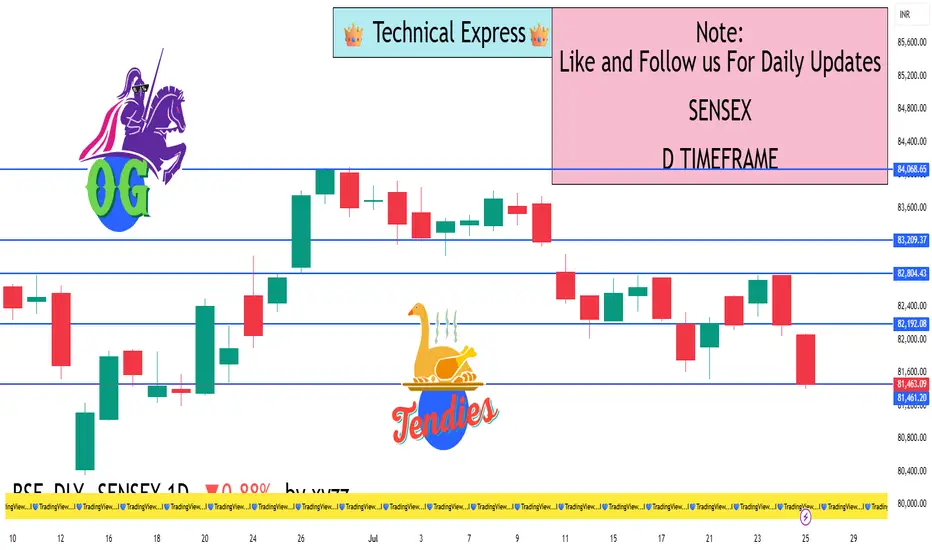

Closing Value: 81,463.09

Net Change: −721.08 points (−0.88%)

Opening Level: 82,065.76

Day’s High: 82,069.51

Day’s Low: 81,397.69

Trend: Bearish

📊 Technical Analysis:

✅ Candle Type:

Large bearish candle with a close near the day’s low.

Indicates strong selling pressure throughout the session.

🔻 Support Levels:

81,400 – Immediate support (Friday’s low)

81,000 – Critical psychological and technical level

80,700 – Medium-term support zone

🔺 Resistance Levels:

82,070 – Intraday high and near-term resistance

82,300 – Minor resistance

82,500 – Strong resistance zone

📈 Indicator Summary:

RSI (Relative Strength Index): Likely below 50 – shows weakening buying strength

MACD: Bearish crossover – confirms ongoing downtrend

Volume: Higher than average – selling was broad-based and strong

🧠 Market Sentiment:

Bearish sentiment due to pressure in Auto, Banking, Energy, and IT sectors

Major stocks pulling down the index: Reliance, HDFC Bank, Infosys, Tech Mahindra, and Bajaj Finance

Investors showed caution amid FII selling, weak global signals, and earnings season pressure

✅ Conclusion:

Sensex is in a short-term downtrend

A breakdown below 81,000 could trigger a move toward 80,700 or lower

Bulls must reclaim 82,000–82,300 levels to regain positive momentum

Net Change: −721.08 points (−0.88%)

Opening Level: 82,065.76

Day’s High: 82,069.51

Day’s Low: 81,397.69

Trend: Bearish

📊 Technical Analysis:

✅ Candle Type:

Large bearish candle with a close near the day’s low.

Indicates strong selling pressure throughout the session.

🔻 Support Levels:

81,400 – Immediate support (Friday’s low)

81,000 – Critical psychological and technical level

80,700 – Medium-term support zone

🔺 Resistance Levels:

82,070 – Intraday high and near-term resistance

82,300 – Minor resistance

82,500 – Strong resistance zone

📈 Indicator Summary:

RSI (Relative Strength Index): Likely below 50 – shows weakening buying strength

MACD: Bearish crossover – confirms ongoing downtrend

Volume: Higher than average – selling was broad-based and strong

🧠 Market Sentiment:

Bearish sentiment due to pressure in Auto, Banking, Energy, and IT sectors

Major stocks pulling down the index: Reliance, HDFC Bank, Infosys, Tech Mahindra, and Bajaj Finance

Investors showed caution amid FII selling, weak global signals, and earnings season pressure

✅ Conclusion:

Sensex is in a short-term downtrend

A breakdown below 81,000 could trigger a move toward 80,700 or lower

Bulls must reclaim 82,000–82,300 levels to regain positive momentum

I built a Buy & Sell Signal Indicator with 85% accuracy.

📈 Get access via DM or

WhatsApp: wa.link/d997q0

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

📈 Get access via DM or

WhatsApp: wa.link/d997q0

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

Pubblicazioni correlate

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.

I built a Buy & Sell Signal Indicator with 85% accuracy.

📈 Get access via DM or

WhatsApp: wa.link/d997q0

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

📈 Get access via DM or

WhatsApp: wa.link/d997q0

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

Pubblicazioni correlate

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.