OPEN-SOURCE SCRIPT

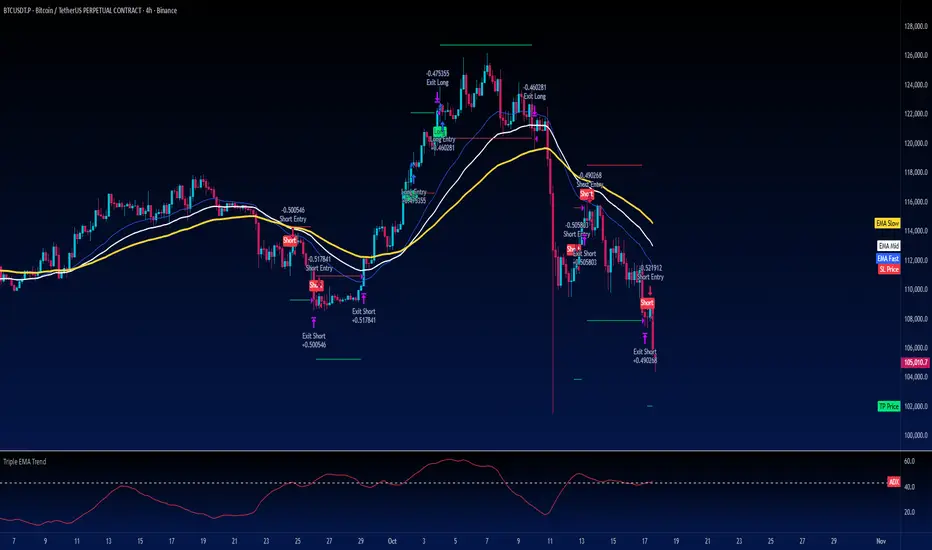

Aggiornato Turtle Strategy - Triple EMA Trend with ADX and ATR

Description

The Triple EMA Trend strategy is a directional momentum system built on the alignment of three exponential moving averages and a strong ADX confirmation filter. It is designed to capture established trends while maintaining disciplined risk management through ATR-based stops and targets.

Core Logic

The system activates only under high-trend conditions, defined by the Average Directional Index (ADX) exceeding a configurable threshold (default: 43).

A bullish setup occurs when the short-term EMA is above the mid-term EMA, which in turn is above the long-term EMA, and price trades above the fastest EMA.

A bearish setup is the mirror condition.

Execution Rules

Entry:

• Long when ADX confirms trend strength and EMA alignment is bullish.

• Short when ADX confirms trend strength and EMA alignment is bearish.

Exit:

• Stop Loss: 1.8 × ATR below (for longs) or above (for shorts) the entry price.

• Take Profit: 3.3 × ATR in the direction of the trade.

Both parameters are configurable.

Additional Features

• Start/end date inputs for controlled backtesting.

• Selective activation of long or short trades.

• Built-in commission and position sizing (percent of equity).

• Full visual representation of EMAs, ADX, stop-loss, and target levels.

This strategy emphasizes clean trend participation, strict entry qualification, and consistent reward-to-risk structure. Ideal for swing or medium-term testing across trending assets.

The Triple EMA Trend strategy is a directional momentum system built on the alignment of three exponential moving averages and a strong ADX confirmation filter. It is designed to capture established trends while maintaining disciplined risk management through ATR-based stops and targets.

Core Logic

The system activates only under high-trend conditions, defined by the Average Directional Index (ADX) exceeding a configurable threshold (default: 43).

A bullish setup occurs when the short-term EMA is above the mid-term EMA, which in turn is above the long-term EMA, and price trades above the fastest EMA.

A bearish setup is the mirror condition.

Execution Rules

Entry:

• Long when ADX confirms trend strength and EMA alignment is bullish.

• Short when ADX confirms trend strength and EMA alignment is bearish.

Exit:

• Stop Loss: 1.8 × ATR below (for longs) or above (for shorts) the entry price.

• Take Profit: 3.3 × ATR in the direction of the trade.

Both parameters are configurable.

Additional Features

• Start/end date inputs for controlled backtesting.

• Selective activation of long or short trades.

• Built-in commission and position sizing (percent of equity).

• Full visual representation of EMAs, ADX, stop-loss, and target levels.

This strategy emphasizes clean trend participation, strict entry qualification, and consistent reward-to-risk structure. Ideal for swing or medium-term testing across trending assets.

Note di rilascio

Updated data set.How to Use

Works best on trending markets such as BTC/USD, major forex pairs, or strong equities.

Use the inputs panel to:

• Adjust EMA, ADX, and ATR lengths to suit your timeframe.

• Enable or disable short trades.

• Set custom backtesting start and end dates.

The chart will display all EMAs, ADX, stop-loss, and take-profit levels, along with entry labels.

Default position size is 5% of equity per trade with commission simulation.

Originality

Unlike basic EMA crossover systems, this script combines triple EMA structure with a strict ADX filter to eliminate low-momentum periods. It also includes full ATR-based risk management and controlled backtesting inputs, making it a self-contained trend-following framework for systematic testing.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

🔥Get the Cyatophilum Indicators today and automate them on Binance! => blockchainfiesta.com/strategies/

Discord Server: discord.gg/RVwBkpnQzm

I am taking PineScript Commissions ✔

=> blockchainfiesta.com/contact/

Discord Server: discord.gg/RVwBkpnQzm

I am taking PineScript Commissions ✔

=> blockchainfiesta.com/contact/

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

🔥Get the Cyatophilum Indicators today and automate them on Binance! => blockchainfiesta.com/strategies/

Discord Server: discord.gg/RVwBkpnQzm

I am taking PineScript Commissions ✔

=> blockchainfiesta.com/contact/

Discord Server: discord.gg/RVwBkpnQzm

I am taking PineScript Commissions ✔

=> blockchainfiesta.com/contact/

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.