OPEN-SOURCE SCRIPT

Aggiornato Buying Opportunity Score V2.1

Overview

A composite scoring system (0-100) that identifies high-probability buying opportunities during market pullbacks. Validated through backtesting on SPY from 2010-2024.

How It Works

The indicator combines multiple fear and oversold signals into a single actionable score. When fear is elevated and the market is oversold, the score rises. Higher scores historically correlate with better forward returns.

Scoring Components

VIX Level (30 pts) - Market fear gauge

Drawdown (30 pts) - Distance from 52-week high

RSI 14 (12 pts) - Oversold confirmation

Bollinger Band (13 pts) - Statistical extreme

VIX Timing (15 pts) - Bonus when VIX declining from peak

Signal Levels

80+ = STRONG BUY (high conviction)

70-79 = BUY (consider entry)

60-69 = WATCH (monitor closely)

Below 60 = No signal

Backtest Results (SPY, 2010-2024)

70+ Signals: 85% win rate, 7.5% average 20-day return

80+ Signals: 100% win rate, 14% average 20-day return

Features

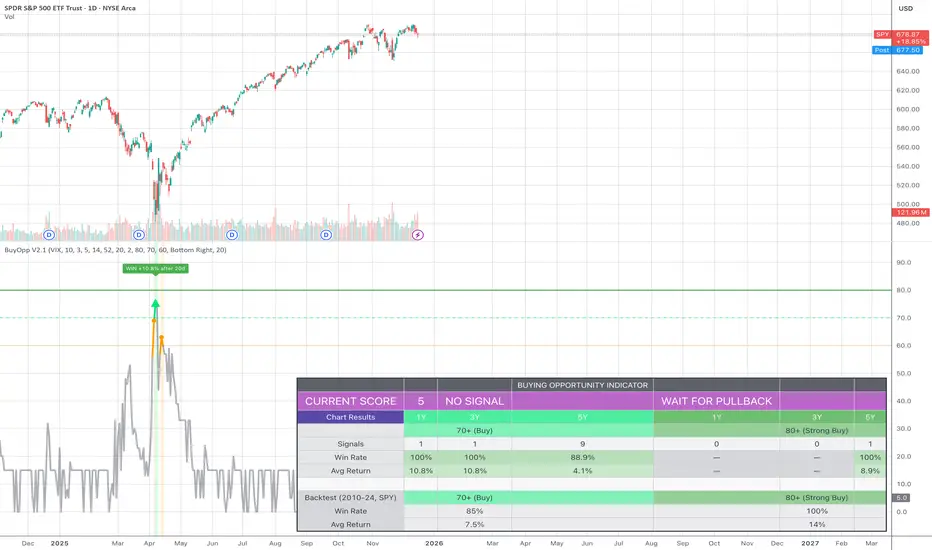

Statistics table showing 1Y, 3Y, 5Y rolling performance

Signal markers (green triangles) on buy signals

Outcome labels showing WIN/LOSS after measurement period

Multiple alert options

Works on SPY, QQQ, IWM (use VIX for all)

How To Use

Add to SPY, QQQ, or IWM (daily timeframe)

Wait for score to reach 70+ or 80+

Green triangle marks signal day

Check statistics table for recent performance

Set alerts for notifications

Alerts Available

STRONG BUY Signal (80+)

BUY Signal (70+)

Moderate Signal (60+)

Score Crossed 80/70

Score Dropped Below 70

Important Notes

Designed for daily timeframe on broad market ETFs

Signals confirm at end of day (bar close)

Statistics table shows rolling windows based on loaded data

Past performance does not guarantee future results

A composite scoring system (0-100) that identifies high-probability buying opportunities during market pullbacks. Validated through backtesting on SPY from 2010-2024.

How It Works

The indicator combines multiple fear and oversold signals into a single actionable score. When fear is elevated and the market is oversold, the score rises. Higher scores historically correlate with better forward returns.

Scoring Components

VIX Level (30 pts) - Market fear gauge

Drawdown (30 pts) - Distance from 52-week high

RSI 14 (12 pts) - Oversold confirmation

Bollinger Band (13 pts) - Statistical extreme

VIX Timing (15 pts) - Bonus when VIX declining from peak

Signal Levels

80+ = STRONG BUY (high conviction)

70-79 = BUY (consider entry)

60-69 = WATCH (monitor closely)

Below 60 = No signal

Backtest Results (SPY, 2010-2024)

70+ Signals: 85% win rate, 7.5% average 20-day return

80+ Signals: 100% win rate, 14% average 20-day return

Features

Statistics table showing 1Y, 3Y, 5Y rolling performance

Signal markers (green triangles) on buy signals

Outcome labels showing WIN/LOSS after measurement period

Multiple alert options

Works on SPY, QQQ, IWM (use VIX for all)

How To Use

Add to SPY, QQQ, or IWM (daily timeframe)

Wait for score to reach 70+ or 80+

Green triangle marks signal day

Check statistics table for recent performance

Set alerts for notifications

Alerts Available

STRONG BUY Signal (80+)

BUY Signal (70+)

Moderate Signal (60+)

Score Crossed 80/70

Score Dropped Below 70

Important Notes

Designed for daily timeframe on broad market ETFs

Signals confirm at end of day (bar close)

Statistics table shows rolling windows based on loaded data

Past performance does not guarantee future results

Note di rilascio

Overview:A composite scoring system (0-100) that identifies high-probability buying opportunities during market pullbacks. Validated through backtesting on SPY from 2010-2024.

How It Works

The indicator combines multiple fear and oversold signals into a single actionable score. When fear is elevated and the market is oversold, the score rises. Higher scores historically correlate with better forward returns.

Scoring Components

VIX Level (30 pts) - Market fear gauge

Drawdown (30 pts) - Distance from 52-week high

RSI 14 (12 pts) - Oversold confirmation

Bollinger Band (13 pts) - Statistical extreme

VIX Timing (15 pts) - Bonus when VIX declining from peak

Signal Levels

80+ = STRONG BUY (high conviction)

70-79 = BUY (consider entry)

60-69 = WATCH (monitor closely)

Below 60 = No signal

Backtest Results (SPY, 2010-2024)

70+ Signals: 85% win rate, 7.5% average 20-day return

80+ Signals: 100% win rate, 14% average 20-day return

Features

Statistics table showing 1Y, 3Y, 5Y rolling performance

Signal markers (green triangles) on buy signals

Outcome labels showing WIN/LOSS after measurement period

Multiple alert options

Works on SPY, QQQ, IWM (use VIX for all)

How To Use

Add to SPY, QQQ, or IWM (daily timeframe)

Wait for score to reach 70+ or 80+

Green triangle marks signal day

Check statistics table for recent performance

Set alerts for notifications

Alerts Available

STRONG BUY Signal (80+)

BUY Signal (70+)

Moderate Signal (60+)

Score Crossed 80/70

Score Dropped Below 70

Important Notes

Designed for daily timeframe on broad market ETFs

Signals confirm at end of day (bar close)

Statistics table shows rolling windows based on loaded data

Past performance does not guarantee future results

Note di rilascio

OverviewA composite scoring system (0-100) that identifies high-probability buying opportunities during market pullbacks. Validated through backtesting on SPY from 2010-2024.

How It Works

The indicator combines multiple fear and oversold signals into a single actionable score. When fear is elevated and the market is oversold, the score rises. Higher scores historically correlate with better forward returns.

Scoring Components

VIX Level (30 pts) - Market fear gauge

Drawdown (30 pts) - Distance from 52-week high

RSI 14 (12 pts) - Oversold confirmation

Bollinger Band (13 pts) - Statistical extreme

VIX Timing (15 pts) - Bonus when VIX declining from peak

Current Score

The table displays your live score (0-100) with context:

0-29 = WAIT FOR PULLBACK - Market calm, no opportunity

30-49 = NOT ACTIONABLE - Mild stress

50-59 = MONITOR - Fear rising

60-69 = WATCH - Potential entry soon

70-79 = BUY - Consider entering

80+ = STRONG BUY - High conviction entry

Signal Levels

80+ = STRONG BUY (high conviction)

70-79 = BUY (consider entry)

60-69 = WATCH (monitor closely)

Below 60 = No signal

Backtest Results (SPY, 2010-2024)

70+ Signals: 85% win rate, 7.5% average 20-day return

80+ Signals: 100% win rate, 14% average 20-day return

Features

Statistics table showing 1Y, 3Y, 5Y rolling performance

Signal markers (green triangles) on buy signals

Outcome labels showing WIN/LOSS result after 20 days

Multiple alert options

Works on SPY, QQQ, IWM (use VIX for all)

How To Use

Add to SPY, QQQ, or IWM (daily timeframe)

Check the CURRENT SCORE row for today's reading

Wait for score to reach 70+ or 80+

Green triangle marks signal day

Set alerts for notifications

Alerts Available

STRONG BUY Signal (80+)

BUY Signal (70+)

Moderate Signal (60+)

Score Crossed 80/70

Score Dropped Below 70

Important Notes

Designed for daily timeframe on broad market ETFs

Signals confirm at end of day (bar close)

Chart Results show rolling 1Y/3Y/5Y performance from loaded data

Backtest row shows validated 2010-2024 SPY results

Past performance does not guarantee future results

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.