Gold just tapped $4,213 — the highest level in three weeks, powered by growing expectations of a dovish Fed and optimism around the potential reopening of the US government.

But the real story isn’t the headline spike — it’s the structure forming right beneath it.

📌 Why this zone matters right now

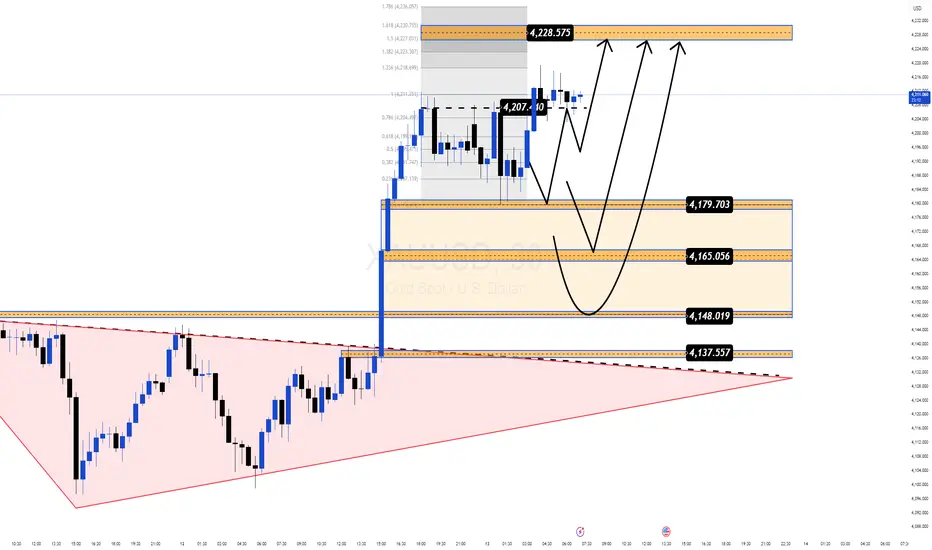

Price is pulling back into $4,179–$4,165, a clean Demand zone aligning with Fibo + breakout structure.

Buyers remain firmly in control despite a mild USD recovery.

The market swept liquidity around $4,207, hinting at accumulation before the next expansion.

The broader pattern resembles a falling-wedge breakout, often appearing before strong upside continuation phases.

🎯 Most Probable Scenario (Mind Insight)

Gold is in a “compression before expansion” phase.

Once this squeeze resolves, momentum is likely to continue in the direction that’s already dominant — and right now, that’s the bulls.

🔶 MMF BUY Zone

$4,179 → $4,165

Looking for a shallow pullback before the next leg.

🔼 Bullish Targets

• $4,207 (liquidity tap)

• $4,228 (Fibo 1.618)

• $4,236 (Fibo 1.786 — major reaction zone)

🧠 Key Takeaway

As long as Gold holds above $4,165, the bullish structure remains intact and the upside expansion toward the upper Fibo cluster stays in play.

But the real story isn’t the headline spike — it’s the structure forming right beneath it.

📌 Why this zone matters right now

Price is pulling back into $4,179–$4,165, a clean Demand zone aligning with Fibo + breakout structure.

Buyers remain firmly in control despite a mild USD recovery.

The market swept liquidity around $4,207, hinting at accumulation before the next expansion.

The broader pattern resembles a falling-wedge breakout, often appearing before strong upside continuation phases.

🎯 Most Probable Scenario (Mind Insight)

Gold is in a “compression before expansion” phase.

Once this squeeze resolves, momentum is likely to continue in the direction that’s already dominant — and right now, that’s the bulls.

🔶 MMF BUY Zone

$4,179 → $4,165

Looking for a shallow pullback before the next leg.

🔼 Bullish Targets

• $4,207 (liquidity tap)

• $4,228 (Fibo 1.618)

• $4,236 (Fibo 1.786 — major reaction zone)

🧠 Key Takeaway

As long as Gold holds above $4,165, the bullish structure remains intact and the upside expansion toward the upper Fibo cluster stays in play.

⚜️Trade with Money Market Flow, logic, Price action

🔥Live Market Updates-Realtime Trading Plans & Signal

t.me/+vpD6XCC9jP05ZDQ1

⚜️Risk Reward 1.3 to 2.5...

⚜️Daily 8 to 16 Signals VIP

MMFLOW gives you precision entries & BIGWIN profits

🔥Live Market Updates-Realtime Trading Plans & Signal

t.me/+vpD6XCC9jP05ZDQ1

⚜️Risk Reward 1.3 to 2.5...

⚜️Daily 8 to 16 Signals VIP

MMFLOW gives you precision entries & BIGWIN profits

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

⚜️Trade with Money Market Flow, logic, Price action

🔥Live Market Updates-Realtime Trading Plans & Signal

t.me/+vpD6XCC9jP05ZDQ1

⚜️Risk Reward 1.3 to 2.5...

⚜️Daily 8 to 16 Signals VIP

MMFLOW gives you precision entries & BIGWIN profits

🔥Live Market Updates-Realtime Trading Plans & Signal

t.me/+vpD6XCC9jP05ZDQ1

⚜️Risk Reward 1.3 to 2.5...

⚜️Daily 8 to 16 Signals VIP

MMFLOW gives you precision entries & BIGWIN profits

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.