The market continues to follow a macro-pattern similar to the previous bull cycles that unfolded in Q4 of 2013, 2017, 2020, and 2021. I discussed this structure in detail in my August 18 update:

Specifically: a summer rally, several weeks of September correction and consolidation, followed by the beginning of a new upside leg in early October.

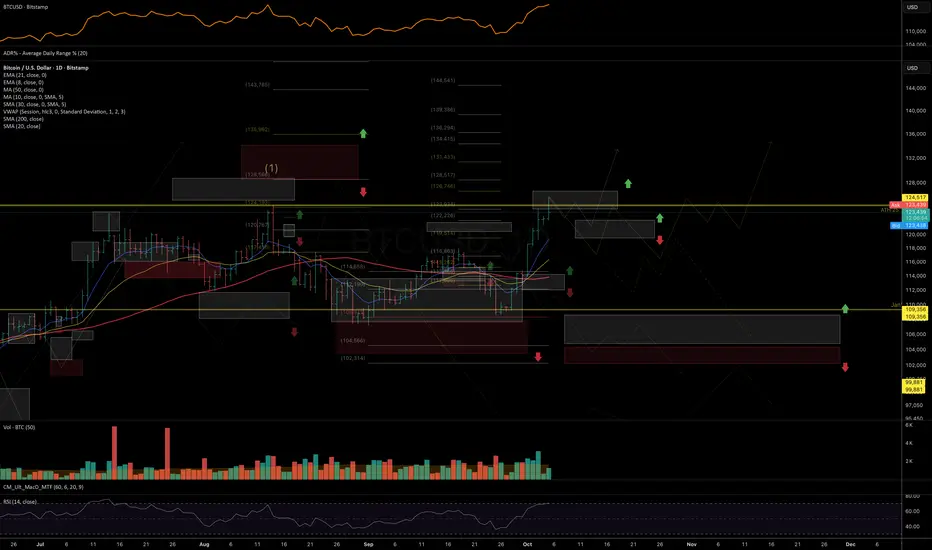

Updated BTC chart:

Another key development is the stablecoin market capitalization approaching a major technical zone. A confirmed breakout above it could signal a strong liquidity rotation into crypto assets — potentially marking the start of a new wave of growth across the crypto space, similar to the dynamics seen in 2023 and 2024.

Inverse correlation of BTC and stablecoin market cap:

Perhaps the most compelling factor is Bitcoin’s relationship with gold. Despite massive institutional adoption through ETFs, the BTC/GOLD ratio has remained stagnant since early 2021. This suggests that Bitcoin remains significantly undervalued relative to gold, leaving substantial room for appreciation as the digital asset continues its mainstream integration.

BTC/GOLD chart:

These factors — combined with the fact that most altcoins have already broken above their local resistance zones mentioned in the previous review — point to a potential recovery of upside momentum across the crypto market and higher targets into Q4.

As long as prices hold above their local and mid-term support zones, I expect continuation of the rally toward the next resistance levels. Breaking these support zones, will push odds in favor of more prolonged consolidation. But as long as BTC is not closing bellow its 50DMA for more than two weeks, macro bull cycles remains intact.

Below are the key technical levels for the main assets this week:

BTCUSD

BTCUSD

Chart:

Short-term support: 122–119.5K

Mid-term support: 117–115K

Resistance: 131–135K

ETHUSD

ETHUSD

Chart:

Support: 4400–4375

Resistance: 4870–5070

BNBUSD

BNBUSD

Chart:

Support: 1142–1089

Resistance: 1225–1275

XRPUSDT

XRPUSDT

Chart:

Support: 2.92–2.88

Resistance: 3.20–3.35

HYPEHUSD

HYPEHUSD

Chart:

Support: 48.5–47.35–46

Resistance: 55.5–60

SOLUSDT

SOLUSDT

Chart:

Short-term support: 223–219

Mid-term support: 212–207

Resistance: 247–260

Thank you for reading - wishing you a great Sunday and a strong start to the new trading week.

Specifically: a summer rally, several weeks of September correction and consolidation, followed by the beginning of a new upside leg in early October.

Updated BTC chart:

Another key development is the stablecoin market capitalization approaching a major technical zone. A confirmed breakout above it could signal a strong liquidity rotation into crypto assets — potentially marking the start of a new wave of growth across the crypto space, similar to the dynamics seen in 2023 and 2024.

Inverse correlation of BTC and stablecoin market cap:

Perhaps the most compelling factor is Bitcoin’s relationship with gold. Despite massive institutional adoption through ETFs, the BTC/GOLD ratio has remained stagnant since early 2021. This suggests that Bitcoin remains significantly undervalued relative to gold, leaving substantial room for appreciation as the digital asset continues its mainstream integration.

BTC/GOLD chart:

These factors — combined with the fact that most altcoins have already broken above their local resistance zones mentioned in the previous review — point to a potential recovery of upside momentum across the crypto market and higher targets into Q4.

As long as prices hold above their local and mid-term support zones, I expect continuation of the rally toward the next resistance levels. Breaking these support zones, will push odds in favor of more prolonged consolidation. But as long as BTC is not closing bellow its 50DMA for more than two weeks, macro bull cycles remains intact.

Below are the key technical levels for the main assets this week:

Chart:

Short-term support: 122–119.5K

Mid-term support: 117–115K

Resistance: 131–135K

Chart:

Support: 4400–4375

Resistance: 4870–5070

Chart:

Support: 1142–1089

Resistance: 1225–1275

Chart:

Support: 2.92–2.88

Resistance: 3.20–3.35

Chart:

Support: 48.5–47.35–46

Resistance: 55.5–60

Chart:

Short-term support: 223–219

Mid-term support: 212–207

Resistance: 247–260

Thank you for reading - wishing you a great Sunday and a strong start to the new trading week.

📊 Daily FREE Market Insights | Crypto + US Stocks

⚡ Technical analysis, setups & commentary

🌍 t.me/MarketArtistryENG | 🇷🇺 t.me/marketartistry

⚡ Technical analysis, setups & commentary

🌍 t.me/MarketArtistryENG | 🇷🇺 t.me/marketartistry

Pubblicazioni correlate

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

📊 Daily FREE Market Insights | Crypto + US Stocks

⚡ Technical analysis, setups & commentary

🌍 t.me/MarketArtistryENG | 🇷🇺 t.me/marketartistry

⚡ Technical analysis, setups & commentary

🌍 t.me/MarketArtistryENG | 🇷🇺 t.me/marketartistry

Pubblicazioni correlate

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.