DXY Analysis: Resistances Holding Strong, Is the Downtrend Back?

Today, I want to analyze one of the important indices of the financial markets, the U.S. Dollar Index( DXY), for you, which can be a guide for taking short-long positions in the Forex, Futures, and even Crypto markets.

DXY), for you, which can be a guide for taking short-long positions in the Forex, Futures, and even Crypto markets.

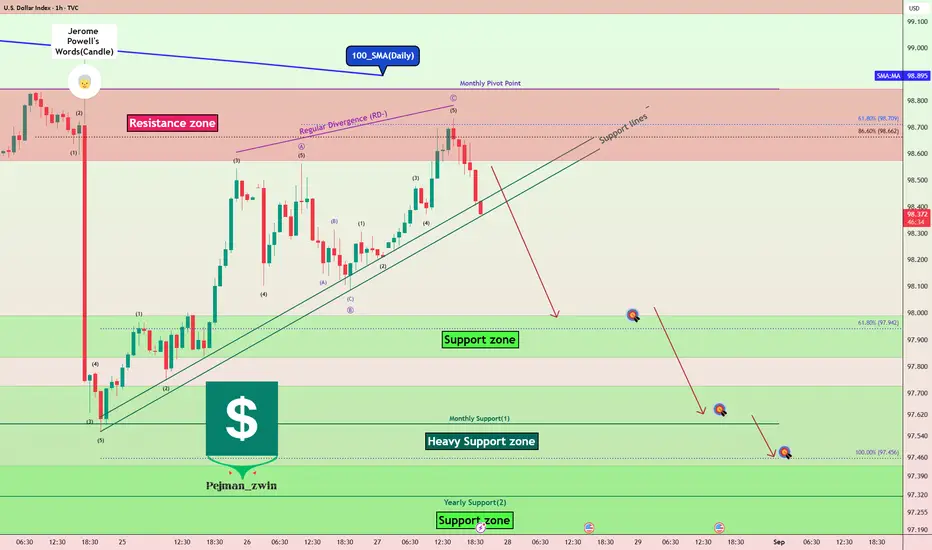

The DXY index fell by about -1.2% after Jerome Powell began talking about the possibility of a rate cut in September, but as the new week began, the DXY index started to rise again.

If we look at the DXY Index chart on the 1-hour time frame, we can see that the DXY Index reacted well to the Resistances and started to decline.

The Resistances for the DXY Index include:

Resistance zone($98.843-$98.575)

Monthly Pivot Point

100_SMA(Daily)

In terms of Elliott Wave theory, it seems that this increase in the DXY Index over the last two days has been in the form of corrective waves. The structure of the corrective waves is Zigzag Correction(ABC/5-3-5). By breaking the Support lines, we can confirm the end of the corrective waves.

Also, we can see the Regular Divergence(RD-) between Consecutive Peaks.

I expect the DXY Index to decline to at least the Support zone($97.989-$97.834) AFTER breaking the Support lines.

Second Target: $97.650

Third Target: $97.450

Stop Loss(SL): $99.000

Note: With the DXY Index declining, we can expect more hope for a weakening of the U.S Dollar's strength in the major Forex pairs.

Please respect each other's ideas and express them politely if you agree or disagree.

U.S. Dollar Index Analyze (DXYUSD), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like'✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

The DXY index fell by about -1.2% after Jerome Powell began talking about the possibility of a rate cut in September, but as the new week began, the DXY index started to rise again.

If we look at the DXY Index chart on the 1-hour time frame, we can see that the DXY Index reacted well to the Resistances and started to decline.

The Resistances for the DXY Index include:

Resistance zone($98.843-$98.575)

Monthly Pivot Point

100_SMA(Daily)

In terms of Elliott Wave theory, it seems that this increase in the DXY Index over the last two days has been in the form of corrective waves. The structure of the corrective waves is Zigzag Correction(ABC/5-3-5). By breaking the Support lines, we can confirm the end of the corrective waves.

Also, we can see the Regular Divergence(RD-) between Consecutive Peaks.

I expect the DXY Index to decline to at least the Support zone($97.989-$97.834) AFTER breaking the Support lines.

Second Target: $97.650

Third Target: $97.450

Stop Loss(SL): $99.000

Note: With the DXY Index declining, we can expect more hope for a weakening of the U.S Dollar's strength in the major Forex pairs.

Please respect each other's ideas and express them politely if you agree or disagree.

U.S. Dollar Index Analyze (DXYUSD), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like'✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

Trade attivo

Trade was activated after DXY was break the support lines.🎁Get a 20% Discount on your trading FEE on BYBIT:👉partner.bybit.com/b/PEJMANZWIN

🎁Get a 20% Bonus & 30% Discount on LBANK exchange(NO KYC)👉lbank.one/join/uBythQd

🎁Get a 20% Bonus & 30% Discount on LBANK exchange(NO KYC)👉lbank.one/join/uBythQd

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.

🎁Get a 20% Discount on your trading FEE on BYBIT:👉partner.bybit.com/b/PEJMANZWIN

🎁Get a 20% Bonus & 30% Discount on LBANK exchange(NO KYC)👉lbank.one/join/uBythQd

🎁Get a 20% Bonus & 30% Discount on LBANK exchange(NO KYC)👉lbank.one/join/uBythQd

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.