OPEN-SOURCE SCRIPT

Aggiornato Enhanced McClellan Summation Index

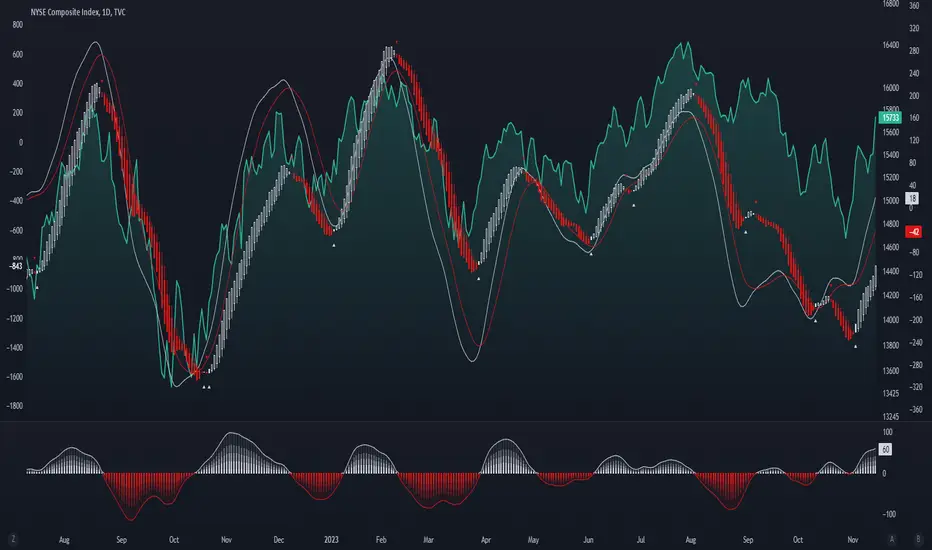

The Enhanced McClellan Summation Index (MSI) is a comprehensive tool that transforms the MSI indicator with Heikin-Ashi visualization, offering improved trend analysis and momentum insights. This indicator includes MACD and it's histogram calculations to refine trend signals, minimize false positives and offer additional momentum analysis.

Methodology:

McClellan Summation Index (MSI) -

The MSI begins by calculating the ratio between advancing and declining issues in the specified index.

float decl = 𝘐𝘯𝘥𝘪𝘤𝘦 𝘥𝘦𝘤𝘭𝘪𝘯𝘪𝘯𝘨 𝘪𝘴𝘴𝘶𝘦𝘴

float adv = 𝘐𝘯𝘥𝘪𝘤𝘦 𝘢𝘥𝘷𝘢𝘯𝘤𝘪𝘯𝘨 𝘪𝘴𝘴𝘶𝘦𝘴

float ratio = (adv - decl) / (adv + decl)

It then computes a cumulative sum of the MACD (the difference between a 19-period EMA and a 39-period EMA) of this ratio. The result is a smoothed indicator reflecting market breadth and momentum.

macd(float r) =>

ta.ema(r, 19) - ta.ema(r, 39)

float msi = ta.cum(macd(ratio))

Heikin-Ashi Transformation -

Heikin-Ashi is a technique that uses a modified candlestick formula to create a smoother representation of price action. It averages the open, close, high, and low prices of the current and previous periods. This transformation reduces noise and provides a clearer view of trends.

type bar

float o = open

float h = high

float l = low

float c = close

bar b = bar.new()

float ha_close = math.avg(b.o, b.h, b.l, b.c)

MACD and Histogram -

The Enhanced MSI incorporates MACD and histogram calculations to provide additional momentum analysis and refine trend signals. The MACD represents the difference between the 12-period EMA and the 26-period EMA of the MSI. The histogram is the visual representation of the difference between the MACD and its signal line.

Options:

- Index Selection - Choose from

NYA,

NDX, or

XAX to tailor the MSI-HA to the desired market index.

- MACD Settings - Adjust the parameters for the MACD calculation to fine-tune the indicator's responsiveness.

- Ratio Multiplier - Apply scaling to the MSI to suit different market conditions and indices.

Benefits of Heikin-Ashi -

- Smoothed Trends - Heikin-Ashi reduces market noise, providing a more apparent and smoothed representation of trends.

- Clearer Patterns - Candlestick patterns are more distinct, aiding in the identification of trend reversals and continuations.

Utility and Use Cases:

- Trend & Momentum Analysis - Utilize the tool's Heikin-Ashi visualization for clearer trend identification in confluence with it's MACD and histogram to gain additional insights into the strength and direction of trends, while filtering out potential false positives.

- Breadth Analysis - Explore market breadth through the MSI's cumulative breadth indicator, gauging the overall health and strength of the underlying market.

- Alerts Setup Guide -

The Enhanced MSI is a robust indicator that combines the breadth analysis of the McClellan Summation Index with the clarity of Heikin-Ashi visualization and additional momentum insights from MACD and histogram calculations. Its customization options make it adaptable to various indices and market conditions, offering traders a comprehensive tool for trend and momentum analysis.

Note di rilascio

improved methodology, added support for plot export to new SuperTrend ToolKitNote di rilascio

Added alerts, improved methodology.Note di rilascio

Added option for any alert call.Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.