Trading Plan for Nifty - 27th November 2024

Introduction:

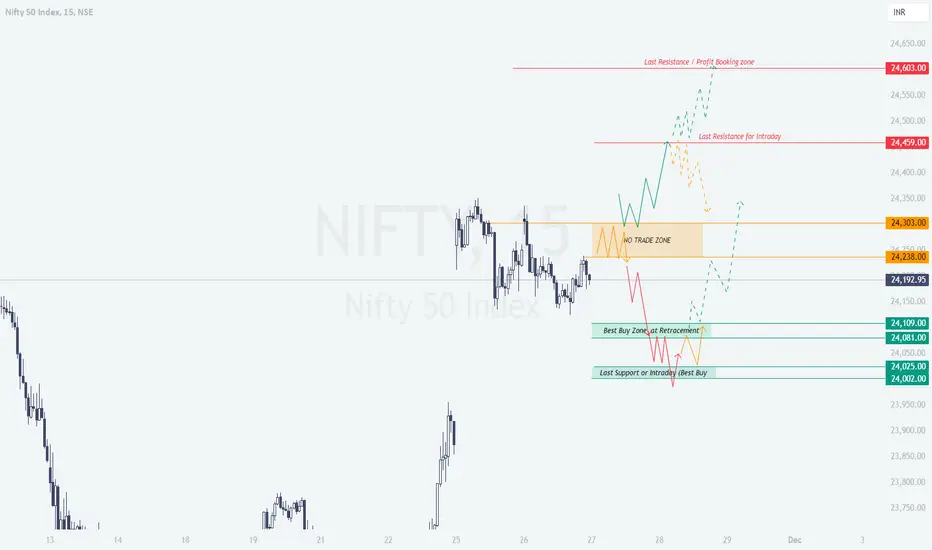

On 26th November 2024, Nifty traded within a defined range, with price movements largely respecting key levels. The chart revealed a consolidation phase highlighted by the "No Trade Zone" (Yellow Trend) around 24,238–24,303, indicating indecision among market participants. Bullish momentum (Green Trend) was observed above 24,459, while bearish pressure (Red Trend) dominated below 24,109. The market continues to exhibit structural clarity, with specific levels marking key support and resistance zones.

Plan for Different Opening Scenarios:

Tips for Risk Management in Options Trading:

Avoid over-leveraging; use position sizing strategies to manage risk effectively.

Trade liquid contracts to minimize slippage.

Use hedging strategies like spreads to limit maximum losses.

Exit positions early if the market invalidates your levels, rather than holding onto losing trades.

Always base your entries on confirmations such as candlestick patterns, volume, or hourly close signals.

Summary and Conclusion:

For 27th November 2024, the chart suggests a clear game plan with pivotal levels to watch:

Bullish above 24,303, targeting 24,459 and 24,603.

Bearish below 24,109, targeting 24,025 and 24,002.

Avoid trading within the "No Trade Zone" (24,238–24,303) unless a decisive breakout occurs.

By adhering to the plan and practicing disciplined risk management, traders can navigate Nifty's movements effectively.

Disclaimer:

I am not a SEBI-registered analyst. The above analysis is for educational purposes only. Please conduct your research or consult with a financial advisor before taking any trades.

Introduction:

On 26th November 2024, Nifty traded within a defined range, with price movements largely respecting key levels. The chart revealed a consolidation phase highlighted by the "No Trade Zone" (Yellow Trend) around 24,238–24,303, indicating indecision among market participants. Bullish momentum (Green Trend) was observed above 24,459, while bearish pressure (Red Trend) dominated below 24,109. The market continues to exhibit structural clarity, with specific levels marking key support and resistance zones.

Plan for Different Opening Scenarios:

- Gap-Up Opening (100+ Points Above Close):

If Nifty opens above 24,303 but below 24,459, wait for price action confirmation. A breakout above 24,459 with an hourly candle close suggests bullish momentum towards the Last Resistance for Intraday at 24,603, where profit booking is advisable.

If Nifty opens directly near or above 24,459, avoid immediate entry. Wait for retracement near 24,303–24,459 for a better risk-reward setup.

Monitor bearish rejection candles near 24,459, as this could signal a reversal towards the "No Trade Zone."

Risk Management Tip: For options, consider buying 24,600 CE with strict stop loss based on the hourly close below 24,303. - Flat Opening (Near Previous Close at 24,192):

If the market opens flat, avoid trading immediately within the No Trade Zone (24,238–24,303). Allow the price to break out or break down from this range.

A breakout above 24,303 targets 24,459, while a breakdown below 24,238 may lead to bearish momentum toward 24,109.

Monitor price reaction around 24,109 (Best Buy Zone), where retracement buyers might step in for a potential reversal.

Risk Management Tip: Utilize strategies like selling Iron Condors to capitalize on the consolidation phase while staying protected. - Gap-Down Opening (100+ Points Below Close):

If Nifty opens below 24,109, watch for support around 24,025–24,002. This zone represents the Last Support and is ideal for reversal trades if bullish price action appears.

Avoid chasing shorts immediately after a gap-down. A pullback towards 24,109 could offer safer entry points for bearish trades.

Below 24,002, bearish momentum strengthens, and traders can target 23,900 with appropriate position sizing.

Risk Management Tip: For bearish plays, consider buying 24,000 PE with a stop loss above 24,109.

Tips for Risk Management in Options Trading:

Avoid over-leveraging; use position sizing strategies to manage risk effectively.

Trade liquid contracts to minimize slippage.

Use hedging strategies like spreads to limit maximum losses.

Exit positions early if the market invalidates your levels, rather than holding onto losing trades.

Always base your entries on confirmations such as candlestick patterns, volume, or hourly close signals.

Summary and Conclusion:

For 27th November 2024, the chart suggests a clear game plan with pivotal levels to watch:

Bullish above 24,303, targeting 24,459 and 24,603.

Bearish below 24,109, targeting 24,025 and 24,002.

Avoid trading within the "No Trade Zone" (24,238–24,303) unless a decisive breakout occurs.

By adhering to the plan and practicing disciplined risk management, traders can navigate Nifty's movements effectively.

Disclaimer:

I am not a SEBI-registered analyst. The above analysis is for educational purposes only. Please conduct your research or consult with a financial advisor before taking any trades.

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.