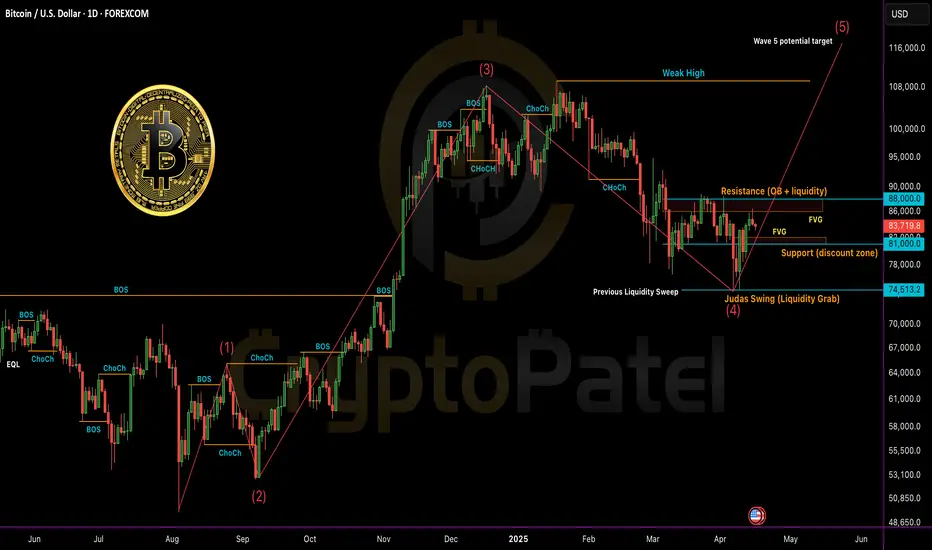

Bitcoin (BTC/USDT) – Full Technical Breakdown - Timeframe: 1D

Market Structure & SMC (Smart Money Concepts)

✅ CHoCH (Change of Character) confirmed from $105K top → current lower high around 88K zone.

88K zone.

📉 Break of Structure (BOS) to the downside occurred at $91K.

🟠 Bearish Order Block (OB): $86K– 88K (price currently reacting here).

88K (price currently reacting here).

Liquidity Levels:

Sell-side: Swept at $76K

Buy-side: Sitting above 88K

88K

Fair Value Gap (FVG): Unfilled zone between $81K– 82K may act as magnet for price.

82K may act as magnet for price.

ICT Model Alignment

Judas Swing: Sharp liquidity grab below $76K → followed by rebound — classic manipulation before real move.

PD Array Setup:

Resistance: 88K (bearish OB + buy-side liquidity)

88K (bearish OB + buy-side liquidity)

Support: $81K (discount zone + FVG)

Elliott Wave Outlook

Wave 1: July–Sept 2024

Wave 3: Nov–Feb rally to $105K (extended wave)

Wave 4: Correction to $76K likely complete

Wave 5 Target: Potential $115K+ if structure holds

Fractal Observation

🔹 Current price structure is mimicking Nov 2023–Jan 2024 pattern

🔹 If history rhymes: consolidation → breakout → retest → parabolic rally

Key Levels to Watch

🔼 Bullish Confirmation: Daily close above 88K → targeting

88K → targeting  92K–$100K

92K–$100K

🔽 Bearish Rejection: Drop below $81K → next support at $74K–$76K

Strategy Summary

🔹 Short-Term Bias: Cautiously Bullish

🔹 Entry Zone: Retest near 82K (FVG + OB)

82K (FVG + OB)

🔹 SL: Below $79.5K

🔹 TP Zones: 88K →

88K →  92K →

92K →  98K

98K

📈 R:R = Minimum 1:5 (High confluence)

Keep your eyes on HTF closures and manage risk. Liquidity traps are in play.

Market Structure & SMC (Smart Money Concepts)

✅ CHoCH (Change of Character) confirmed from $105K top → current lower high around

📉 Break of Structure (BOS) to the downside occurred at $91K.

🟠 Bearish Order Block (OB): $86K–

Liquidity Levels:

Sell-side: Swept at $76K

Buy-side: Sitting above

Fair Value Gap (FVG): Unfilled zone between $81K–

ICT Model Alignment

Judas Swing: Sharp liquidity grab below $76K → followed by rebound — classic manipulation before real move.

PD Array Setup:

Resistance:

Support: $81K (discount zone + FVG)

Elliott Wave Outlook

Wave 1: July–Sept 2024

Wave 3: Nov–Feb rally to $105K (extended wave)

Wave 4: Correction to $76K likely complete

Wave 5 Target: Potential $115K+ if structure holds

Fractal Observation

🔹 Current price structure is mimicking Nov 2023–Jan 2024 pattern

🔹 If history rhymes: consolidation → breakout → retest → parabolic rally

Key Levels to Watch

🔼 Bullish Confirmation: Daily close above

🔽 Bearish Rejection: Drop below $81K → next support at $74K–$76K

Strategy Summary

🔹 Short-Term Bias: Cautiously Bullish

🔹 Entry Zone: Retest near

🔹 SL: Below $79.5K

🔹 TP Zones:

📈 R:R = Minimum 1:5 (High confluence)

Keep your eyes on HTF closures and manage risk. Liquidity traps are in play.

Twitter: twitter.com/CryptoPatel

Telegram: t.me/OfficialCryptoPatel

Instagram: instagram.com/cryptopatel?utm_medium=copy_link

Telegram: t.me/OfficialCryptoPatel

Instagram: instagram.com/cryptopatel?utm_medium=copy_link

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.

Twitter: twitter.com/CryptoPatel

Telegram: t.me/OfficialCryptoPatel

Instagram: instagram.com/cryptopatel?utm_medium=copy_link

Telegram: t.me/OfficialCryptoPatel

Instagram: instagram.com/cryptopatel?utm_medium=copy_link

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.