DOGE/USD – Bearish Market Structure Breakdown with Minor Supply Rejection (M30)

Overview

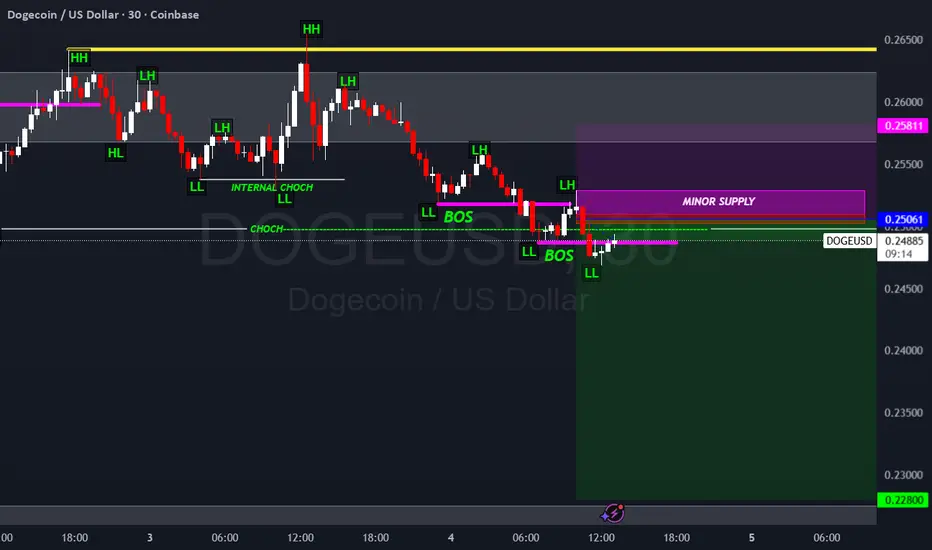

This analysis focuses on the 30-minute chart of Dogecoin (DOGE/USD), where a clear bearish market structure has emerged following a series of lower highs and lower lows. The setup is based on a combination of price action, market structure shifts, and supply zone rejection, aligning with principles of Support & Resistance, Supply & Demand, and Smart Money Concepts.

The trade idea targets a move down to $0.22800, with a stop loss placed 75 pips above the entry, ensuring a favorable risk-to-reward ratio.

Market Structure Analysis

The chart reveals a textbook transition from bullish to bearish structure:

Initial Bullish Structure: The price action began with a series of Higher Highs (HH) and Higher Lows (HL), indicating bullish momentum.

Change of Character (CHOCH): A significant CHOCH is observed, marking the first sign of weakness in the bullish trend. This is a critical signal that buyers are losing control.

Internal CHOCH: A more granular shift within the structure, confirming the weakening of bullish pressure.

Lower High (LH) and Lower Low (LL): These confirm the transition into a bearish structure. The formation of a Lower High followed by a Lower Low is a classic sign of trend reversal.

Break of Structure (BOS): The BOS validates the bearish bias, showing that sellers have taken control and are pushing price lower.

Supply Zone Rejection

A Minor Supply Zone is clearly marked around $0.25061, which aligns with previous resistance levels. Price action shows a rejection from this zone, reinforcing the bearish outlook.

This supply zone is significant because:

It coincides with the Lower High, suggesting institutional selling pressure.

The rejection from this zone adds confluence to the short bias.

It serves as a potential area for re-entry or confirmation if price retests it.

Key Levels

Resistance Zones:

$0.25811: A higher resistance level, previously tested and rejected.

$0.25061: Minor Supply Zone, current rejection point.

Support Zone:

$0.22800: Target level, based on previous structure lows and potential demand zone.

Trade Setup

Entry: Near current price action around $0.24847, ideally after confirmation of continued rejection from the Minor Supply Zone.

Stop Loss: Placed 75 pips above the entry, approximately at $0.25697, just above the Minor Supply Zone and previous resistance.

Take Profit: $0.22800, aligning with the next significant support level and previous structure low.

Risk-to-Reward Analysis

Risk: ~75 pips

Reward: ~204.7 pips (from $0.24847 to $0.22800)

Risk-to-Reward Ratio: Approximately 1:2.7, offering a strong edge for this setup.

Confluence Factors

This trade setup is supported by multiple layers of confluence:

Market Structure Shift: CHOCH, BOS, LH, LL – all point to bearish control.

Supply Zone Rejection: Price failed to break above $0.25061, confirming seller dominance.

Clear Target: $0.22800 is a well-defined support level with historical significance.

Smart Money Concepts: The internal CHOCH and BOS align with institutional behavior patterns.

Timeframe Alignment: The M30 chart provides a balance between precision and broader trend visibility.

Trade Management Strategy

Entry Confirmation: Wait for a bearish engulfing or rejection wick near the Minor Supply Zone.

Partial Take Profit: Consider scaling out at intermediate levels (e.g., $0.23800) to lock in profits.

Stop Loss Adjustment: If price breaks below $0.24000 with momentum, consider trailing the stop to breakeven.

Re-entry Opportunity: If price retests $0.25061 and rejects again, a second entry may be viable.

Risk Considerations

Volatility: DOGE/USD can be highly volatile; ensure proper position sizing.

News Events: Monitor for any crypto-related news that could impact sentiment.

Liquidity: Minor supply zones may not hold under high volume; watch for volume spikes.

Conclusion

This DOGE/USD setup presents a compelling short opportunity based on a well-defined bearish market structure and supply zone rejection. With a clear target at $0.22800 and a disciplined stop loss placement, the trade offers a strong risk-to-reward profile.

The setup is rooted in price action and structure, making it suitable for traders who follow Smart Money Concepts and institutional-style analysis. As always, trade with discipline and manage risk appropriately.

Overview

This analysis focuses on the 30-minute chart of Dogecoin (DOGE/USD), where a clear bearish market structure has emerged following a series of lower highs and lower lows. The setup is based on a combination of price action, market structure shifts, and supply zone rejection, aligning with principles of Support & Resistance, Supply & Demand, and Smart Money Concepts.

The trade idea targets a move down to $0.22800, with a stop loss placed 75 pips above the entry, ensuring a favorable risk-to-reward ratio.

Market Structure Analysis

The chart reveals a textbook transition from bullish to bearish structure:

Initial Bullish Structure: The price action began with a series of Higher Highs (HH) and Higher Lows (HL), indicating bullish momentum.

Change of Character (CHOCH): A significant CHOCH is observed, marking the first sign of weakness in the bullish trend. This is a critical signal that buyers are losing control.

Internal CHOCH: A more granular shift within the structure, confirming the weakening of bullish pressure.

Lower High (LH) and Lower Low (LL): These confirm the transition into a bearish structure. The formation of a Lower High followed by a Lower Low is a classic sign of trend reversal.

Break of Structure (BOS): The BOS validates the bearish bias, showing that sellers have taken control and are pushing price lower.

Supply Zone Rejection

A Minor Supply Zone is clearly marked around $0.25061, which aligns with previous resistance levels. Price action shows a rejection from this zone, reinforcing the bearish outlook.

This supply zone is significant because:

It coincides with the Lower High, suggesting institutional selling pressure.

The rejection from this zone adds confluence to the short bias.

It serves as a potential area for re-entry or confirmation if price retests it.

Key Levels

Resistance Zones:

$0.25811: A higher resistance level, previously tested and rejected.

$0.25061: Minor Supply Zone, current rejection point.

Support Zone:

$0.22800: Target level, based on previous structure lows and potential demand zone.

Trade Setup

Entry: Near current price action around $0.24847, ideally after confirmation of continued rejection from the Minor Supply Zone.

Stop Loss: Placed 75 pips above the entry, approximately at $0.25697, just above the Minor Supply Zone and previous resistance.

Take Profit: $0.22800, aligning with the next significant support level and previous structure low.

Risk-to-Reward Analysis

Risk: ~75 pips

Reward: ~204.7 pips (from $0.24847 to $0.22800)

Risk-to-Reward Ratio: Approximately 1:2.7, offering a strong edge for this setup.

Confluence Factors

This trade setup is supported by multiple layers of confluence:

Market Structure Shift: CHOCH, BOS, LH, LL – all point to bearish control.

Supply Zone Rejection: Price failed to break above $0.25061, confirming seller dominance.

Clear Target: $0.22800 is a well-defined support level with historical significance.

Smart Money Concepts: The internal CHOCH and BOS align with institutional behavior patterns.

Timeframe Alignment: The M30 chart provides a balance between precision and broader trend visibility.

Trade Management Strategy

Entry Confirmation: Wait for a bearish engulfing or rejection wick near the Minor Supply Zone.

Partial Take Profit: Consider scaling out at intermediate levels (e.g., $0.23800) to lock in profits.

Stop Loss Adjustment: If price breaks below $0.24000 with momentum, consider trailing the stop to breakeven.

Re-entry Opportunity: If price retests $0.25061 and rejects again, a second entry may be viable.

Risk Considerations

Volatility: DOGE/USD can be highly volatile; ensure proper position sizing.

News Events: Monitor for any crypto-related news that could impact sentiment.

Liquidity: Minor supply zones may not hold under high volume; watch for volume spikes.

Conclusion

This DOGE/USD setup presents a compelling short opportunity based on a well-defined bearish market structure and supply zone rejection. With a clear target at $0.22800 and a disciplined stop loss placement, the trade offers a strong risk-to-reward profile.

The setup is rooted in price action and structure, making it suitable for traders who follow Smart Money Concepts and institutional-style analysis. As always, trade with discipline and manage risk appropriately.

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.