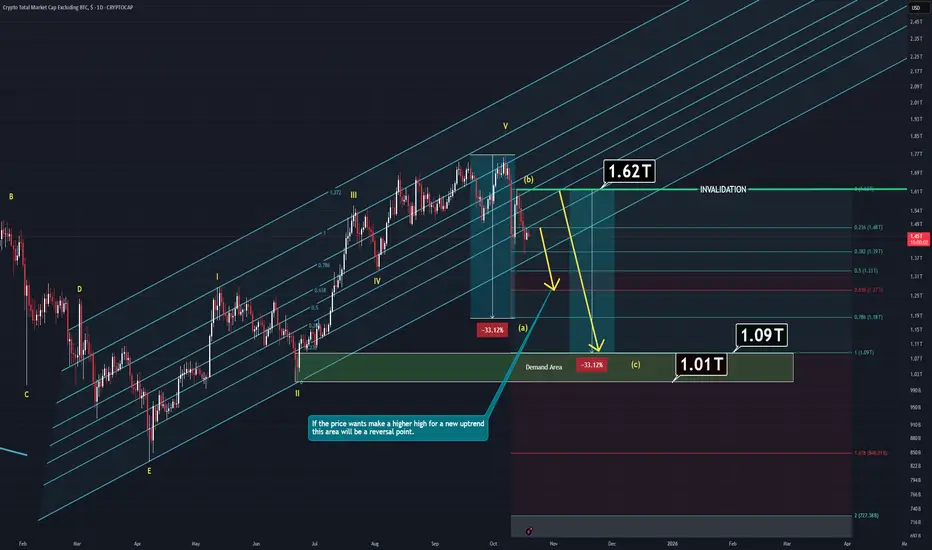

Total 2 has started its correction wave known as A-B-C but there are much to consider:

Main component of Total 2 is ETH and we'll need to dive into that so the chart would make sense.

-Companies like Bitmine keep buying ETH but they don't actually own it yet.

Specifically, Ethereum treasury companies collectively hold around 5.66 million ETH, equivalent to 4.68% of supply. Meanwhile, spot Ethereum ETFs hold roughly 6.81 million ETH, or 5.63% of the total.

If this companies would like to keep buying there are also two things to consider:

1- ETH price is still high despite the last crash. Any company would consider buying more if the price is lower than current.

2- ETH has unlimited max supply. It means, these companies will need way more than currently they have if they actually want to control it better which they do. Another thing to consider is, they actually don't have "that much". According to data we have, they only control around %5 at max. It means, ETH's price is not dependent on their favor, big wallets are.

Other things to consider:

ETF's:

After approvel of the SEC, these companies now can offer staked ETH ETF which also means price won't actually matter for the long term. These companies will be able to buy more ETH with the lower interest rates while prices are lower and cheaper. Lower interest rates means cheap liquidty which will trigger more buying events despite the price.

Also;

In the long term, these companies and ETF holders will be able to buy more thanks to staking mekanism. Staking will allow them to accummulate more ETH as a bonus.

When you add technical analysis into all of this, the chart actually makes sense.

Last crash mitigated closest demand zone. If the price wants to go higher it will at least has to make a higher high which means some of that wick's portion must be filled. And if that amount is not going to be enough, next demand zone will act as a magnet for the price.

Either way, waiting for invalidation line trigger or simply demand zone to react is going to be wiser action.

Thanks for reading.

Main component of Total 2 is ETH and we'll need to dive into that so the chart would make sense.

-Companies like Bitmine keep buying ETH but they don't actually own it yet.

Specifically, Ethereum treasury companies collectively hold around 5.66 million ETH, equivalent to 4.68% of supply. Meanwhile, spot Ethereum ETFs hold roughly 6.81 million ETH, or 5.63% of the total.

If this companies would like to keep buying there are also two things to consider:

1- ETH price is still high despite the last crash. Any company would consider buying more if the price is lower than current.

2- ETH has unlimited max supply. It means, these companies will need way more than currently they have if they actually want to control it better which they do. Another thing to consider is, they actually don't have "that much". According to data we have, they only control around %5 at max. It means, ETH's price is not dependent on their favor, big wallets are.

Other things to consider:

ETF's:

After approvel of the SEC, these companies now can offer staked ETH ETF which also means price won't actually matter for the long term. These companies will be able to buy more ETH with the lower interest rates while prices are lower and cheaper. Lower interest rates means cheap liquidty which will trigger more buying events despite the price.

Also;

In the long term, these companies and ETF holders will be able to buy more thanks to staking mekanism. Staking will allow them to accummulate more ETH as a bonus.

When you add technical analysis into all of this, the chart actually makes sense.

Last crash mitigated closest demand zone. If the price wants to go higher it will at least has to make a higher high which means some of that wick's portion must be filled. And if that amount is not going to be enough, next demand zone will act as a magnet for the price.

Either way, waiting for invalidation line trigger or simply demand zone to react is going to be wiser action.

Thanks for reading.

Ordine annullato

The first expected move has happened, but I'm afraid this analysis might be invalidated soon.Momentum and confidence in cryptocurrencies are still strong, so I'm cancelling this analysis before its invalidated.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.