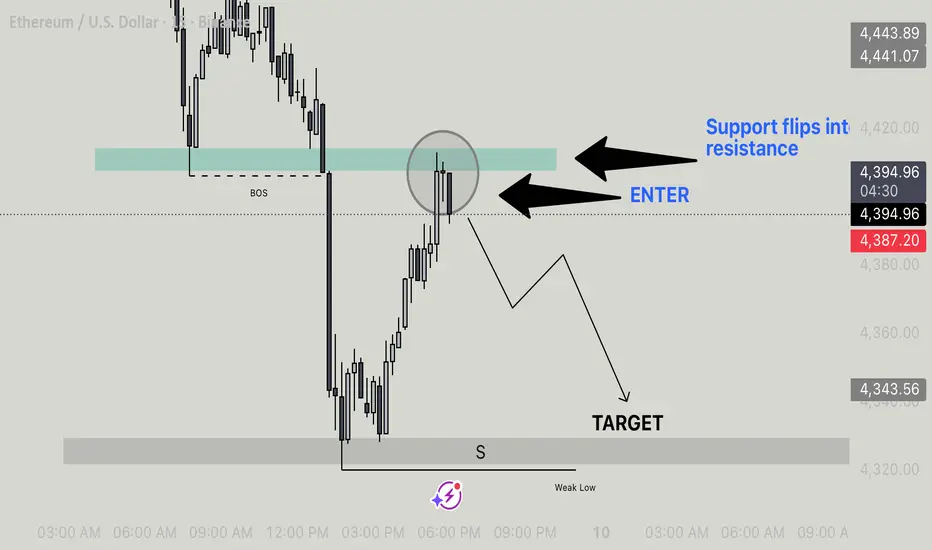

Key Structure Areas:

Previous Support Zone (highlighted in green) is now acting as resistance.

Break of Structure (BOS) indicates a shift in market direction from bullish to bearish.

Target Zone marked near a prior weak low / support (S) zone.

Setup Explanation:

Break of Structure (BOS):

Price breaks below the previously strong support zone.

Signals bearish momentum and a potential trend reversal.

Retest of Support as Resistance:

After the BOS, price pulls back into the old support zone.

This zone now acts as resistance, confirming the change in polarity.

Entry Point:

The ideal entry is marked at the retest level within the resistance zone.

Candlestick reaction (e.g., rejections or wicks) confirms seller strength.

Target Area:

The target is the weak low marked with an “S” — a previous swing low that may now be liquidated or swept.

This gives a favorable risk-to-reward ratio for a short trade.

Key Trading Concepts Used:

Market Structure: BOS identifies trend change.

Support/Resistance Flip: A classic and reliable trading concept.

Liquidity Sweep Target: Going for the weak low assumes it will be tested or broken.

Potential Trade Summary:

Direction: Short / Sell

Entry: ~$4,397 (at retest of resistance zone)

Target: ~$4,343 or lower

Stop-loss: Above the resistance zone (around $4,420)

Previous Support Zone (highlighted in green) is now acting as resistance.

Break of Structure (BOS) indicates a shift in market direction from bullish to bearish.

Target Zone marked near a prior weak low / support (S) zone.

Setup Explanation:

Break of Structure (BOS):

Price breaks below the previously strong support zone.

Signals bearish momentum and a potential trend reversal.

Retest of Support as Resistance:

After the BOS, price pulls back into the old support zone.

This zone now acts as resistance, confirming the change in polarity.

Entry Point:

The ideal entry is marked at the retest level within the resistance zone.

Candlestick reaction (e.g., rejections or wicks) confirms seller strength.

Target Area:

The target is the weak low marked with an “S” — a previous swing low that may now be liquidated or swept.

This gives a favorable risk-to-reward ratio for a short trade.

Key Trading Concepts Used:

Market Structure: BOS identifies trend change.

Support/Resistance Flip: A classic and reliable trading concept.

Liquidity Sweep Target: Going for the weak low assumes it will be tested or broken.

Potential Trade Summary:

Direction: Short / Sell

Entry: ~$4,397 (at retest of resistance zone)

Target: ~$4,343 or lower

Stop-loss: Above the resistance zone (around $4,420)

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.