Stock markets around the globe are turning their focus to one key earnings report: Nvidia. AI has been the primary driver of the U.S. stock market over the past few years, and Nvidia’s earnings are widely viewed as the best indicator of growth in the AI sector. The correlation between Nvidia and broader U.S. stock performance as well as its influence on global equities, crypto, and FX is strong enough for the world to fixate on this report.

Nvidia is expected to report $0.88 EPS for the first quarter of FY2026, representing a 43.36% year-over-year increase, but a slight decline quarter-over-quarter. The company previously guided revenue between $42.14 billion and $43.86 billion, with market consensus currently at $43.317 billion, in line with that range.

The key revenue stream, Data Center, is expected to generate $39.357 billion, reflecting 74.44% growth. Some analysts are forecasting as high as $42.051 billion for this segment alone.

At a forward P/E ratio of 27.6x, Nvidia is trading well below its 1-year (32.1x), 2-year (33.7x), and 5-year (40.1x) historical averages. This more favorable valuation, coupled with strong AI tailwinds, could present a solid medium- to long-term buying opportunity if earnings and guidance support the growth narrative.

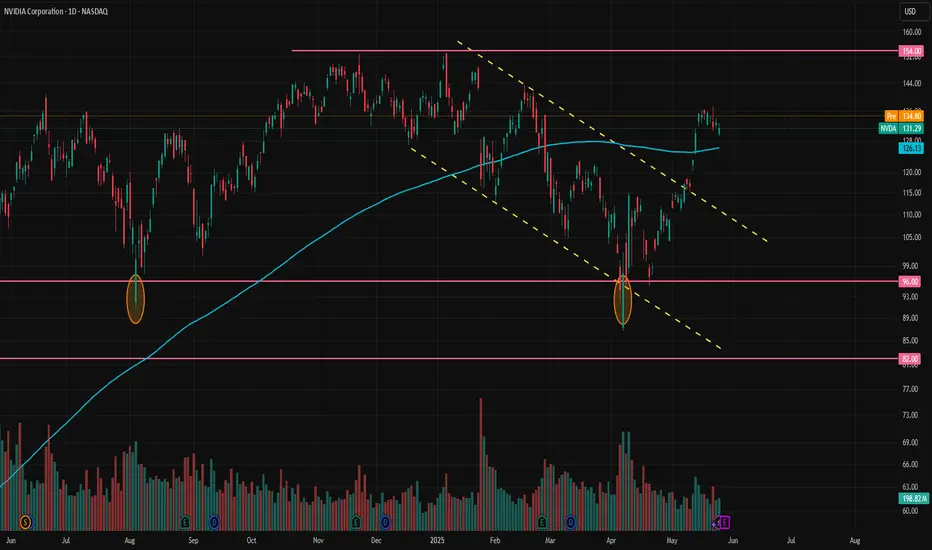

After breaking out of the downtrend, NVDA approached the 140 resistance level but failed to break through. Following the upcoming earnings release, if Nvidia pulls back to either 118 or 110, those levels could present buying opportunities, assuming the report isn’t significantly negative.

It’s worth noting that sometimes real market expectations run much higher than the analyst consensus, which can lead to a selloff even after a strong earnings report.

The 154 level remains the key resistance for now, and in our view, a breakout this week carries a relatively low probability. If the report tomorrow exceeds expectations, 154 could still act as a barrier and trigger some profit-taking by Nvidia bulls.

Nvidia is expected to report $0.88 EPS for the first quarter of FY2026, representing a 43.36% year-over-year increase, but a slight decline quarter-over-quarter. The company previously guided revenue between $42.14 billion and $43.86 billion, with market consensus currently at $43.317 billion, in line with that range.

The key revenue stream, Data Center, is expected to generate $39.357 billion, reflecting 74.44% growth. Some analysts are forecasting as high as $42.051 billion for this segment alone.

At a forward P/E ratio of 27.6x, Nvidia is trading well below its 1-year (32.1x), 2-year (33.7x), and 5-year (40.1x) historical averages. This more favorable valuation, coupled with strong AI tailwinds, could present a solid medium- to long-term buying opportunity if earnings and guidance support the growth narrative.

After breaking out of the downtrend, NVDA approached the 140 resistance level but failed to break through. Following the upcoming earnings release, if Nvidia pulls back to either 118 or 110, those levels could present buying opportunities, assuming the report isn’t significantly negative.

It’s worth noting that sometimes real market expectations run much higher than the analyst consensus, which can lead to a selloff even after a strong earnings report.

The 154 level remains the key resistance for now, and in our view, a breakout this week carries a relatively low probability. If the report tomorrow exceeds expectations, 154 could still act as a barrier and trigger some profit-taking by Nvidia bulls.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.