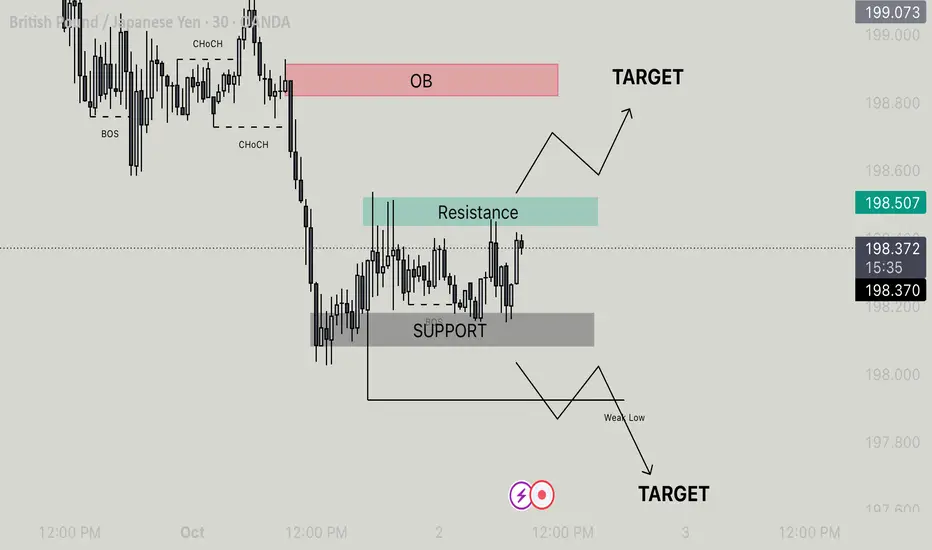

Price is currently consolidating between a clearly defined Support Zone and Resistance Zone after a strong bearish move.

Support has been respected multiple times, indicating short-term buying interest.

Resistance aligns with a previous supply zone, showing potential rejection or continuation bias.

Two possible scenarios are unfolding:

Bullish Breakout

If price breaks above the resistance zone, it could target the Order Block (OB) above, which is a key supply area from the last strong bearish move.

Break and retest of resistance would confirm bullish structure shift.

Target area: ~199.07

Bearish Continuation

A rejection from resistance could lead to another test of support.

A break below the support zone and the Weak Low would confirm bearish continuation.

Bearish target sits around 197.60 (lower liquidity grab zone).

Key Notes:

Watch for a Change of Character (ChoCH) for confirmation in either direction.

Volume and momentum confirmation will strengthen breakout bias.

Consider OB zone as a potential reversal or mitigation point.

Support has been respected multiple times, indicating short-term buying interest.

Resistance aligns with a previous supply zone, showing potential rejection or continuation bias.

Two possible scenarios are unfolding:

Bullish Breakout

If price breaks above the resistance zone, it could target the Order Block (OB) above, which is a key supply area from the last strong bearish move.

Break and retest of resistance would confirm bullish structure shift.

Target area: ~199.07

Bearish Continuation

A rejection from resistance could lead to another test of support.

A break below the support zone and the Weak Low would confirm bearish continuation.

Bearish target sits around 197.60 (lower liquidity grab zone).

Key Notes:

Watch for a Change of Character (ChoCH) for confirmation in either direction.

Volume and momentum confirmation will strengthen breakout bias.

Consider OB zone as a potential reversal or mitigation point.

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.