OPEN-SOURCE SCRIPT

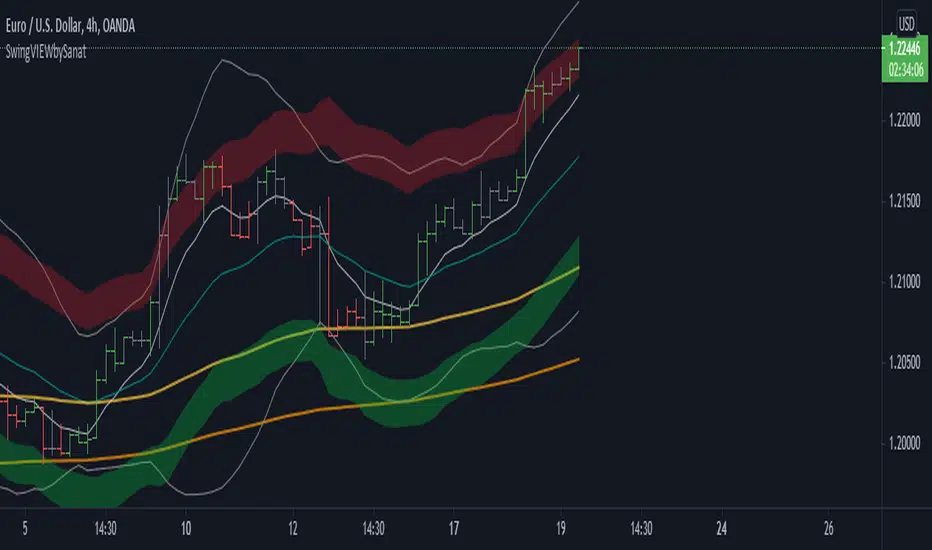

Aggiornato SVIEW

This is momentum based indicator

Input

1. Two EMA

2. Stochastic

Thought process

1. Difference between fast and slow ema has a oscillating nature.

2. Stochastic %k %d crossover gives early signals

3. early entry gives low risk high reward setup

Calculation

1. A= EMA (fast) - EMA (slow)

2. B =Stochastic(%K)-Stochastic(%D)

When A is increasing and B is positive, bar is green

When A is decreasing and B is negative, bar is red

Else, bar is black

Use

This is an early entry signal system. When used with Channel trading system, it gives high probability, low risk high reward setups

Example

When price has breached below -2 Keltner channel, and impulse candle turns green, go long (or sell put options )

29 minutes ago

Release Notes:

This is combination of

1. Ema diff

2. stochastic

3. Keltner channel

4. Bollinger bands

5. bunch of EMAs

Thought process

1. Difference between fast and slow ema has a oscillating nature.

2. Stochastic %k %d crossover gives early signals

3. early entry gives low risk high reward setup

Calculation

1. A= EMA (fast) - EMA (slow)

2. B =Stochastic(%K)-Stochastic(%D)

When A is increasing and B is positive, bar is green

When A is decreasing and B is negative, bar is red

Else, bar is black

Use

This is an early entry signal system. When used with Channel trading system, it gives high probability, low risk high reward setups

Example

When price has breached below -2 Keltner channel, and impulse candle turns green, go long (or sell put options )

Input

1. Two EMA

2. Stochastic

Thought process

1. Difference between fast and slow ema has a oscillating nature.

2. Stochastic %k %d crossover gives early signals

3. early entry gives low risk high reward setup

Calculation

1. A= EMA (fast) - EMA (slow)

2. B =Stochastic(%K)-Stochastic(%D)

When A is increasing and B is positive, bar is green

When A is decreasing and B is negative, bar is red

Else, bar is black

Use

This is an early entry signal system. When used with Channel trading system, it gives high probability, low risk high reward setups

Example

When price has breached below -2 Keltner channel, and impulse candle turns green, go long (or sell put options )

29 minutes ago

Release Notes:

This is combination of

1. Ema diff

2. stochastic

3. Keltner channel

4. Bollinger bands

5. bunch of EMAs

Thought process

1. Difference between fast and slow ema has a oscillating nature.

2. Stochastic %k %d crossover gives early signals

3. early entry gives low risk high reward setup

Calculation

1. A= EMA (fast) - EMA (slow)

2. B =Stochastic(%K)-Stochastic(%D)

When A is increasing and B is positive, bar is green

When A is decreasing and B is negative, bar is red

Else, bar is black

Use

This is an early entry signal system. When used with Channel trading system, it gives high probability, low risk high reward setups

Example

When price has breached below -2 Keltner channel, and impulse candle turns green, go long (or sell put options )

Note di rilascio

Default layout simplifiedLogic for bar color modified

Note di rilascio

update in this version1. for bar color, smooth stochastic used in place of stochastic

2. default layout made visually more simple

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.