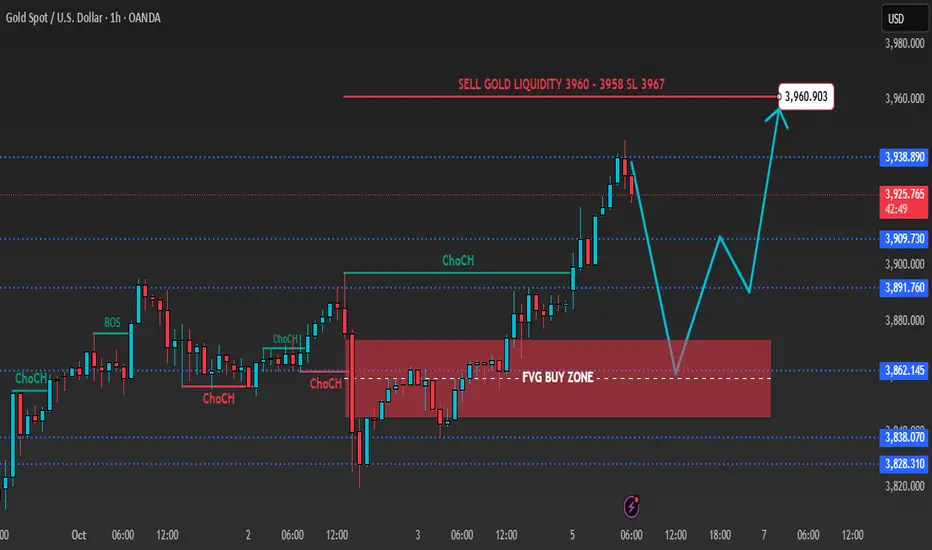

Gold on the 1H timeframe is reacting near 3,928 after a clean structure break and buildup toward the premium zone 3960–3958, where liquidity remains above recent highs. Market structure shows a bullish impulse leg forming, but engineered sweeps at premium supply are likely before continuation. The defined FVG buy zone around 3840–3842 marks discount territory for potential re-entry if price retraces deeper.

From the macro side, gold is consolidating as traders brace for this week’s U.S. CPI data and renewed Treasury yield volatility. The dollar’s firm tone and cautious risk sentiment following stronger U.S. job figures are keeping gold capped near short-term supply. Still, geopolitical tensions and central-bank demand continue to provide underlying support, reinforcing the buy-on-dip narrative toward year-end.

________________________________________

📌 Key Structure & Liquidity Zones (1H):

• 🔴 SELL GOLD 3960–3958 (SL 3967): Premium liquidity sweep zone targeting retracement toward 3940 → 3900.

• 🟢 BUY ZONE 3840–3842 (SL 3833): Discount demand and FVG mitigation aligned with higher-timeframe support. Upside targets 3860 → 3880 → 3900+.

________________________________________

📊 Trading Ideas (Scenario-Based):

🔻 Sell Setup – Liquidity Sweep at 3960–3958

• Entry: 3960–3958

• Stop Loss: 3967

• Take Profits:

• TP1: 3940

• TP2: 3920

• TP3: 3900

🔺 Buy Setup – FVG Mitigation at 3840–3842

• Entry: 3840–3842

• Stop Loss: 3833

• Take Profits:

• TP1: 3860

• TP2: 3880

• TP3: 3900+

________________________________________

🔑 Strategy Note

Gold remains liquidity-driven within a mid-range structure. Expect engineered sweeps into 3960–3958 before deeper pullbacks into discount demand near 3840–3842. Tactical bias favors fading rallies at premium while preparing to join the continuation move from discount FVG support if CPI-related volatility clears the liquidity pools.

From the macro side, gold is consolidating as traders brace for this week’s U.S. CPI data and renewed Treasury yield volatility. The dollar’s firm tone and cautious risk sentiment following stronger U.S. job figures are keeping gold capped near short-term supply. Still, geopolitical tensions and central-bank demand continue to provide underlying support, reinforcing the buy-on-dip narrative toward year-end.

________________________________________

📌 Key Structure & Liquidity Zones (1H):

• 🔴 SELL GOLD 3960–3958 (SL 3967): Premium liquidity sweep zone targeting retracement toward 3940 → 3900.

• 🟢 BUY ZONE 3840–3842 (SL 3833): Discount demand and FVG mitigation aligned with higher-timeframe support. Upside targets 3860 → 3880 → 3900+.

________________________________________

📊 Trading Ideas (Scenario-Based):

🔻 Sell Setup – Liquidity Sweep at 3960–3958

• Entry: 3960–3958

• Stop Loss: 3967

• Take Profits:

• TP1: 3940

• TP2: 3920

• TP3: 3900

🔺 Buy Setup – FVG Mitigation at 3840–3842

• Entry: 3840–3842

• Stop Loss: 3833

• Take Profits:

• TP1: 3860

• TP2: 3880

• TP3: 3900+

________________________________________

🔑 Strategy Note

Gold remains liquidity-driven within a mid-range structure. Expect engineered sweeps into 3960–3958 before deeper pullbacks into discount demand near 3840–3842. Tactical bias favors fading rallies at premium while preparing to join the continuation move from discount FVG support if CPI-related volatility clears the liquidity pools.

⚜️ Daily 4 - 6 Swing SIGNALS

⚜️ Daily 9 - 15 Scalping SIGNALS

⚜️ SMC - ICT | Document and Real Trade Logic

⚜️ Forex & Crypto & Gold | SIGNALS

Join Real - Time Signals Here: t.me/+pi-w7HQsxw03YWNl

⚜️ Daily 9 - 15 Scalping SIGNALS

⚜️ SMC - ICT | Document and Real Trade Logic

⚜️ Forex & Crypto & Gold | SIGNALS

Join Real - Time Signals Here: t.me/+pi-w7HQsxw03YWNl

Pubblicazioni correlate

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.

⚜️ Daily 4 - 6 Swing SIGNALS

⚜️ Daily 9 - 15 Scalping SIGNALS

⚜️ SMC - ICT | Document and Real Trade Logic

⚜️ Forex & Crypto & Gold | SIGNALS

Join Real - Time Signals Here: t.me/+pi-w7HQsxw03YWNl

⚜️ Daily 9 - 15 Scalping SIGNALS

⚜️ SMC - ICT | Document and Real Trade Logic

⚜️ Forex & Crypto & Gold | SIGNALS

Join Real - Time Signals Here: t.me/+pi-w7HQsxw03YWNl

Pubblicazioni correlate

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.