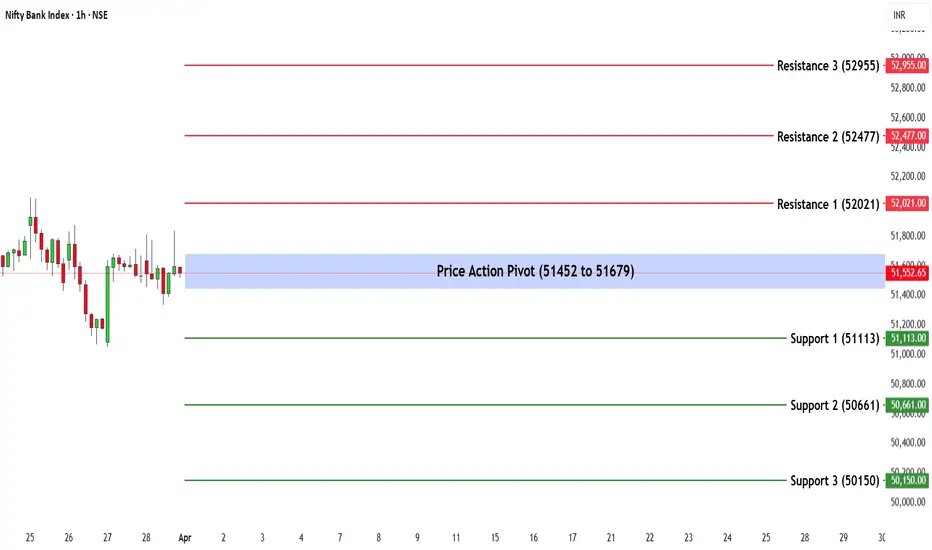

Bank Nifty ended the week at 51,564.85, registering a strong gain of 1.92%.

Key Levels for the Upcoming Week

🔹Price Action Pivot Zone:

The critical range to monitor for potential trend reversals or continuation is 51,452 - 51,679.

🔹Support & Resistance Levels:

Support Levels:

S1: 51,113

S2: 50,661

S3: 50,156

Resistance Levels:

R1: 52,021

R2: 52,477

R3: 52,955

Market Outlook

✅Bullish Scenario: A sustained move above 51,679 could trigger buying momentum, potentially driving Bank Nifty towards R1 (52,021) and beyond.

❌Bearish Scenario: If the index falls below 51,452, selling pressure may increase, pulling it towards S1 (51,113) and lower levels.

Disclaimer: This analysis is for educational purposes only. Investors should conduct their own research before making any trading decisions.

Key Levels for the Upcoming Week

🔹Price Action Pivot Zone:

The critical range to monitor for potential trend reversals or continuation is 51,452 - 51,679.

🔹Support & Resistance Levels:

Support Levels:

S1: 51,113

S2: 50,661

S3: 50,156

Resistance Levels:

R1: 52,021

R2: 52,477

R3: 52,955

Market Outlook

✅Bullish Scenario: A sustained move above 51,679 could trigger buying momentum, potentially driving Bank Nifty towards R1 (52,021) and beyond.

❌Bearish Scenario: If the index falls below 51,452, selling pressure may increase, pulling it towards S1 (51,113) and lower levels.

Disclaimer: This analysis is for educational purposes only. Investors should conduct their own research before making any trading decisions.

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.