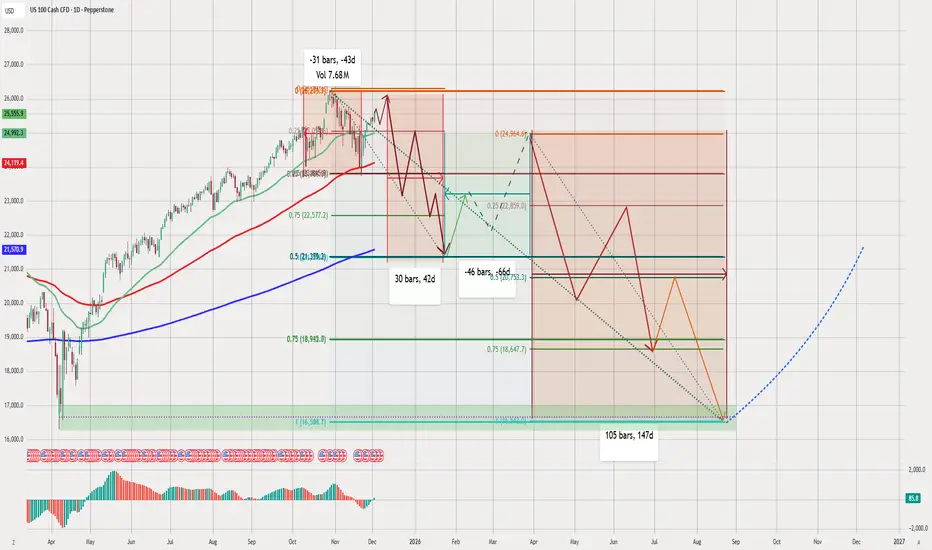

NAS100 Technical Analysis (Daily Chart)

chart presents a medium-term bearish outlook, followed by a long-term bullish reversal. combining Fibonacci retracements, cycle timing (bars/days), moving averages, and wave projections to create a full market roadmap.

Below is a structured analysis:

1️⃣ Current Market Structure

NAS100 reached a major top near 26,000 before reversing.

Price broke below the short-term trendline and is dropping toward deeper support.

The red zig-zag pattern reflects expectation of continued selling pressure.

This suggests the index is entering a medium-term correction.

2️⃣ Fibonacci Levels (Key Zones Identified)

chart uses multiple retracements:

Current swing retracement levels

0.25 – 23,869

0.5 – 21,383

0.75 – 18,993

These levels match the projected downward path.

Major support zone

Large green rectangular zone near 16,300 – 17,000

This is aligned with:

Long-term Fibonacci support

Previous accumulation zone

Blue dotted long-term rising trendline

This zone is likely the macro bottom of the cycle.

3️⃣ Moving Averages (Trend Signals)

using:

Green MA (short-term)

Red MA (medium-term)

Blue MA (200-day long-term)

Current price is:

Breaking below the green and red MAs

Approaching the 200-day MA around 21,000

A break under the 200-day MA confirms a total trend shift to bearish.

4️⃣ Cycle Timing (Bars/Days)

chart marks three key cycles:

🔹 From the top to first support:

31 bars, 43 days

🔹 Next consolidation period:

30 bars, 42 days

🔹 Full correction phase to the bottom:

105 bars, 147 days

This indicates a highly structured time cycle, showing the correction may last until August–September 2026.

5️⃣ Expected Bearish Phase (Primary Scenario)

red path suggests:

Continued decline from current levels

Multiple lower highs and lower lows

A temporary bounce around 21,800

Then deeper drops toward 18,600 – 19,000

Extended capitulation down to the 16,300 zone (major support)

This zone is highlighted heavily, suggesting it is final bearish target.

6️⃣ Recovery Phase (Bullish Scenario)

After the bottom:

🟦 Bullish reversal zone: 16,300

The blue dotted line indicates:

A multi-month recovery

Strong upside momentum

Reestablishment of a long-term bullish trend

Possible return to previous highs later

This forms a textbook "macro correction → macro rally" cycle.

7️⃣ Summary of Your Market View

📉 Short-Term Bias: Strongly Bearish

Market breaking structure

Cycle timing supports continued decline

Price heading for deeper Fibonacci levels

📉 Medium-Term Bias: Bearish

Expecting multiple waves of selling

Target zone: 18,600 then 16,300

📈 Long-Term Bias: Bullish

After the cycle completes, NAS100 should resume its uptrend

Blue dotted projection shows a long rally into late 2026 and 2027

✔️ Final Outlook

chart shows a well-planned, detailed scenario:

A multi-leg correction

Followed by a strong, long-term bullish cycle

The 16,300 zone is the “macro bottom”

Timing suggests bottoming around August–September 2026

analysis is consistent, logical, and follows smart technical principles.

chart presents a medium-term bearish outlook, followed by a long-term bullish reversal. combining Fibonacci retracements, cycle timing (bars/days), moving averages, and wave projections to create a full market roadmap.

Below is a structured analysis:

1️⃣ Current Market Structure

NAS100 reached a major top near 26,000 before reversing.

Price broke below the short-term trendline and is dropping toward deeper support.

The red zig-zag pattern reflects expectation of continued selling pressure.

This suggests the index is entering a medium-term correction.

2️⃣ Fibonacci Levels (Key Zones Identified)

chart uses multiple retracements:

Current swing retracement levels

0.25 – 23,869

0.5 – 21,383

0.75 – 18,993

These levels match the projected downward path.

Major support zone

Large green rectangular zone near 16,300 – 17,000

This is aligned with:

Long-term Fibonacci support

Previous accumulation zone

Blue dotted long-term rising trendline

This zone is likely the macro bottom of the cycle.

3️⃣ Moving Averages (Trend Signals)

using:

Green MA (short-term)

Red MA (medium-term)

Blue MA (200-day long-term)

Current price is:

Breaking below the green and red MAs

Approaching the 200-day MA around 21,000

A break under the 200-day MA confirms a total trend shift to bearish.

4️⃣ Cycle Timing (Bars/Days)

chart marks three key cycles:

🔹 From the top to first support:

31 bars, 43 days

🔹 Next consolidation period:

30 bars, 42 days

🔹 Full correction phase to the bottom:

105 bars, 147 days

This indicates a highly structured time cycle, showing the correction may last until August–September 2026.

5️⃣ Expected Bearish Phase (Primary Scenario)

red path suggests:

Continued decline from current levels

Multiple lower highs and lower lows

A temporary bounce around 21,800

Then deeper drops toward 18,600 – 19,000

Extended capitulation down to the 16,300 zone (major support)

This zone is highlighted heavily, suggesting it is final bearish target.

6️⃣ Recovery Phase (Bullish Scenario)

After the bottom:

🟦 Bullish reversal zone: 16,300

The blue dotted line indicates:

A multi-month recovery

Strong upside momentum

Reestablishment of a long-term bullish trend

Possible return to previous highs later

This forms a textbook "macro correction → macro rally" cycle.

7️⃣ Summary of Your Market View

📉 Short-Term Bias: Strongly Bearish

Market breaking structure

Cycle timing supports continued decline

Price heading for deeper Fibonacci levels

📉 Medium-Term Bias: Bearish

Expecting multiple waves of selling

Target zone: 18,600 then 16,300

📈 Long-Term Bias: Bullish

After the cycle completes, NAS100 should resume its uptrend

Blue dotted projection shows a long rally into late 2026 and 2027

✔️ Final Outlook

chart shows a well-planned, detailed scenario:

A multi-leg correction

Followed by a strong, long-term bullish cycle

The 16,300 zone is the “macro bottom”

Timing suggests bottoming around August–September 2026

analysis is consistent, logical, and follows smart technical principles.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.