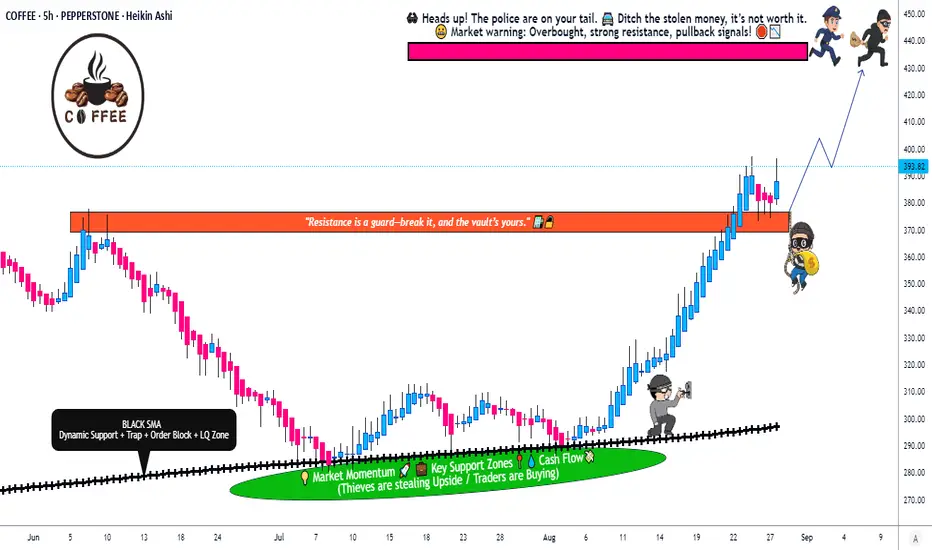

🚨☕ "COFFEE" Heist Plan – Swing/Day Robbery 🚨

🌟 Hola! Ola! Bonjour! Hallo! Marhaba! 🌟

Dear Robbers & Money Makers 🤑💰💸✈️

Based on 🔥 Thief Trading Style Analysis 🔥 here’s our master heist plan to rob the "COFFEE" Commodities CFD Market.

🎯 Plan: Bullish Robbery

Entry 📥: Any price level – Thief always sneaks in at any vault door.

👉 But remember: Thief Strategy = LAYERED ENTRY ⚡

Multiple Buy-Limit Layers:

(390.00) 🏦

(380.00) 💎

(370.00) 🎭

(360.00) 🔑

(Add more layers based on your own robbery plan)

Stop Loss 🛑:

This is Thief SL @ 340.00 ⚔️

Dear Ladies & Gentlemen (Thief OG’s) – Adjust your SL based on your personal robbery strategy & risk appetite.

Target 🎯:

⚠️ Police barricade spotted @ 440.00 🚔

So escape early with the loot @ 430.00 💸 before getting caught!

🏴☠️ Thief Notes:

Our heist is in the bullish zone 🚀

Layer in carefully, don’t rush 💎

Always manage risk – the cops (market makers) are watching 👮♂️

Use alerts, trailing SL & risk management to protect your stolen bags 💰

💥 If you’re riding with the Thief crew – Hit Boost 🚀 & Share Love ❤️ – that fuels our robbery strength!

We rob, we trade, we escape – That’s the Thief Way! 🏆🐱👤

#ThiefTrader #CoffeeHeist #CommoditiesCFD #SwingTrade #DayTrade #LayerStrategy #BuyTheDip #TradingPlan #ForexRobbers #MarketHeist

🌟 Hola! Ola! Bonjour! Hallo! Marhaba! 🌟

Dear Robbers & Money Makers 🤑💰💸✈️

Based on 🔥 Thief Trading Style Analysis 🔥 here’s our master heist plan to rob the "COFFEE" Commodities CFD Market.

🎯 Plan: Bullish Robbery

Entry 📥: Any price level – Thief always sneaks in at any vault door.

👉 But remember: Thief Strategy = LAYERED ENTRY ⚡

Multiple Buy-Limit Layers:

(390.00) 🏦

(380.00) 💎

(370.00) 🎭

(360.00) 🔑

(Add more layers based on your own robbery plan)

Stop Loss 🛑:

This is Thief SL @ 340.00 ⚔️

Dear Ladies & Gentlemen (Thief OG’s) – Adjust your SL based on your personal robbery strategy & risk appetite.

Target 🎯:

⚠️ Police barricade spotted @ 440.00 🚔

So escape early with the loot @ 430.00 💸 before getting caught!

🏴☠️ Thief Notes:

Our heist is in the bullish zone 🚀

Layer in carefully, don’t rush 💎

Always manage risk – the cops (market makers) are watching 👮♂️

Use alerts, trailing SL & risk management to protect your stolen bags 💰

💥 If you’re riding with the Thief crew – Hit Boost 🚀 & Share Love ❤️ – that fuels our robbery strength!

We rob, we trade, we escape – That’s the Thief Way! 🏆🐱👤

#ThiefTrader #CoffeeHeist #CommoditiesCFD #SwingTrade #DayTrade #LayerStrategy #BuyTheDip #TradingPlan #ForexRobbers #MarketHeist

Trade attivo

Nota

☕ COFFEE CFD MARKET REPORTDate: September 2, 2025

📊 Real-Time Price Data

Current Price: 387.74 USd/Lbs

Daily Change: -10.34 (-2.60%)

52-Week Range: 238.10 - 429.95

Volume: 3,812 contracts

📈 Recent Performance

1-Month Change: +34.38% 🚀

1-Year Change: +59.54% 📅🔥

All-Time High: 440.85 (Feb 2025)

😨😊 Investor Sentiment: Fear & Greed Index

Current Sentiment: Neutral (Score: 49)

Trend: Shift from "Fear" to "Neutral" in past 24 hours

Market Mood: Balanced - neither overly optimistic nor pessimistic

🌍 Fundamental & Macro Score Points

Supply & Demand Dynamics

Tight Supply: ICE-monitored Arabica inventories at 1.25-year low (710,196 bags)

Production Cuts: Brazil’s 2025 harvest forecast reduced to 63.35 million bags (-3.3% from prior estimate)

Weather Risks: Frost damage in Brazil & drought in Vietnam impacting yields

Tariff Impact: 50% tariffs on Brazilian imports adding cost pressures

Demand & Macro Factors

Global Consumption: Steady demand from emerging markets (e.g., Asia-Pacific)

Currency Impact: Strong USD making coffee more expensive for non-US buyers

Logistics: Shipping delays and geopolitical tensions (e.g., Red Sea disruptions)

🐂🐻 Overall Market Outlook Score

Bullish (Long) Score: 70% ✅

Reasons: Supply shortages, seasonal rebound trends (July-August historically strong), and speculative buying interest.

Bearish (Short) Risks: Profit-taking pullbacks, potential demand softening from high prices, and macro uncertainties (e.g., tariffs).

📋 Key Takeaways

Supply Crunch is driving long-term bullish momentum.

Short-term volatility due to profit-taking and macro headwinds.

Neutral investor sentiment suggests cautious optimism.

Seasonal trends favor upward momentum in coming months.

🎯 Summary: Coffee CFDs remain in a strong uptrend with supply deficits supporting prices, but stay alert for short-term corrections.

Trade chiuso: obiettivo raggiunto

📊 Real-Time Market DataPrice (US Coffee C Futures): 365.47 USd/Lbs (September 19, 2025, -4.04% daily change)

Yearly Performance: +44.91% compared to last year

Monthly Performance: +1.45% over the past month

Technical Sentiment:

Hourly, Daily, Weekly, Monthly: Strong Buy

20-Day Historic Volatility: Available on Barchart, specific value not disclosed

Contract Specs: Tracks Arabica coffee, ~8x yearly production traded in New York

🌍 Fundamental Factors

Supply Dynamics:

Brazil: Dominant producer, facing severe drought and 2021 frost impacts. 2025/26 production estimates cut by 11M bags, tightening global supply. ICE Arabica inventories at 16.75-month low (654,224 bags)

Vietnam: Bumper Robusta crop expected for 2025/26, bearish for Robusta prices

US Imports: 50% tariffs on Brazilian coffee imports reduce US supply, as ~33% of unroasted coffee comes from Brazil

Demand Dynamics:

Global coffee consumption rising, especially in emerging markets

Holiday seasons drive peak demand, supporting prices

Geopolitical Influences:

US-Brazil tariffs (50%) disrupt trade flows, tightening US coffee supply and pushing prices up

Shipping delays and labor shortages exacerbate supply chain bottlenecks

Geopolitical risk index (GPR) impacts coffee volatility, alongside weather and yields

💹 Macroeconomic Factors

Interest Rates:

Lower interest rates reduce opportunity cost of holding commodities, supporting coffee prices

US Federal Reserve maintained rates (September 2025), with two cuts projected for 2025. Uncertainty from tariffs may delay cuts, impacting commodity demand

Inflation:

US inflation expectations: 3.2% (1-year), 3.0% (3-year), 2.6% (5-year) as of May 2025

Tariffs may reaccelerate inflation, increasing coffee prices as a dollar-priced commodity

US Dollar Strength:

Stronger USD depresses coffee prices; weaker USD lifts them. Recent USD decline supports commodity prices

Economic Growth:

Faltering global growth (World Bank, April 2025) may reduce coffee demand, but rising consumption in emerging markets offsets this

💰 Money-Making Analysis

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

Pubblicazioni correlate

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.

💰 Money-Making Analysis

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

Pubblicazioni correlate

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.