The market continues to move within the framework of the main hypothesis — a potential completion of the correction from historical highs and the early signs of a possible trend reversal, as discussed in my recent market review:

https://www.tradingview.com/chart/BTCUSD/4FXGCnwn-BTC-and-ETH-key-levels-to-watch-in-coming-weeks/

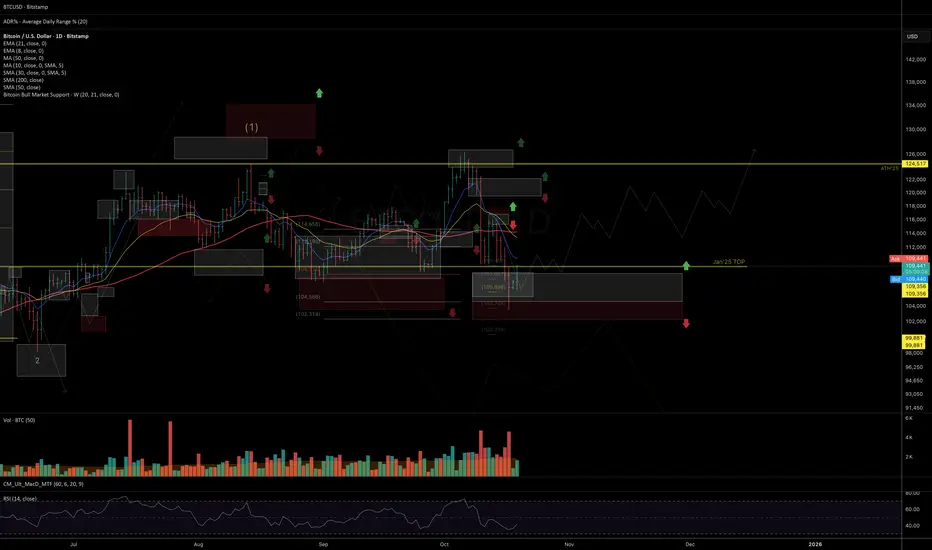

As long as #BTC maintains weekly closes above 102K, the base scenario (both for #BTC and #ETH) remains unchanged — gradual recovery, consolidation, and a move toward new highs. I wouldn’t rule out the possibility that this could happen even before year-end.

However, a weekly close below 102K would signal an increased probability that the four-year macro growth cycle has ended and the market could be transitioning into a macro corrective phase across the crypto sphere.

Updated key levels and charts:

BTCUSD

BTCUSD

Support: 106K | Resistance: 110–112K

Chart:

ETHUSD

ETHUSD

Support: 3680 | Resistance: 4360

Chart:

Thank you for your attention, and I wish you a productive start to the week and successful trading decisions ahead!

https://www.tradingview.com/chart/BTCUSD/4FXGCnwn-BTC-and-ETH-key-levels-to-watch-in-coming-weeks/

As long as #BTC maintains weekly closes above 102K, the base scenario (both for #BTC and #ETH) remains unchanged — gradual recovery, consolidation, and a move toward new highs. I wouldn’t rule out the possibility that this could happen even before year-end.

However, a weekly close below 102K would signal an increased probability that the four-year macro growth cycle has ended and the market could be transitioning into a macro corrective phase across the crypto sphere.

Updated key levels and charts:

Support: 106K | Resistance: 110–112K

Chart:

Support: 3680 | Resistance: 4360

Chart:

Thank you for your attention, and I wish you a productive start to the week and successful trading decisions ahead!

Nota

Hedging at current levels for existing medium- and long-term long positions looks like a reasonable decision under possible market turbulence. Risk reference zones can be considered around 112K and 114.5K.BTC — 1H chart (4H view):

To confirm momentum and ensure a confident continuation of the uptrend, it’s important to see a breakout and price consolidation above the 65 EMA on the hourly timeframe.

📊 Daily FREE Market Insights | Crypto + US Stocks

⚡ Technical analysis, setups & commentary

🌍 t.me/MarketArtistryENG | 🇷🇺 t.me/marketartistry

Join and let's grow together! 🚀

⚡ Technical analysis, setups & commentary

🌍 t.me/MarketArtistryENG | 🇷🇺 t.me/marketartistry

Join and let's grow together! 🚀

Pubblicazioni correlate

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.

📊 Daily FREE Market Insights | Crypto + US Stocks

⚡ Technical analysis, setups & commentary

🌍 t.me/MarketArtistryENG | 🇷🇺 t.me/marketartistry

Join and let's grow together! 🚀

⚡ Technical analysis, setups & commentary

🌍 t.me/MarketArtistryENG | 🇷🇺 t.me/marketartistry

Join and let's grow together! 🚀

Pubblicazioni correlate

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.