Overview:

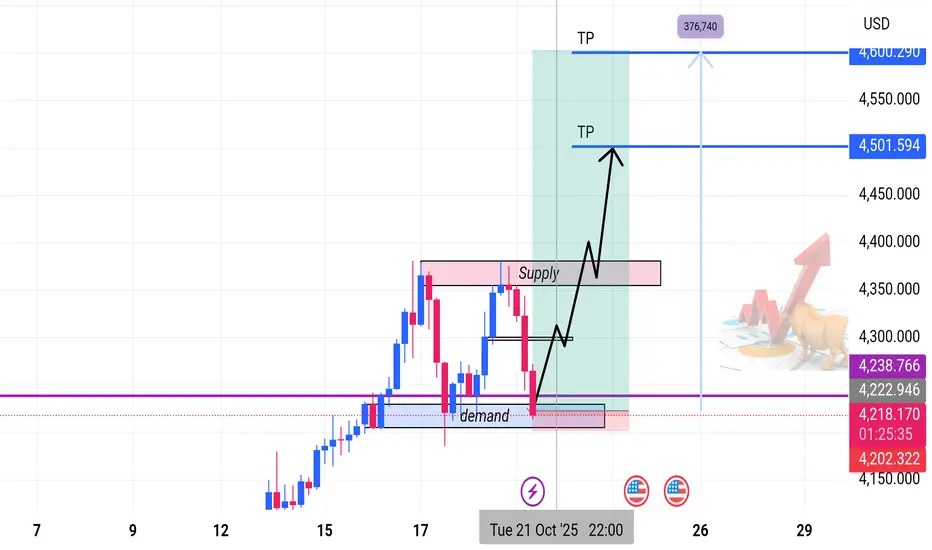

Gold is maintaining a strong bullish structure on the 4-hour timeframe, forming consistent higher highs and higher lows.

Recently, price tapped into a key Demand Zone, showing a clear rejection and early signs of buyer re-entry — signaling a potential continuation of the uptrend.

Technical Outlook

• Trend: Bullish market structure intact.

• Current Price: ~4,230.34

• Demand Zone (Buy Zone): Price has bounced from a major demand area — indicating renewed buying pressure.

• Reversal Confirmation: Rejection wicks and bullish candles confirm demand reaction.

• Supply Zone (Resistance): Overhead supply remains the key obstacle. A break and close above it could trigger a strong rally toward the next resistance.

Trade Setup

Parameter Level (Approx.) Description

Entry (Buy Zone) 4,230.34 Reaction from demand zone

Take Profit 1 (TP1) 4,501.59 Conservative target

Take Profit 2 (TP2) 4,576.74 Extended target

Stop Loss (SL) ~4,200.00 Below demand zone

Market Outlook

As long as the demand zone holds, the bullish structure remains valid.

A confirmed break above the supply zone could invite strong momentum toward higher targets.

Failure to hold the demand base may trigger a corrective move lower — hence, risk management remains crucial.

Bias: 🟢 Bullish

Timeframe: 4H

Strategy: Supply & Demand | Market Structure | Price Action

Gold is maintaining a strong bullish structure on the 4-hour timeframe, forming consistent higher highs and higher lows.

Recently, price tapped into a key Demand Zone, showing a clear rejection and early signs of buyer re-entry — signaling a potential continuation of the uptrend.

Technical Outlook

• Trend: Bullish market structure intact.

• Current Price: ~4,230.34

• Demand Zone (Buy Zone): Price has bounced from a major demand area — indicating renewed buying pressure.

• Reversal Confirmation: Rejection wicks and bullish candles confirm demand reaction.

• Supply Zone (Resistance): Overhead supply remains the key obstacle. A break and close above it could trigger a strong rally toward the next resistance.

Trade Setup

Parameter Level (Approx.) Description

Entry (Buy Zone) 4,230.34 Reaction from demand zone

Take Profit 1 (TP1) 4,501.59 Conservative target

Take Profit 2 (TP2) 4,576.74 Extended target

Stop Loss (SL) ~4,200.00 Below demand zone

Market Outlook

As long as the demand zone holds, the bullish structure remains valid.

A confirmed break above the supply zone could invite strong momentum toward higher targets.

Failure to hold the demand base may trigger a corrective move lower — hence, risk management remains crucial.

Bias: 🟢 Bullish

Timeframe: 4H

Strategy: Supply & Demand | Market Structure | Price Action

Champ_of_Gold

ICT • PA • SMC

I don’t predict. I synchronize with the market’s rhythm.

Signals here 👉t.me/+TDFp_Ervho80YzU0

ICT • PA • SMC

I don’t predict. I synchronize with the market’s rhythm.

Signals here 👉t.me/+TDFp_Ervho80YzU0

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.

Champ_of_Gold

ICT • PA • SMC

I don’t predict. I synchronize with the market’s rhythm.

Signals here 👉t.me/+TDFp_Ervho80YzU0

ICT • PA • SMC

I don’t predict. I synchronize with the market’s rhythm.

Signals here 👉t.me/+TDFp_Ervho80YzU0

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.