✈️ Boeing (BA) – Final Leg of Macro Bull Run | Wave 5 to 1.618 Extension ($1200) 🚀

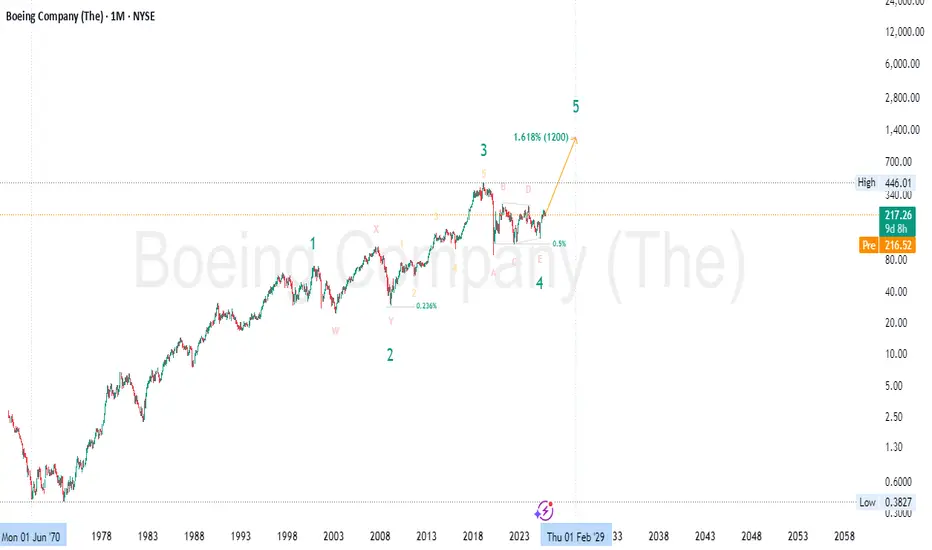

📅 Timeframe: Monthly (Macro Cycle Outlook)

📍 Current Price: $217

🎯 Wave 5 Target: ~$1200 (1.618 Extension)

🌀 Wave Theory Structure

Boeing appears to be entering Wave 5 of a long-term Elliott Wave cycle:

This is a textbook impulsive wave structure playing out on the monthly macro scale — with a final bullish leg now unfolding.

📐 Fibonacci Confluence

🧠 Smart Money Concepts (SMC)

🔹 Accumulation Phase (2020–2024): After COVID crash and multi-year consolidation, price has shown strong accumulation characteristics

🔹 Final Sweep of Lows (E leg) flushed out late longs and retail stops before institutional re-entry

🔹 Break of Structure (BOS) confirms transition from reaccumulation to markup phase 📈

🔹 Price is now in a reprice phase — a classic SMC trait where value is rapidly adjusted after institutional positioning completes

📊 Price Action Analysis

💼 Fundamental Outlook

Boeing is regaining strength after multiple challenging years:

Although regulatory and delivery risks remain, Boeing’s turnaround story is gathering steam — aligning with the technical forecast of Wave 5 acceleration.

🔍 Summary

Boeing is entering what could be the final and most explosive leg (Wave 5) of its macro Elliott Wave cycle. Key confluences include:

✅ Elliott Wave triangle completion

✅ Fibonacci 1.618 extension to ~$1200

✅ Institutional accumulation confirmed

✅ Price Action breakout from multi-year structure

✅ Improving long-term fundamentals

This setup favors long-term swing positions, with pullbacks offering buying opportunities until the final cycle target is approached. 🧠📈

⚠️ Disclaimer: This is not financial advice. For educational purposes only. Always do your own due diligence and manage risk responsibly. 🛡️

#Boeing #BA #ElliottWave #SmartMoney #PriceAction #Fibonacci #Wave5 #TriangleBreakout #TechnicalAnalysis #LongTermInvestment #MacroTrading #StockMarket #BullishOutlook #Aerospace #WaveTheory #SwingTrading #AviationRecovery #FibonacciTargets #TradingStrategy

📅 Timeframe: Monthly (Macro Cycle Outlook)

📍 Current Price: $217

🎯 Wave 5 Target: ~$1200 (1.618 Extension)

🌀 Wave Theory Structure

Boeing appears to be entering Wave 5 of a long-term Elliott Wave cycle:

- ✅ Wave 1: Multi-decade rise until the early 2000s

- ✅ Wave 2: Complex correction (W–X–Y) into 2009 lows

- ✅ Wave 3: Powerful rally through 2019, completed with an extended 5-wave subdivision

- ✅ Wave 4: A large-scale triangle correction (ABCDE) — now completed, as price has broken structure upward

- 🚀 Wave 5: Projected move toward the 1.618 Fibonacci extension (~$1200) from the 1–3 wave distance

This is a textbook impulsive wave structure playing out on the monthly macro scale — with a final bullish leg now unfolding.

📐 Fibonacci Confluence

- Wave 2 retraced ~0.236 of Wave 1 (shallow, bullish corrective behavior)

- Wave 4 retraced ~0.5 of Wave 3 — typical for triangle patterns and expanded flats

- Wave 5 target at 1.618 Fib extension measured from Wave 1–3 aligns around $1200, completing the 5-wave macro cycle 🔺

🧠 Smart Money Concepts (SMC)

🔹 Accumulation Phase (2020–2024): After COVID crash and multi-year consolidation, price has shown strong accumulation characteristics

🔹 Final Sweep of Lows (E leg) flushed out late longs and retail stops before institutional re-entry

🔹 Break of Structure (BOS) confirms transition from reaccumulation to markup phase 📈

🔹 Price is now in a reprice phase — a classic SMC trait where value is rapidly adjusted after institutional positioning completes

📊 Price Action Analysis

- Bullish breakout from triangle structure

- Monthly higher low established at E-wave base

- Strong bullish candle from demand zone — early confirmation of trend continuation

- Break above $260 would open clean skies toward the next major resistance at ATH ($446) and beyond 🧭

💼 Fundamental Outlook

Boeing is regaining strength after multiple challenging years:

- ✈️ Rebound in global aviation demand

- 📦 Growing defense & aerospace contracts amid rising geopolitical tensions

- 💰 Expected recovery in cash flows, backlog, and profitability

- 🌐 Expansion in space and unmanned systems (future growth verticals)

Although regulatory and delivery risks remain, Boeing’s turnaround story is gathering steam — aligning with the technical forecast of Wave 5 acceleration.

🔍 Summary

Boeing is entering what could be the final and most explosive leg (Wave 5) of its macro Elliott Wave cycle. Key confluences include:

✅ Elliott Wave triangle completion

✅ Fibonacci 1.618 extension to ~$1200

✅ Institutional accumulation confirmed

✅ Price Action breakout from multi-year structure

✅ Improving long-term fundamentals

This setup favors long-term swing positions, with pullbacks offering buying opportunities until the final cycle target is approached. 🧠📈

⚠️ Disclaimer: This is not financial advice. For educational purposes only. Always do your own due diligence and manage risk responsibly. 🛡️

#Boeing #BA #ElliottWave #SmartMoney #PriceAction #Fibonacci #Wave5 #TriangleBreakout #TechnicalAnalysis #LongTermInvestment #MacroTrading #StockMarket #BullishOutlook #Aerospace #WaveTheory #SwingTrading #AviationRecovery #FibonacciTargets #TradingStrategy

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.