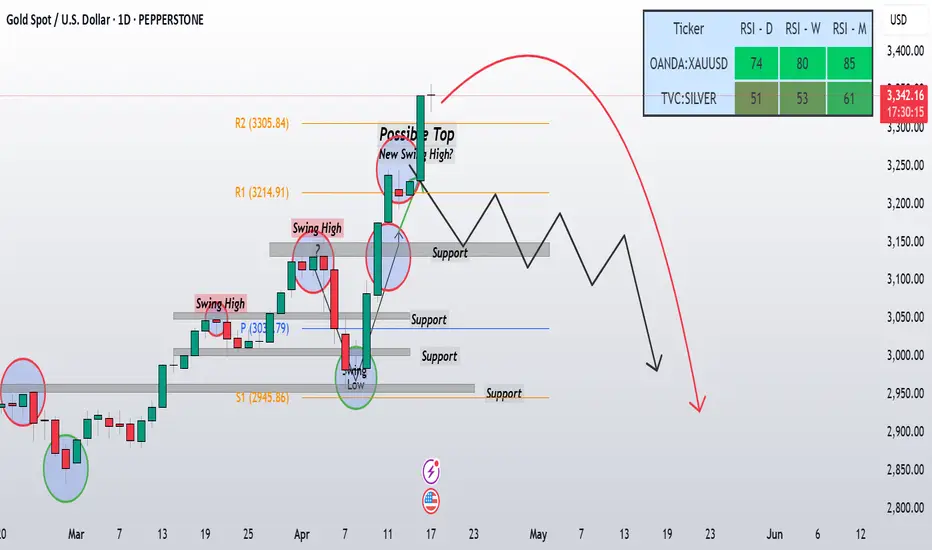

In my previous update for this week , Despite my expectation of a correction beginning this week, Gold closed with a 3% gain yesterday, showing amazing strength . The daily chart still reflects an overbought RSI on monthly (85) and weekly (80) timeframes, reinforcing my view that a correction phase is imminent.

While Gold has soared, Silver has lagged, failing to reclaim its late March high. I expect Silver to follow gold during this correction, potentially pushing the Gold/Silver ratio higher to a target of 110-114. The recent upside move in Silver formed an ending diagonal with a powerful throw-over, suggesting exhaustion. For Silver to confirm an uptrend and invalidate the corrective count, it must break above 33.45.

Sentiment levels are at extremes, with the Daily Sentiment Index hitting 83 for Gold and 87 for Silver, indicating overbought conditions that often precede reversals. A major concern is the Dollar Index (DXY), which looks set to make a lower low after forming an triangle on the 1-hour chart. When DXY turns up, metals are likely to face heavy pressure. I believe better entry points for bullish metals positions will emerge after this correction, especially as DXY bottoming process nears.

Despite Gold recent strength, my view remains unchanged—both metals are due for a correction. Gold rally off the April 7 low appears corrective (wave iv) compared to the impulsive wave iii sell-off, and Silver ending diagonal adds to the bearish case.

The lack of daily close confirmation for a correction in Gold hasn’t altered my stance, but I’m watching closely. The DXY anticipated rally could be the catalyst to push metals lower. I’m targeting Gold support at 3,150-3,168 and then 3000 for this correction and Silver critical level at 30.50 as key areas to monitor.

While Gold has soared, Silver has lagged, failing to reclaim its late March high. I expect Silver to follow gold during this correction, potentially pushing the Gold/Silver ratio higher to a target of 110-114. The recent upside move in Silver formed an ending diagonal with a powerful throw-over, suggesting exhaustion. For Silver to confirm an uptrend and invalidate the corrective count, it must break above 33.45.

Sentiment levels are at extremes, with the Daily Sentiment Index hitting 83 for Gold and 87 for Silver, indicating overbought conditions that often precede reversals. A major concern is the Dollar Index (DXY), which looks set to make a lower low after forming an triangle on the 1-hour chart. When DXY turns up, metals are likely to face heavy pressure. I believe better entry points for bullish metals positions will emerge after this correction, especially as DXY bottoming process nears.

Despite Gold recent strength, my view remains unchanged—both metals are due for a correction. Gold rally off the April 7 low appears corrective (wave iv) compared to the impulsive wave iii sell-off, and Silver ending diagonal adds to the bearish case.

The lack of daily close confirmation for a correction in Gold hasn’t altered my stance, but I’m watching closely. The DXY anticipated rally could be the catalyst to push metals lower. I’m targeting Gold support at 3,150-3,168 and then 3000 for this correction and Silver critical level at 30.50 as key areas to monitor.

✅For Live Update on Gold Price and trade opportunities ; Join Free community

t.me/livepriceactiontrading

t.me/livepriceactiontrading

Pubblicazioni correlate

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.

✅For Live Update on Gold Price and trade opportunities ; Join Free community

t.me/livepriceactiontrading

t.me/livepriceactiontrading

Pubblicazioni correlate

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.