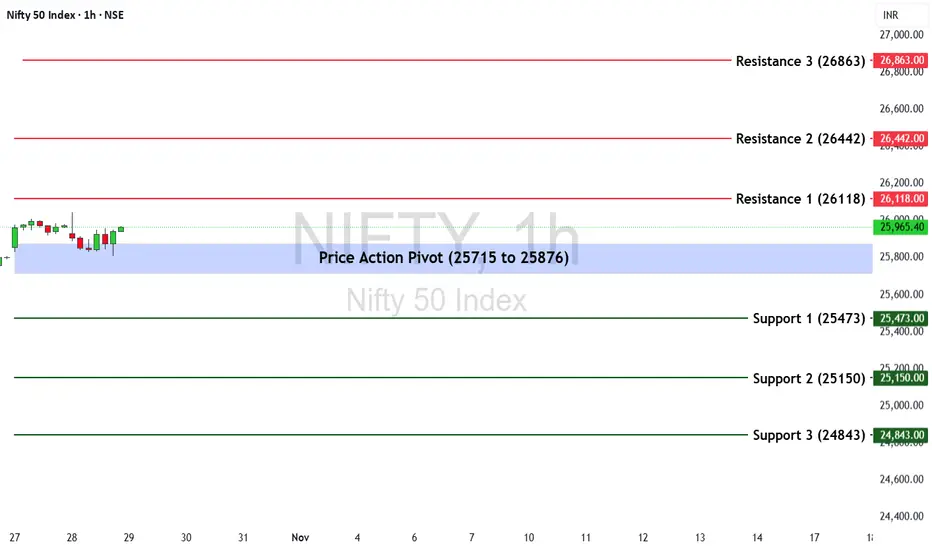

The Nifty 50 Index last week ended at 25,795.15, posting a +0.33% gain. The index continues to consolidate near recent highs, signaling a potential directional move in the upcoming week.

🔹 Key Levels for the Upcoming Week

📌 Price Action Pivot Zone:

25,715 to 25,876 – This blue-shaded zone represents the key decision area. Sustaining above this range may attract fresh buying interest, while a fall below could trigger mild profit booking.

🔻 Support Levels:

S1: 25,473

S2: 25,150

S3: 24,843

🔺 Resistance Levels:

R1: 26,118

R2: 26,442

R3: 26,863

📈 Market Outlook

Bullish Scenario:

If Nifty holds above 25,876, a breakout move could take the index toward R1 (26,118). Sustained strength above this level may open the path to R2 (26,442) and R3 (26,863) in the near term.

Bearish Scenario:

If the index slips below 25,715, short-term weakness could drag it toward S1 (25,473), followed by S2 (25,150) and S3 (24,843).

Disclaimer: aliceblueonline.com/legal-documentation/disclaimer/

🔹 Key Levels for the Upcoming Week

📌 Price Action Pivot Zone:

25,715 to 25,876 – This blue-shaded zone represents the key decision area. Sustaining above this range may attract fresh buying interest, while a fall below could trigger mild profit booking.

🔻 Support Levels:

S1: 25,473

S2: 25,150

S3: 24,843

🔺 Resistance Levels:

R1: 26,118

R2: 26,442

R3: 26,863

📈 Market Outlook

Bullish Scenario:

If Nifty holds above 25,876, a breakout move could take the index toward R1 (26,118). Sustained strength above this level may open the path to R2 (26,442) and R3 (26,863) in the near term.

Bearish Scenario:

If the index slips below 25,715, short-term weakness could drag it toward S1 (25,473), followed by S2 (25,150) and S3 (24,843).

Disclaimer: aliceblueonline.com/legal-documentation/disclaimer/

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.