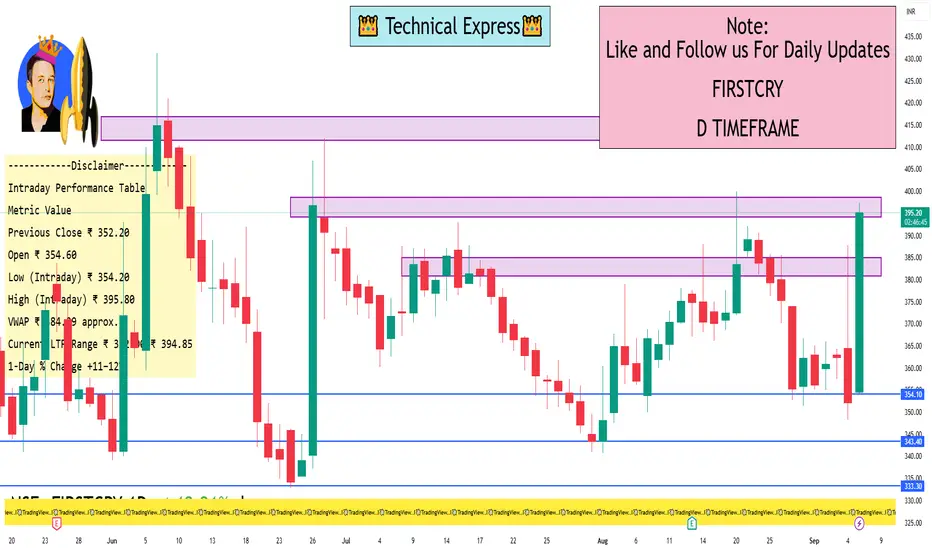

Intraday Overview (1-Day Time-Frame)

Current / Last Traded Price (LTP): ₹392–₹393 range, reflecting an ~11 % gain over the previous close of ₹352.20

Previous Close: ₹352.20

Intraday Percentage Gain: Approximately +11.3 %

VWAP (Volume Weighted Average Price): ₹384.39–₹384.85

Open / High / Low (Today):

Opening price around ₹354–₹355

Intraday range observed between low: ₹354.20 and high: ₹395.80

Interpretation & Insights

Brainbees Solutions is exhibiting strong intraday momentum, trading well above its VWAP—a typical indication of bullish sentiment among intraday traders (on 5 Sept, LTP ~₹352 earlier but now at ₹392–₹393, significantly above VWAP of ~₹384)

Such a movement suggests significant buying interest during the session, pushing both price and volume upward.

With a low intraday at ₹354.20, the stock had a wide trading range, potentially offering good intraday opportunity for active traders depending on entry/exit strategies.

What This Indicates

Strong Intraday Rally: The stock opened near the lower end of its trading range but surged sharply, trading well above VWAP—suggesting substantial buying momentum

High Volatility: With a wide range from ₹ 354 to ₹ 395, intraday traders had ample opportunity—though caution is advised in such volatile swings.

Bullish Sentiment: Momentum indicators like VWAP positioning and high-volatility trading are consistent with bullish intraday sentiment.

Current / Last Traded Price (LTP): ₹392–₹393 range, reflecting an ~11 % gain over the previous close of ₹352.20

Previous Close: ₹352.20

Intraday Percentage Gain: Approximately +11.3 %

VWAP (Volume Weighted Average Price): ₹384.39–₹384.85

Open / High / Low (Today):

Opening price around ₹354–₹355

Intraday range observed between low: ₹354.20 and high: ₹395.80

Interpretation & Insights

Brainbees Solutions is exhibiting strong intraday momentum, trading well above its VWAP—a typical indication of bullish sentiment among intraday traders (on 5 Sept, LTP ~₹352 earlier but now at ₹392–₹393, significantly above VWAP of ~₹384)

Such a movement suggests significant buying interest during the session, pushing both price and volume upward.

With a low intraday at ₹354.20, the stock had a wide trading range, potentially offering good intraday opportunity for active traders depending on entry/exit strategies.

What This Indicates

Strong Intraday Rally: The stock opened near the lower end of its trading range but surged sharply, trading well above VWAP—suggesting substantial buying momentum

High Volatility: With a wide range from ₹ 354 to ₹ 395, intraday traders had ample opportunity—though caution is advised in such volatile swings.

Bullish Sentiment: Momentum indicators like VWAP positioning and high-volatility trading are consistent with bullish intraday sentiment.

I built a Buy & Sell Signal Indicator with 85% accuracy.

📈 Get access via DM or

WhatsApp: wa.link/d997q0

Contact - +91 76782 40962

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

📈 Get access via DM or

WhatsApp: wa.link/d997q0

Contact - +91 76782 40962

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

Pubblicazioni correlate

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

I built a Buy & Sell Signal Indicator with 85% accuracy.

📈 Get access via DM or

WhatsApp: wa.link/d997q0

Contact - +91 76782 40962

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

📈 Get access via DM or

WhatsApp: wa.link/d997q0

Contact - +91 76782 40962

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

Pubblicazioni correlate

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.