Mild inflation supports rate cut expectations

Data from the US Bureau of Labor Statistics showed that the Consumer Price Index (CPI) rose 2.7% year-on-year in July, below expectations of 2.8% and unchanged from June.

Core CPI rose 3.1% year-on-year and 0.3% month-on-month, the largest increase in six months.

While core inflation remains above the Federal Reserve’s target, the overall data was interpreted by the market as positive for a rate cut.

The US Dollar Index fell to 98.02, making non-dollar-denominated gold more attractive.

Market data showed traders are betting that the chances of a Fed rate cut in September and December remain high.

Next up, the US will release weekly PPI, retail sales and initial jobless claims data, all of which could influence the policy outlook.

Viewpoint: Rate cuts and political uncertainty pave the way for gold to hit new highs

Uncertainty over the independence of the Federal Reserve and continued central bank buying of gold are key factors supporting gold prices. Demand for gold ETFs grew at its fastest pace since early 2020 in the first half of this year.

If the independence of the Federal Reserve is increasingly questioned, the safe-haven value of gold will increase significantly. Gold is a counterweight to fiat currencies (US dollars), and once investors question the independence of central banks, demand will increase.

Forex Market Volatility and Safe Haven Demand

Recent trade policy uncertainty has added to volatility in global forex markets.

The Indian rupee is nearing a record low against the US dollar, with the Reserve Bank of India selling at least $5 billion to support the exchange rate.

The US dollar has weakened after a brief rally, while the Chinese yuan has remained stable.

The weakening US dollar has somewhat increased the relative appeal of gold, leading to a recovery in safe-haven demand.

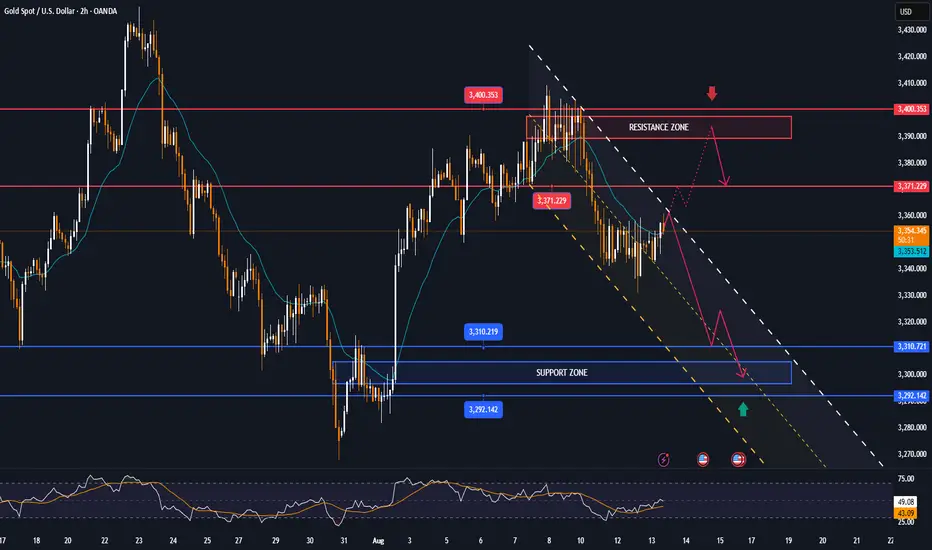

Technical Outlook Analysis

Gold rallied, but the recovery momentum is still limited by the EMA21 as the first resistance, followed by the 0.236% Fibonacci retracement level. If gold breaks above the 0.236% Fibonacci retracement level, it will be eligible to continue to increase in price towards the 3,400 USD price point, opening a new bullish cycle.

However, at the current position, gold price can still retest the $3,310 – $3,300 area due to the pressure from EMA21 and 0.236% Fibonacci retracement. This means that the $3,310 – $3,300 area is an important support area for the uptrend. As long as gold remains above $3,300, it can still increase in the short term, but in case of a sell-off below $3,300, confirmed by a price action below $3,292, it will open the conditions for a downtrend with the next target around $3,246 in the short term.

During the day, the trend of gold prices is generally sideways, with balanced conditions and indicators, described by the Relative Strength Index (RSI) hovering around the 50 level, also showing the market's hesitant sentiment. Personally, I am inclined to the upside, along with that, open long positions should be protected when the 3,300 USD mark is broken below.

Notable positions will also be listed as follows.

Support: 3,310 – 3,300 – 3,292 USD

Resistance: 3,350 – 3,371 – 3,400 USD

SELL XAUUSD PRICE 3391 - 3389⚡️

↠↠ Stop Loss 3395

→Take Profit 1 3383

↨

→Take Profit 2 3377

BUY XAUUSD PRICE 3299 - 3301⚡️

↠↠ Stop Loss 3295

→Take Profit 1 3307

↨

→Take Profit 2 3313

Nota

Spot gold is hovering below 3340, with multiple candlesticks now appearing on the hourly chart.Nota

Gold prices fell 0.5% to around $3,313/oz, close to the 100-day moving average support, due to a stronger USD and concerns that the Fed will maintain a "hawkish" stance.Nota

The world's largest gold ETF, SPDR Gold Trust, fell 3.16 tonnes.Nota

Gold prices on August 20 jumped nearly $40, reaching a high of $3,350 and closing at $3,348.20/oz after holding 100-day support, thanks to bottom-fishing buying and a weakening USD.Nota

Gold prices edged lower as the dollar rose to a two-week high, as investors focused on Federal Reserve Chairman Powell's speech at the Jackson Hole conference.🔰| Forex trading

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

Pubblicazioni correlate

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.

🔰| Forex trading

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

Pubblicazioni correlate

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.