Hello traders, stepping into a fresh week with a clear head sets the tone, so here’s a warm dive into what gold is whispering on the weekly chart.

Gold opens the week sitting inside a crucial balance pocket on the W1 map. Momentum is easing, candle bodies are shrinking, and the structure is quietly storing energy for a decisive breakout. This outlook stays loyal to pure Weekly flow — no lower-timeframe noise, just the five-day roadmap drawn by W1 structure itself.

Macro & News Context

The USD steps into a heavy data line-up this week: Retail Sales, GDP, PCE, and Durable Goods.

Any one of these can tilt momentum and sculpt the shape of the weekly candle, so stay alert — the macro winds are active.

WEEKLY — Neutral-Bullish but Losing Momentum

The weekly chart remains bullish in structure but fragile in strength.

Upper wicks = hesitation. Buyers control trend, but conviction is fading.

Key Weekly Zones

🟥 Supply Above

4170–4270 → Rejection shelf. Repeated sell absorption.

4330–4460 → Major distribution ceiling.

4570–4700 → Extreme premium, exhaustion zone.

🟦 Demand Below

3980–3880 → Primary weekly support keeping HLs alive.

3830–3700 → Mid-range accumulation.

3600–3450 → Deep structural foundation.

⚪ Weekly Balance Point: 4040–4140

This is the pivot of the week.

Above → continuation possible.

Below → correction opens.

Weekly Scenarios

Bullish: Hold above 4040–4140 → targets 4170 → 4270 → 4330.

Bearish: Lose 4040 → drop toward 3980 → 3880 → 3830.

Weekly view: A data-driven coin toss — USD strength will decide the winner.

DAILY — Compression Between Supply & Demand

Price is trapped between EMA21 and EMA50, RSI rolling over → indecision.

Daily Supply

4235–4330 → The final battlefield. Every test = heavy rejection.

4140–4210 → Active distribution. Sellers defend aggressively.

Daily Demand

3980–3880 → Key bullish defense.

3720–3580 → Discount base of the October rally.

3450–3300 → Long-term accumulation.

Daily Decision Zone: 4055–4115

Stuck here — no direction until a breakout.

Daily Scenarios

Bullish: D1 close above 4120 → aim for 4210 → 4330.

Bearish: Break & close below 3980 → opens 3880 → 3720.

Daily view: Market is coiling — the next D1 close decides the week.

H4 — Pressure Building Inside a Tight Box

H4 is in a compression pocket 4060–4090.

H4 Supply

4135–4165 → Nearest premium selling.

4210–4240 → Heavy distribution cap.

4320–4350 → Deep premium reversal zone.

H4 Demand

4020–3990 → Nearest support.

3935–3905 → Continuation demand.

3840–3810 → Major accumulation.

H4 Scenarios

Bullish: Reclaim 4090 → 4135–4165 → 4210–4240.

Bearish: Lose 4020 → 3990 → 3935–3905.

H4 view: Expect a violent expansion once it escapes the box.

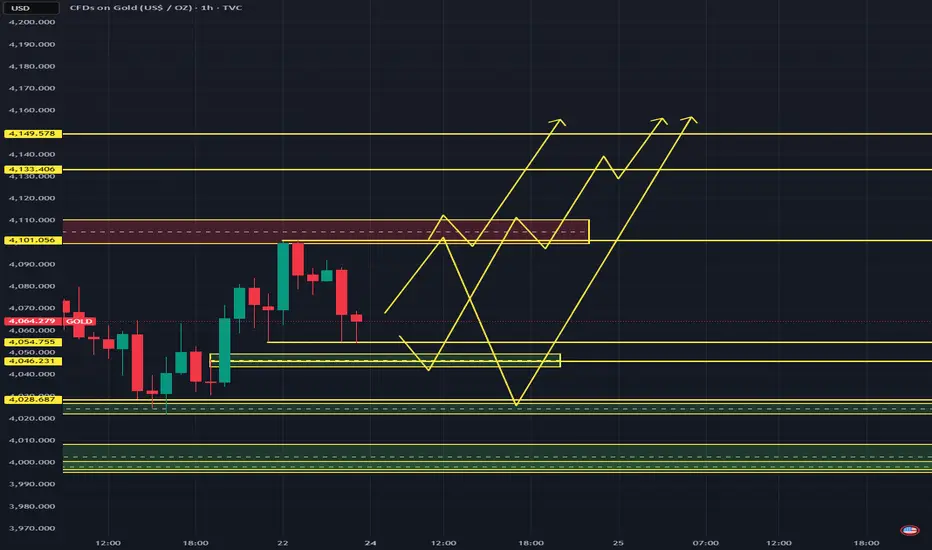

H1 — Liquidity Games Underway

Bias: Neutral–Bullish, liquidity-driven.

4140 = weak high, perfect sweep candidate.

EMAs flat → compression.

RSI mid-50s → room on upside if impulse forms.

H1 Supply

4170–4185 → Extreme premium reversal.

4118–4135 → Weak high liquidity.

4088–4100 → Breaker supply.

H1 Demand

4025–4040 → Key intraday floor.

3988–4005 → Deep H1/H4 confluence.

4055–4065 → Micro accumulation.

H1 Pivot: 4075–4085

Above → bullish continuation.

Below → bearish intraday flow.

Intraday Scenarios

Bullish Liquidity Sweep:

Reclaim 4085 → aim for: 4110 → 4135/40 → 4170/85.

Bearish Retrace:

Reject 4135–4140 → drop toward 4075 → 4053 → 4025–4005.

💡 THE REAL TAKEAWAY — MASTER SUMMARY

📌 Gold is coiled inside multi-timeframe compression.

All major biases depend on a breakout from 4055–4115 (D1) and 4060–4090 (H4).

Upside Bias:

Only valid above 4120 (D1) / 4090 (H4) → targets 4135 → 4170 → 4210+.

Downside Bias:

Confirmed only below 4020 (H4) / 3980 (D1) → targets 3900 → 3830.

Intraday Edge:

Expect a sweep of 4140 before any decisive move.

Most probable play:

↗️ Sweep 4140 → fade

or

↘️ Dip into 4050–4020 → reload upward.

Gold opens the week sitting inside a crucial balance pocket on the W1 map. Momentum is easing, candle bodies are shrinking, and the structure is quietly storing energy for a decisive breakout. This outlook stays loyal to pure Weekly flow — no lower-timeframe noise, just the five-day roadmap drawn by W1 structure itself.

Macro & News Context

The USD steps into a heavy data line-up this week: Retail Sales, GDP, PCE, and Durable Goods.

Any one of these can tilt momentum and sculpt the shape of the weekly candle, so stay alert — the macro winds are active.

WEEKLY — Neutral-Bullish but Losing Momentum

The weekly chart remains bullish in structure but fragile in strength.

Upper wicks = hesitation. Buyers control trend, but conviction is fading.

Key Weekly Zones

🟥 Supply Above

4170–4270 → Rejection shelf. Repeated sell absorption.

4330–4460 → Major distribution ceiling.

4570–4700 → Extreme premium, exhaustion zone.

🟦 Demand Below

3980–3880 → Primary weekly support keeping HLs alive.

3830–3700 → Mid-range accumulation.

3600–3450 → Deep structural foundation.

⚪ Weekly Balance Point: 4040–4140

This is the pivot of the week.

Above → continuation possible.

Below → correction opens.

Weekly Scenarios

Bullish: Hold above 4040–4140 → targets 4170 → 4270 → 4330.

Bearish: Lose 4040 → drop toward 3980 → 3880 → 3830.

Weekly view: A data-driven coin toss — USD strength will decide the winner.

DAILY — Compression Between Supply & Demand

Price is trapped between EMA21 and EMA50, RSI rolling over → indecision.

Daily Supply

4235–4330 → The final battlefield. Every test = heavy rejection.

4140–4210 → Active distribution. Sellers defend aggressively.

Daily Demand

3980–3880 → Key bullish defense.

3720–3580 → Discount base of the October rally.

3450–3300 → Long-term accumulation.

Daily Decision Zone: 4055–4115

Stuck here — no direction until a breakout.

Daily Scenarios

Bullish: D1 close above 4120 → aim for 4210 → 4330.

Bearish: Break & close below 3980 → opens 3880 → 3720.

Daily view: Market is coiling — the next D1 close decides the week.

H4 — Pressure Building Inside a Tight Box

H4 is in a compression pocket 4060–4090.

H4 Supply

4135–4165 → Nearest premium selling.

4210–4240 → Heavy distribution cap.

4320–4350 → Deep premium reversal zone.

H4 Demand

4020–3990 → Nearest support.

3935–3905 → Continuation demand.

3840–3810 → Major accumulation.

H4 Scenarios

Bullish: Reclaim 4090 → 4135–4165 → 4210–4240.

Bearish: Lose 4020 → 3990 → 3935–3905.

H4 view: Expect a violent expansion once it escapes the box.

H1 — Liquidity Games Underway

Bias: Neutral–Bullish, liquidity-driven.

4140 = weak high, perfect sweep candidate.

EMAs flat → compression.

RSI mid-50s → room on upside if impulse forms.

H1 Supply

4170–4185 → Extreme premium reversal.

4118–4135 → Weak high liquidity.

4088–4100 → Breaker supply.

H1 Demand

4025–4040 → Key intraday floor.

3988–4005 → Deep H1/H4 confluence.

4055–4065 → Micro accumulation.

H1 Pivot: 4075–4085

Above → bullish continuation.

Below → bearish intraday flow.

Intraday Scenarios

Bullish Liquidity Sweep:

Reclaim 4085 → aim for: 4110 → 4135/40 → 4170/85.

Bearish Retrace:

Reject 4135–4140 → drop toward 4075 → 4053 → 4025–4005.

💡 THE REAL TAKEAWAY — MASTER SUMMARY

📌 Gold is coiled inside multi-timeframe compression.

All major biases depend on a breakout from 4055–4115 (D1) and 4060–4090 (H4).

Upside Bias:

Only valid above 4120 (D1) / 4090 (H4) → targets 4135 → 4170 → 4210+.

Downside Bias:

Confirmed only below 4020 (H4) / 3980 (D1) → targets 3900 → 3830.

Intraday Edge:

Expect a sweep of 4140 before any decisive move.

Most probable play:

↗️ Sweep 4140 → fade

or

↘️ Dip into 4050–4020 → reload upward.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.