📊 Trade Context

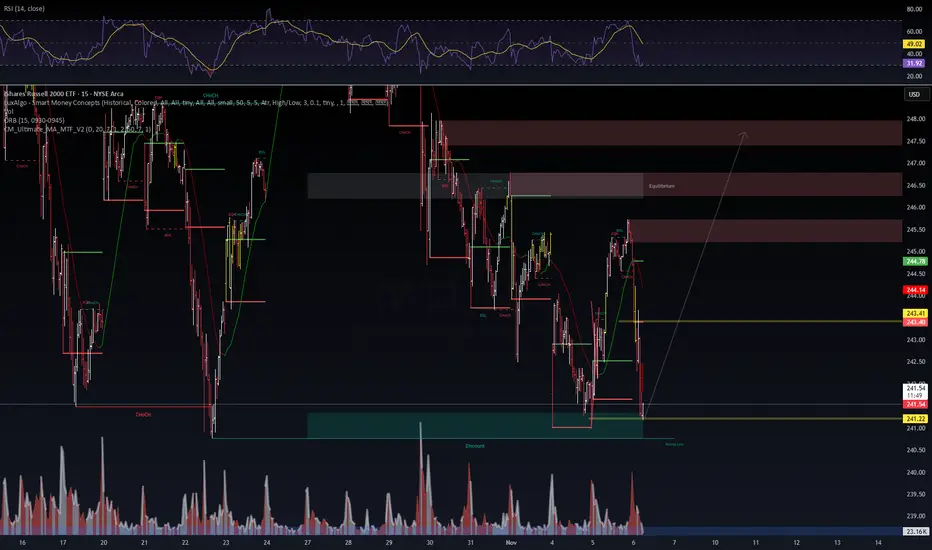

Symbol: IWM (Russell 2000 ETF)

IWM (Russell 2000 ETF)

Timeframe: 15-minute

Current Price Zone: $241.20–$241.40

Structure: Clear BOS (Break of Structure) → CHoCH (Change of Character) → Discount zone retest.

RSI: ~29 (oversold), showing early divergence potential.

⚙️ Setup Breakdown

Discount Zone: The green zone marks a liquidity sweep and potential “strong low.”

Confluence:

Volume spike at discount (buyer absorption).

RSI divergence (momentum exhaustion on the downside).

Structural sweep of previous equal lows.

Immediate Resistance: $243.40 → minor supply zone.

Main Target Zone: $246.00–$247.50 (equilibrium and prior inefficiency zone).

🧠 Trade Thesis

Buyers are defending the discount region around $241.00.

Expectation: Liquidity grab → reaccumulation → move toward equilibrium.

Entry: Around $241.20 (discount reaction confirmed with bullish candle).

Stop-loss: Below $240.70 (invalidate if lower low forms).

Take-profit:

TP1: $243.40 (intraframe supply)

TP2: $246.40 (equilibrium)

TP3: $247.50 (full mitigation zone)

🕹️ Execution Plan

Wait for bullish confirmation on smaller timeframes (M5–M1 BOS/CHoCH).

Use reduced size at entry; scale as momentum confirms.

Watch RSI reclaim above 40 — it usually aligns with structural reversal.

⚠️ Risk and Management

Risk/Reward ~1:3.5 (optimal under current volatility).

Avoid adding below $241.00 — zone invalidates below $240.70.

Volume must increase on breakout above $243.40; otherwise, partial exit recommended.

Symbol:

Timeframe: 15-minute

Current Price Zone: $241.20–$241.40

Structure: Clear BOS (Break of Structure) → CHoCH (Change of Character) → Discount zone retest.

RSI: ~29 (oversold), showing early divergence potential.

⚙️ Setup Breakdown

Discount Zone: The green zone marks a liquidity sweep and potential “strong low.”

Confluence:

Volume spike at discount (buyer absorption).

RSI divergence (momentum exhaustion on the downside).

Structural sweep of previous equal lows.

Immediate Resistance: $243.40 → minor supply zone.

Main Target Zone: $246.00–$247.50 (equilibrium and prior inefficiency zone).

🧠 Trade Thesis

Buyers are defending the discount region around $241.00.

Expectation: Liquidity grab → reaccumulation → move toward equilibrium.

Entry: Around $241.20 (discount reaction confirmed with bullish candle).

Stop-loss: Below $240.70 (invalidate if lower low forms).

Take-profit:

TP1: $243.40 (intraframe supply)

TP2: $246.40 (equilibrium)

TP3: $247.50 (full mitigation zone)

🕹️ Execution Plan

Wait for bullish confirmation on smaller timeframes (M5–M1 BOS/CHoCH).

Use reduced size at entry; scale as momentum confirms.

Watch RSI reclaim above 40 — it usually aligns with structural reversal.

⚠️ Risk and Management

Risk/Reward ~1:3.5 (optimal under current volatility).

Avoid adding below $241.00 — zone invalidates below $240.70.

Volume must increase on breakout above $243.40; otherwise, partial exit recommended.

WaverVanir ⚡ To grow and conquer

stocktwits.com/WaverVanir | wavervanir.com | buymeacoffee.com/wavervanir

Not Investment Advice

stocktwits.com/WaverVanir | wavervanir.com | buymeacoffee.com/wavervanir

Not Investment Advice

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

WaverVanir ⚡ To grow and conquer

stocktwits.com/WaverVanir | wavervanir.com | buymeacoffee.com/wavervanir

Not Investment Advice

stocktwits.com/WaverVanir | wavervanir.com | buymeacoffee.com/wavervanir

Not Investment Advice

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.