OPEN-SOURCE SCRIPT

Aggiornato Lorentzian Classification - Advanced Trading Dashboard

Lorentzian Classification - Relativistic Market Analysis

A Journey from Theory to Trading Reality

What began as fascination with Einstein's relativity and Lorentzian geometry has evolved into a practical trading tool that bridges theoretical physics and market dynamics. This indicator represents months of wrestling with complex mathematical concepts, debugging intricate algorithms, and transforming abstract theory into actionable trading signals.

The Theoretical Foundation

Lorentzian Distance in Market Space

Traditional Euclidean distance treats all feature differences equally, but markets don't behave uniformly. Lorentzian distance, borrowed from spacetime geometry, provides a more nuanced similarity measure:

d(x,y) = Σ ln(1 + |xi - yi|)

This logarithmic formulation naturally handles:

Scale invariance: Large price moves don't overwhelm small but significant patterns

Outlier robustness: Extreme values are dampened rather than dominating

Non-linear relationships: Captures market behavior better than linear metrics

K-Nearest Neighbors with Relativistic Weighting

The algorithm searches historical market states for patterns similar to current conditions. Each neighbor receives weight inversely proportional to its Lorentzian distance:

w = 1 / (1 + distance)

This creates a "gravitational" effect where closer patterns have stronger influence on predictions.

The Implementation Challenge

Creating meaningful market features required extensive experimentation:

Price Features: Multi-timeframe momentum (1, 2, 3, 5, 8 bar lookbacks) Volume Features: Relative volume analysis against 20-period average

Volatility Features: ATR and Bollinger Band width normalization Momentum Features: RSI deviation from neutral and MACD/price ratio

Each feature undergoes min-max normalization to ensure equal weighting in distance calculations.

The Prediction Mechanism

For each current market state:

Feature Vector Construction: 12-dimensional representation of market conditions

Historical Search: Scan lookback period for similar patterns using Lorentzian distance

Neighbor Selection: Identify K nearest historical matches

Outcome Analysis: Examine what happened N bars after each match

Weighted Prediction: Combine outcomes using distance-based weights

Confidence Calculation: Measure agreement between neighbors

Technical Hurdles Overcome

Array Management: Complex indexing to prevent look-ahead bias

Distance Calculations: Optimizing nested loops for performance

Memory Constraints: Balancing lookback depth with computational limits

Signal Filtering: Preventing clustering of identical signals

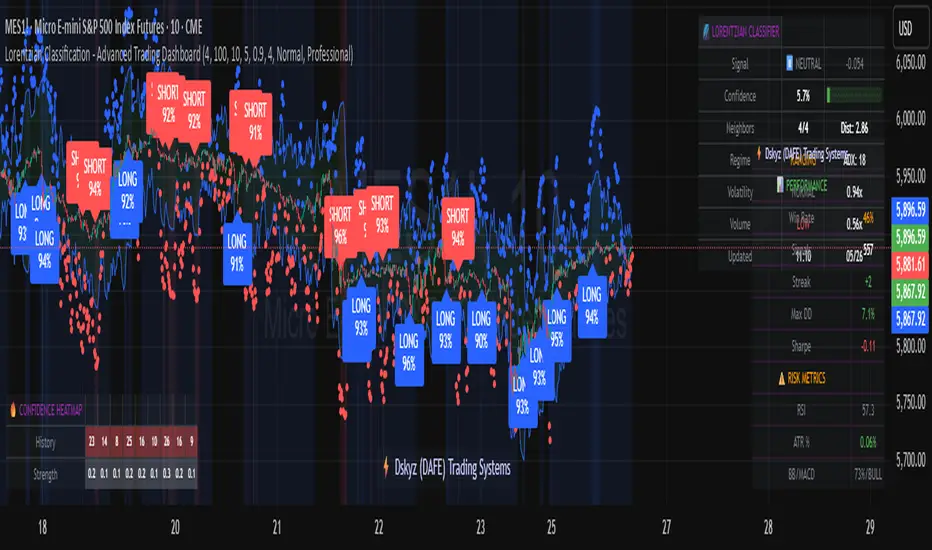

Advanced Dashboard System

Main Control Panel

The primary dashboard provides real-time market intelligence:

Signal Status: Current prediction with confidence percentage

Neighbor Analysis: How many historical patterns match current conditions

Market Regime: Trend strength, volatility, and volume analysis

Temporal Context: Real-time updates with timestamp

Performance Analytics

Comprehensive tracking system monitors:

Win Rate: Percentage of successful predictions

Signal Count: Total predictions generated

Streak Analysis: Current winning/losing sequence

Drawdown Monitoring: Maximum equity decline

Sharpe Approximation: Risk-adjusted performance estimate

Risk Assessment Panel

Multi-dimensional risk analysis:

RSI Positioning: Overbought/oversold conditions

ATR Percentage: Current volatility relative to price

Bollinger Position: Price location within volatility bands

MACD Alignment: Momentum confirmation

Confidence Heatmap

Visual representation of prediction reliability:

Historical Confidence: Last 10 periods of prediction certainty

Strength Analysis: Magnitude of prediction values over time

Pattern Recognition: Color-coded confidence levels for quick assessment

Input Parameters Deep Dive

Core Algorithm Settings

K Nearest Neighbors (1-20): More neighbors create smoother but less responsive signals. Optimal range 5-8 for most markets.

Historical Lookback (50-500): Deeper history improves pattern recognition but reduces adaptability. 100-200 bars optimal for most timeframes.

Feature Window (5-30): Longer windows capture more context but reduce sensitivity. Match to your trading timeframe.

Feature Selection

Price Changes: Essential for momentum and reversal detection Volume Profile: Critical for institutional activity recognition Volatility Measures: Key for regime change detection Momentum Indicators: Vital for trend confirmation

Signal Generation

Prediction Horizon (1-20): How far ahead to predict. Shorter horizons for scalping, longer for swing trading.

Signal Threshold (0.5-0.9): Confidence required for signal generation. Higher values reduce false signals but may miss opportunities.

Smoothing (1-10): EMA applied to raw predictions. More smoothing reduces noise but increases lag.

Visual Design Philosophy

Color Themes

Professional: Corporate blue/red for institutional environments Neon: Cyberpunk cyan/magenta for modern aesthetics

Matrix: Green/red hacker-inspired palette Classic: Traditional trading colors

Information Hierarchy

The dashboard system prioritizes information by importance:

Primary Signals: Largest, most prominent display

Confidence Metrics: Secondary but clearly visible

Supporting Data: Detailed but unobtrusive

Historical Context: Available but not distracting

Trading Applications

Signal Interpretation

Long Signals: Prediction > threshold with high confidence

Look for volume confirmation

- Check trend alignment

- Verify support levels

Short Signals: Prediction < -threshold with high confidence

Confirm with resistance levels

- Check for distribution patterns

- Verify momentum divergence

- Market Regime Adaptation

Trending Markets: Higher confidence in directional signals

Ranging Markets: Focus on reversal signals at extremes

Volatile Markets: Require higher confidence thresholds

Low Volume: Reduce position sizes, increase caution

Risk Management Integration

Confidence-Based Sizing: Larger positions for higher confidence signals

Regime-Aware Stops: Wider stops in volatile regimes

Multi-Timeframe Confirmation: Align signals across timeframes

Volume Confirmation: Require volume support for major signals

Originality and Innovation

This indicator represents genuine innovation in several areas:

Mathematical Approach

First application of Lorentzian geometry to market pattern recognition. Unlike Euclidean-based systems, this naturally handles market non-linearities.

Feature Engineering

Sophisticated multi-dimensional feature space combining price, volume, volatility, and momentum in normalized form.

Visualization System

Professional-grade dashboard system providing comprehensive market intelligence in intuitive format.

Performance Tracking

Real-time performance analytics typically found only in institutional trading systems.

Development Journey

Creating this indicator involved overcoming numerous technical challenges:

Mathematical Complexity: Translating theoretical concepts into practical code

Performance Optimization: Balancing accuracy with computational efficiency

User Interface Design: Making complex data accessible and actionable

Signal Quality: Filtering noise while maintaining responsiveness

The result is a tool that brings institutional-grade analytics to individual traders while maintaining the theoretical rigor of its mathematical foundation.

Best Practices

- Parameter Optimization

- Start with default settings and adjust based on:

Market Characteristics: Volatile vs. stable

Trading Timeframe: Scalping vs. swing trading

Risk Tolerance: Conservative vs. aggressive

Signal Confirmation

Never trade on Lorentzian signals alone:

Price Action: Confirm with support/resistance

Volume: Verify with volume analysis

Multiple Timeframes: Check higher timeframe alignment

Market Context: Consider overall market conditions

Risk Management

Position Sizing: Scale with confidence levels

Stop Losses: Adapt to market volatility

Profit Targets: Based on historical performance

Maximum Risk: Never exceed 2-3% per trade

Disclaimer

This indicator is for educational and research purposes only. It does not constitute financial advice or guarantee profitable trading results. The Lorentzian classification system reveals market patterns but cannot predict future price movements with certainty. Always use proper risk management, conduct your own analysis, and never risk more than you can afford to lose.

Market dynamics are inherently uncertain, and past performance does not guarantee future results. This tool should be used as part of a comprehensive trading strategy, not as a standalone solution.

Bringing the elegance of relativistic geometry to market analysis through sophisticated pattern recognition and intuitive visualization.

Thank you for sharing the idea. You're more than a follower, you're a leader!

vasanthgautham1221

Trade with precision. Trade with insight.

— Dskyz, for DAFE Trading Systems

A Journey from Theory to Trading Reality

What began as fascination with Einstein's relativity and Lorentzian geometry has evolved into a practical trading tool that bridges theoretical physics and market dynamics. This indicator represents months of wrestling with complex mathematical concepts, debugging intricate algorithms, and transforming abstract theory into actionable trading signals.

The Theoretical Foundation

Lorentzian Distance in Market Space

Traditional Euclidean distance treats all feature differences equally, but markets don't behave uniformly. Lorentzian distance, borrowed from spacetime geometry, provides a more nuanced similarity measure:

d(x,y) = Σ ln(1 + |xi - yi|)

This logarithmic formulation naturally handles:

Scale invariance: Large price moves don't overwhelm small but significant patterns

Outlier robustness: Extreme values are dampened rather than dominating

Non-linear relationships: Captures market behavior better than linear metrics

K-Nearest Neighbors with Relativistic Weighting

The algorithm searches historical market states for patterns similar to current conditions. Each neighbor receives weight inversely proportional to its Lorentzian distance:

w = 1 / (1 + distance)

This creates a "gravitational" effect where closer patterns have stronger influence on predictions.

The Implementation Challenge

Creating meaningful market features required extensive experimentation:

Price Features: Multi-timeframe momentum (1, 2, 3, 5, 8 bar lookbacks) Volume Features: Relative volume analysis against 20-period average

Volatility Features: ATR and Bollinger Band width normalization Momentum Features: RSI deviation from neutral and MACD/price ratio

Each feature undergoes min-max normalization to ensure equal weighting in distance calculations.

The Prediction Mechanism

For each current market state:

Feature Vector Construction: 12-dimensional representation of market conditions

Historical Search: Scan lookback period for similar patterns using Lorentzian distance

Neighbor Selection: Identify K nearest historical matches

Outcome Analysis: Examine what happened N bars after each match

Weighted Prediction: Combine outcomes using distance-based weights

Confidence Calculation: Measure agreement between neighbors

Technical Hurdles Overcome

Array Management: Complex indexing to prevent look-ahead bias

Distance Calculations: Optimizing nested loops for performance

Memory Constraints: Balancing lookback depth with computational limits

Signal Filtering: Preventing clustering of identical signals

Advanced Dashboard System

Main Control Panel

The primary dashboard provides real-time market intelligence:

Signal Status: Current prediction with confidence percentage

Neighbor Analysis: How many historical patterns match current conditions

Market Regime: Trend strength, volatility, and volume analysis

Temporal Context: Real-time updates with timestamp

Performance Analytics

Comprehensive tracking system monitors:

Win Rate: Percentage of successful predictions

Signal Count: Total predictions generated

Streak Analysis: Current winning/losing sequence

Drawdown Monitoring: Maximum equity decline

Sharpe Approximation: Risk-adjusted performance estimate

Risk Assessment Panel

Multi-dimensional risk analysis:

RSI Positioning: Overbought/oversold conditions

ATR Percentage: Current volatility relative to price

Bollinger Position: Price location within volatility bands

MACD Alignment: Momentum confirmation

Confidence Heatmap

Visual representation of prediction reliability:

Historical Confidence: Last 10 periods of prediction certainty

Strength Analysis: Magnitude of prediction values over time

Pattern Recognition: Color-coded confidence levels for quick assessment

Input Parameters Deep Dive

Core Algorithm Settings

K Nearest Neighbors (1-20): More neighbors create smoother but less responsive signals. Optimal range 5-8 for most markets.

Historical Lookback (50-500): Deeper history improves pattern recognition but reduces adaptability. 100-200 bars optimal for most timeframes.

Feature Window (5-30): Longer windows capture more context but reduce sensitivity. Match to your trading timeframe.

Feature Selection

Price Changes: Essential for momentum and reversal detection Volume Profile: Critical for institutional activity recognition Volatility Measures: Key for regime change detection Momentum Indicators: Vital for trend confirmation

Signal Generation

Prediction Horizon (1-20): How far ahead to predict. Shorter horizons for scalping, longer for swing trading.

Signal Threshold (0.5-0.9): Confidence required for signal generation. Higher values reduce false signals but may miss opportunities.

Smoothing (1-10): EMA applied to raw predictions. More smoothing reduces noise but increases lag.

Visual Design Philosophy

Color Themes

Professional: Corporate blue/red for institutional environments Neon: Cyberpunk cyan/magenta for modern aesthetics

Matrix: Green/red hacker-inspired palette Classic: Traditional trading colors

Information Hierarchy

The dashboard system prioritizes information by importance:

Primary Signals: Largest, most prominent display

Confidence Metrics: Secondary but clearly visible

Supporting Data: Detailed but unobtrusive

Historical Context: Available but not distracting

Trading Applications

Signal Interpretation

Long Signals: Prediction > threshold with high confidence

Look for volume confirmation

- Check trend alignment

- Verify support levels

Short Signals: Prediction < -threshold with high confidence

Confirm with resistance levels

- Check for distribution patterns

- Verify momentum divergence

- Market Regime Adaptation

Trending Markets: Higher confidence in directional signals

Ranging Markets: Focus on reversal signals at extremes

Volatile Markets: Require higher confidence thresholds

Low Volume: Reduce position sizes, increase caution

Risk Management Integration

Confidence-Based Sizing: Larger positions for higher confidence signals

Regime-Aware Stops: Wider stops in volatile regimes

Multi-Timeframe Confirmation: Align signals across timeframes

Volume Confirmation: Require volume support for major signals

Originality and Innovation

This indicator represents genuine innovation in several areas:

Mathematical Approach

First application of Lorentzian geometry to market pattern recognition. Unlike Euclidean-based systems, this naturally handles market non-linearities.

Feature Engineering

Sophisticated multi-dimensional feature space combining price, volume, volatility, and momentum in normalized form.

Visualization System

Professional-grade dashboard system providing comprehensive market intelligence in intuitive format.

Performance Tracking

Real-time performance analytics typically found only in institutional trading systems.

Development Journey

Creating this indicator involved overcoming numerous technical challenges:

Mathematical Complexity: Translating theoretical concepts into practical code

Performance Optimization: Balancing accuracy with computational efficiency

User Interface Design: Making complex data accessible and actionable

Signal Quality: Filtering noise while maintaining responsiveness

The result is a tool that brings institutional-grade analytics to individual traders while maintaining the theoretical rigor of its mathematical foundation.

Best Practices

- Parameter Optimization

- Start with default settings and adjust based on:

Market Characteristics: Volatile vs. stable

Trading Timeframe: Scalping vs. swing trading

Risk Tolerance: Conservative vs. aggressive

Signal Confirmation

Never trade on Lorentzian signals alone:

Price Action: Confirm with support/resistance

Volume: Verify with volume analysis

Multiple Timeframes: Check higher timeframe alignment

Market Context: Consider overall market conditions

Risk Management

Position Sizing: Scale with confidence levels

Stop Losses: Adapt to market volatility

Profit Targets: Based on historical performance

Maximum Risk: Never exceed 2-3% per trade

Disclaimer

This indicator is for educational and research purposes only. It does not constitute financial advice or guarantee profitable trading results. The Lorentzian classification system reveals market patterns but cannot predict future price movements with certainty. Always use proper risk management, conduct your own analysis, and never risk more than you can afford to lose.

Market dynamics are inherently uncertain, and past performance does not guarantee future results. This tool should be used as part of a comprehensive trading strategy, not as a standalone solution.

Bringing the elegance of relativistic geometry to market analysis through sophisticated pattern recognition and intuitive visualization.

Thank you for sharing the idea. You're more than a follower, you're a leader!

vasanthgautham1221

Trade with precision. Trade with insight.

— Dskyz, for DAFE Trading Systems

Note di rilascio

Update: Fixed Performance Dashboard MetricsFixed an issue with the performance dashboard showing incorrect metrics. The win rate, PnL, and other statistics were being calculated before trades had time to complete their prediction horizon, resulting in odd numbers.

Now properly tracks signal history and only evaluates performance after the prediction period has passed, giving accurate win rates and returns.

Due to the complexity of implementing Lorentzian distance calculations with k-nearest neighbors classification, this was overlooked in our excitement to get the core algorithm working. Sometimes when you're pushing the boundaries with advanced physics-based indicators, the simple stuff gets missed!

Thanks to everyone using this - your feedback helps us refine these cutting-edge tools. The dashboard now shows real, actionable performance metrics. 🚀

Note di rilascio

Minor adjustment to input.Note di rilascio

* I updated with branding. I forgot about this because I was just too excited to get this released. Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Empowering everyday traders and DAFE Trading Systems

DAFETradingSystems.com

DAFETradingSystems.com

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Empowering everyday traders and DAFE Trading Systems

DAFETradingSystems.com

DAFETradingSystems.com

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.