📊 Market Overview

Gold experienced a sharp intraday drop during the Asian session, testing the 4,280 – 4,279 USD zone before quickly recovering. Despite short-term volatility, it continues to close the week in green for the ninth consecutive time — confirming the strength of the ongoing bullish cycle.

The broader fundamentals remain supportive:

💥 Persistent geopolitical tensions keep safe-haven demand high.

⚖️ US–China trade uncertainty and the risk of a prolonged US government shutdown weaken risk appetite.

💵 Fed rate-cut expectations and USD softness continue to favor gold upside.

In short — Smart Money remains positioned long, and every dip still looks like a liquidity grab for re-accumulation.

🧠 Technical Structure (MMFLOW View)

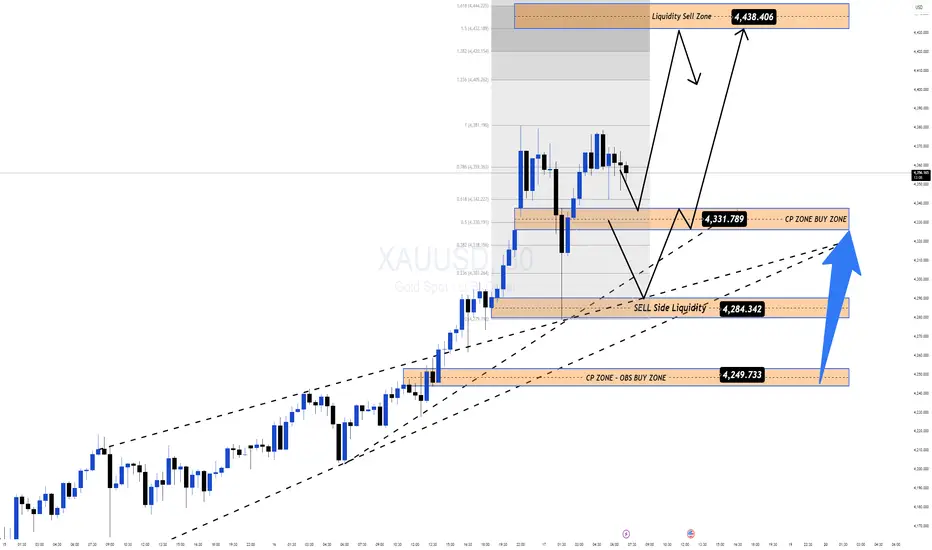

On the M30 timeframe, gold continues to respect an ascending channel, currently forming a liquidity trap and breakout setup around 4,280 – 4,330.

Price action suggests gold may be completing a short-term corrective wave (B) before resuming the larger bullish impulse.

The structure remains technically bullish, with all pullbacks showing strong rejections from demand zones.

🔑 Key Levels to Watch

🟢 BUY ZONE (Primary Setup)

Zone: 4,230 – 4,228

SL: 4,220

TP: 4,240 – 4,250 – 4,260 – 4,270 – ???

🔵 CP ZONE BUY (Secondary Support)

Zone: 4,284 – 4,285

SL: 4,275

TP: 4,300 – 4,315 – 4,330 – 4,340 – ???

🔴 SCALP SELL (Liquidity Reaction Zone)

Zone: 4,438 – 4,440

SL: 4,448

TP: 4,420 – 4,410 – 4,390 – ???

⚙️ MMFLOW Scenarios

1️⃣ Primary Bullish Scenario:

If gold holds above 4,280 – 4,284, expect continuation toward 4,380 – 4,438 (Liquidity Sell Zone).

The 4,284 level is the key control point where Smart Money may look to re-enter long positions.

2️⃣ Alternative Correction Scenario:

A clean break below 4,280 could drive price toward 4,249 – 4,243 (CP Buy Zone) before another bullish push higher.

This structure still aligns with a Healthy Correction Pattern within a broader uptrend.

⚡️ MMFLOW Insights

Gold remains in a mid-term expansion phase, with both macro and technical alignment favoring continued upside.

The 4,280 – 4,330 range acts as a Smart Money accumulation zone, preparing for a liquidity sweep higher.

Medium-term upside target: 4,438 – 4,445 USD/oz (Liquidity Sell Zone).

⚠️ Trading Notes

✅ Always use a protective Stop Loss — volatility can spike during liquidity hunts.

✅ Avoid chasing entries at highs; wait for reaction around BUY ZONES.

✅ Focus on liquidity confluence zones (Fibo + CP Zone + Order Block) for the highest-probability setups.

🧭 Quick Summary

Gold remains resilient despite early-session volatility.

Watch BUY ZONES at 4,230 – 4,228 and 4,284 – 4,285 for possible long re-entries.

Short-term target: 4,380 – 4,438 USD/oz.

Bias: Bullish – Buy the dips, not the breakouts.

Gold experienced a sharp intraday drop during the Asian session, testing the 4,280 – 4,279 USD zone before quickly recovering. Despite short-term volatility, it continues to close the week in green for the ninth consecutive time — confirming the strength of the ongoing bullish cycle.

The broader fundamentals remain supportive:

💥 Persistent geopolitical tensions keep safe-haven demand high.

⚖️ US–China trade uncertainty and the risk of a prolonged US government shutdown weaken risk appetite.

💵 Fed rate-cut expectations and USD softness continue to favor gold upside.

In short — Smart Money remains positioned long, and every dip still looks like a liquidity grab for re-accumulation.

🧠 Technical Structure (MMFLOW View)

On the M30 timeframe, gold continues to respect an ascending channel, currently forming a liquidity trap and breakout setup around 4,280 – 4,330.

Price action suggests gold may be completing a short-term corrective wave (B) before resuming the larger bullish impulse.

The structure remains technically bullish, with all pullbacks showing strong rejections from demand zones.

🔑 Key Levels to Watch

🟢 BUY ZONE (Primary Setup)

Zone: 4,230 – 4,228

SL: 4,220

TP: 4,240 – 4,250 – 4,260 – 4,270 – ???

🔵 CP ZONE BUY (Secondary Support)

Zone: 4,284 – 4,285

SL: 4,275

TP: 4,300 – 4,315 – 4,330 – 4,340 – ???

🔴 SCALP SELL (Liquidity Reaction Zone)

Zone: 4,438 – 4,440

SL: 4,448

TP: 4,420 – 4,410 – 4,390 – ???

⚙️ MMFLOW Scenarios

1️⃣ Primary Bullish Scenario:

If gold holds above 4,280 – 4,284, expect continuation toward 4,380 – 4,438 (Liquidity Sell Zone).

The 4,284 level is the key control point where Smart Money may look to re-enter long positions.

2️⃣ Alternative Correction Scenario:

A clean break below 4,280 could drive price toward 4,249 – 4,243 (CP Buy Zone) before another bullish push higher.

This structure still aligns with a Healthy Correction Pattern within a broader uptrend.

⚡️ MMFLOW Insights

Gold remains in a mid-term expansion phase, with both macro and technical alignment favoring continued upside.

The 4,280 – 4,330 range acts as a Smart Money accumulation zone, preparing for a liquidity sweep higher.

Medium-term upside target: 4,438 – 4,445 USD/oz (Liquidity Sell Zone).

⚠️ Trading Notes

✅ Always use a protective Stop Loss — volatility can spike during liquidity hunts.

✅ Avoid chasing entries at highs; wait for reaction around BUY ZONES.

✅ Focus on liquidity confluence zones (Fibo + CP Zone + Order Block) for the highest-probability setups.

🧭 Quick Summary

Gold remains resilient despite early-session volatility.

Watch BUY ZONES at 4,230 – 4,228 and 4,284 – 4,285 for possible long re-entries.

Short-term target: 4,380 – 4,438 USD/oz.

Bias: Bullish – Buy the dips, not the breakouts.

⚜️Trade with Money Market Flow, logic, Price action

🔥Live Market Updates-Realtime Trading Plans & Signal

👉t.me/+KLdjQ2d0LjszNTk1

⚜️Risk Reward 1.3 to 2.5...

⚜️Daily 8 to 16 Signals VIP

MMFLOW gives you precision entries & BIGWIN profits

🔥Live Market Updates-Realtime Trading Plans & Signal

👉t.me/+KLdjQ2d0LjszNTk1

⚜️Risk Reward 1.3 to 2.5...

⚜️Daily 8 to 16 Signals VIP

MMFLOW gives you precision entries & BIGWIN profits

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.

⚜️Trade with Money Market Flow, logic, Price action

🔥Live Market Updates-Realtime Trading Plans & Signal

👉t.me/+KLdjQ2d0LjszNTk1

⚜️Risk Reward 1.3 to 2.5...

⚜️Daily 8 to 16 Signals VIP

MMFLOW gives you precision entries & BIGWIN profits

🔥Live Market Updates-Realtime Trading Plans & Signal

👉t.me/+KLdjQ2d0LjszNTk1

⚜️Risk Reward 1.3 to 2.5...

⚜️Daily 8 to 16 Signals VIP

MMFLOW gives you precision entries & BIGWIN profits

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.