunder.

💼 Use Cases & Advantages

• Swing-Entry Precision

Pinpoint true momentum bursts for tighter entries and stops—avoiding false breakouts in choppy environments.

• Trend Confirmation

Validate whether a breakout is a sustained impulse (e.g., > 75th percentile) or just a spike that quickly fades.

• Regime Adaptability

Automatically tune sensitivity in low-volatility consolidations versus high-volatility expansions—no manual adjustments needed.

• Multi-Asset Versatility

Works seamlessly on stocks, futures, FX, crypto, and commodities—because it normalizes entirely to volatility, not price scale.

• Clarity & Confidence

A single, easy-to-interpret % reading plus visual cues make momentum obvious at a glance—empowering quick, data-driven decisions.

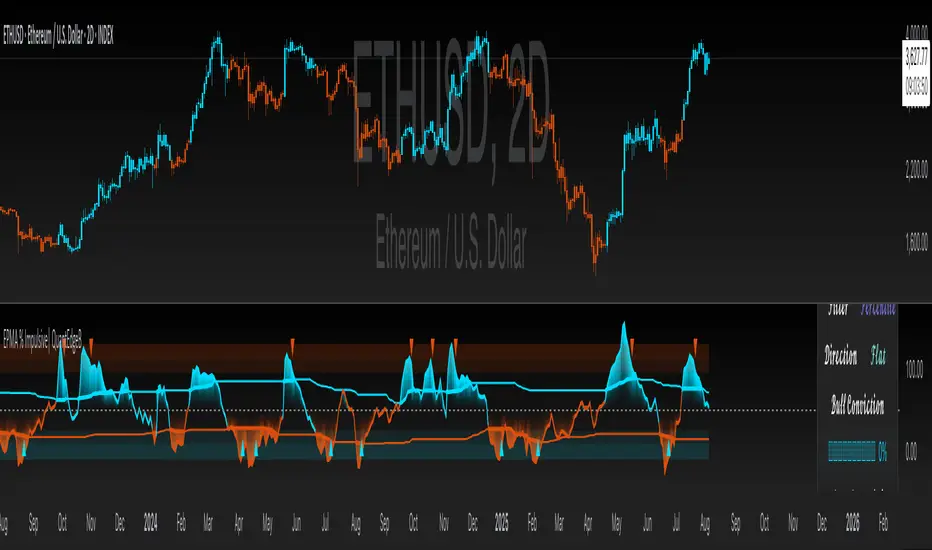

• Couple of charts examples.

BTC 1D

ETH 12H

SOL 8H

DOGE 4H

📌 Disclaimer:

Backtest results are based on past performance and do not guarantee future success. Always incorporate real-time validation and risk management in live trading.

🎨 Default Settings (Example)

• EPMA Lookback: 21 bars, forward-project 50 bars

• Volatility Band: ±2 × SD over 20 bars

• Threshold Type: Percentile 75/25 over 70 bars

• Signal Mode: Impulsive, Bar Color = On

📌 In Summary

EPMA % Impulsive | QuantEdgeB is your forward-projecting, volatility-aware momentum meter—combining regression forecasting with adaptive scaling to surface only the most meaningful impulse moves. Whether you’re timing swing entries or validating breakouts, it turns raw price into a clear, normalized impulse signal that adapts to any market regime.

🔹 Disclaimer: Past performance is not indicative of future results. No trading strategy can guarantee success in financial markets.

🔹 Strategic Advice: Always backtest, optimize, and align parameters with your trading objectives and risk tolerance before live trading.

Script su invito

Solo gli utenti approvati dall'autore possono accedere a questo script. È necessario richiedere e ottenere l'autorizzazione per utilizzarlo. Tale autorizzazione viene solitamente concessa dopo il pagamento. Per ulteriori dettagli, seguire le istruzioni dell'autore riportate di seguito o contattare direttamente QuantEdgeB.

TradingView NON consiglia di acquistare o utilizzare uno script a meno che non si abbia piena fiducia nel suo autore e se ne comprenda il funzionamento. È inoltre possibile trovare alternative gratuite e open source nei nostri script della community.

Istruzioni dell'autore

whop.com/quantedgeb/ 💎

🔹 Unlock our free toolbox:

tradinglibrary.carrd.co/ 🛠️

Disclaimer: All resources and indicators provided are for educational purposes only

Declinazione di responsabilità

Script su invito

Solo gli utenti approvati dall'autore possono accedere a questo script. È necessario richiedere e ottenere l'autorizzazione per utilizzarlo. Tale autorizzazione viene solitamente concessa dopo il pagamento. Per ulteriori dettagli, seguire le istruzioni dell'autore riportate di seguito o contattare direttamente QuantEdgeB.

TradingView NON consiglia di acquistare o utilizzare uno script a meno che non si abbia piena fiducia nel suo autore e se ne comprenda il funzionamento. È inoltre possibile trovare alternative gratuite e open source nei nostri script della community.

Istruzioni dell'autore

whop.com/quantedgeb/ 💎

🔹 Unlock our free toolbox:

tradinglibrary.carrd.co/ 🛠️

Disclaimer: All resources and indicators provided are for educational purposes only