Sessions

Introduction

Exchanges define a session for every symbol, which represents the times of day and days of the week in which the symbol can be traded. Exchanges might also define sessions other than the default one, which are called subsessions. Subsessions can be shorter or longer than the default session. If different sessions are available for a symbol, users can switch between them either from the “Sessions” controls in the bottom-right corner of the chart or from the chart’s “Settings/Symbol/Session” menu.

Programmers can use built-in functions and variables to define custom sessions, determine whether bars belong to specific sessions, retrieve data from named subsessions, and access session-related market states.

Time-based sessions

A script can define a custom session by encoding the start time, end time, and, optionally, days of the week of the session into a session string. Scripts often use time-based session strings to check whether a bar belongs to certain time period.

Creating time-based sessions

Time-based session strings have the following syntax:

<time_period>:<days>Where:

-

<time_period>specifies the session’s start and end times in"HHmm-HHmm"format, where"HH"represents the hour in 24-hour format ("00"to"23") and"mm"represents the minute ("00"to"59") — for example,"1700"for 5PM. A comma can separate multiple time periods to specify combinations of discrete periods for the session, e.g.,"0800-0900,1230-1630". -

<days>specifies the days of the week that the session applies to, using a set of digits from 1 to 7 to represent each day. The digits use"1"to represent Sunday, and count up through the week, ending with"7"to represent Saturday."0"is not a valid day. If unspecified, the session applies every day.

The following table shows some examples of session strings:

| Example | Description |

|---|---|

"0000-0000:1234567" | The normal format for a 7-day, 24-hour session beginning at midnight. |

"0000-0000" | Equivalent to the previous example, because the default days are "1234567". |

"0000-0000:23456" | A 24-hour session beginning at midnight, but only Monday to Friday. |

"2000-1630:1234567" | An overnight session that begins at 20:00 and ends at 16:30 the next day. It applies on all days of the week. |

"0930-1700:146" | A session that begins at 9:30 and ends at 17:00 on Sundays (1), Wednesdays (4), and Fridays (6). |

"1700-1700:23456" | An overnight session. The Monday session starts Sunday at 17:00 and ends Monday at 17:00. It applies Monday through Friday. |

"1000-1001:26" | An unusual session that lasts only one minute on Mondays (2) and Fridays (6). |

"0900-1600,1700-2000" | A session that begins at 9:00, breaks from 16:00 to 17:00, and continues until 20:00. Applies to every day of the week. |

Note that a special format exists to represent a 7-day, 24-hour session beginning at midnight: "24x7" — this session string is equivalent to the first two examples in the table above.

Using time-based sessions

The time() and time_close() functions can accept time-based session strings as their session parameter arguments:

- The time() function returns a UNIX timestamp for the opening time of the current bar, or na if the bar is not in the specified session.

- The time_close() function returns a UNIX timestamp for the closing time of the current bar, or na if the bar is not in the specified session.

By testing for a returned na value, scripts can use the above functions to check whether a particular bar falls within a certain session.

To interpret the time zone of the specified session, the time() and time_close() functions use the time zone of the exchange by default, unless a timezone argument is specified. This time zone can be different from the chart time zone, depending on the chart’s settings. For more information on time zones, see the Time zones section of the Time page.

Additionally, the input.session() function also takes a time-based session string as its defval argument, to determine the input’s default value. Using this input type, users can define session times (but not days of the week) from a script’s “Inputs” tab. See the Session input section for more information.

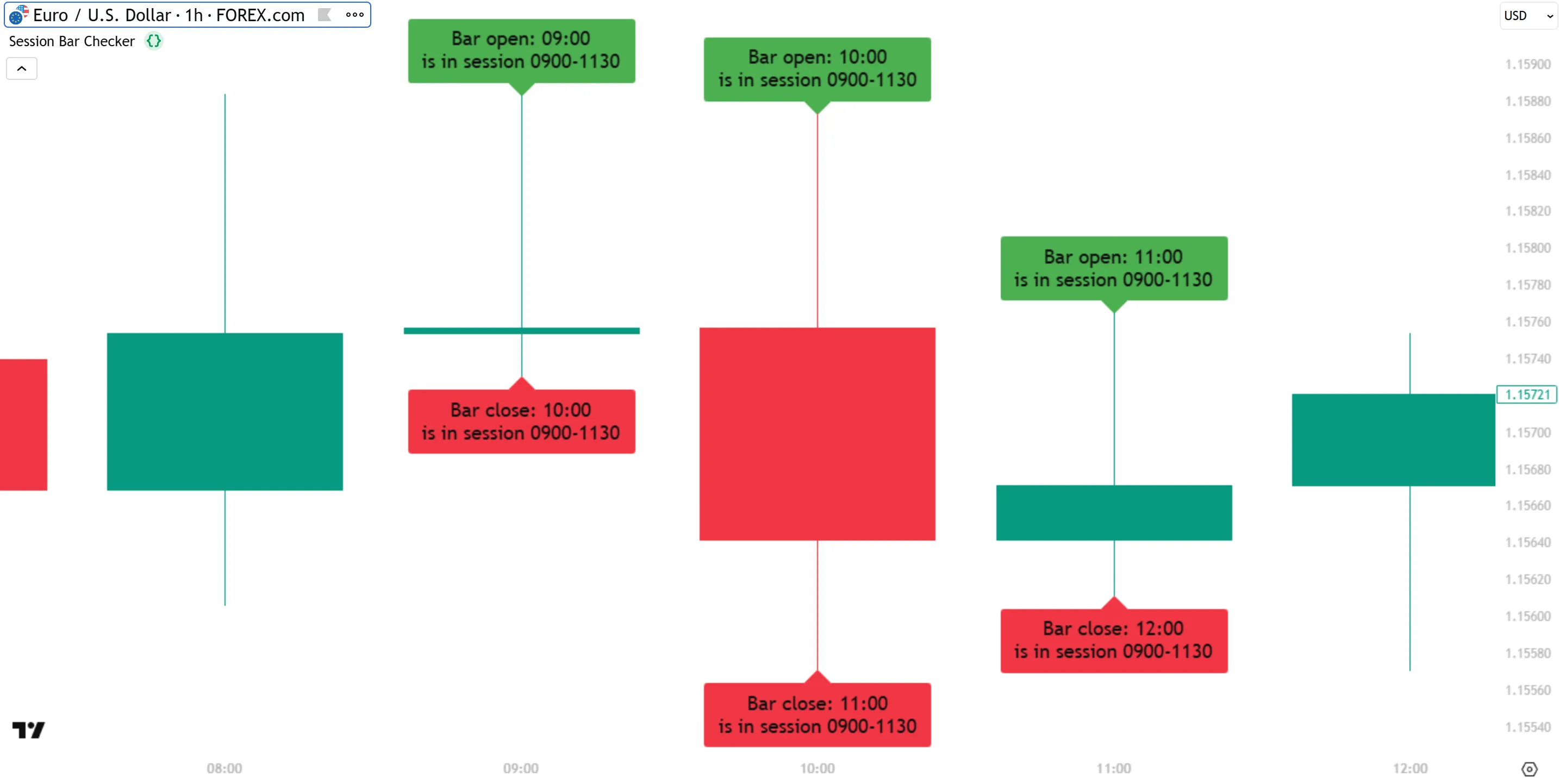

The following example script checks whether the start and end time of a bar fall within a user-defined session. If the bar’s opening time, as returned by time(), is within the session (i.e., the value is not na), the script draws a label above the bar. Similarly, if the closing time returned by time_close() is not na, it draws a label below the bar. The labels display the bar open or close times and compare them to the selected session. Here, we run the script on an hourly chart with a short default morning session of “0900-1130”:

Note that:

- The script draws labels for the opening and closing times of all bars that start within the session, even though the closing time of the last chart bar is outside the session. This is because the time() and time_close() functions create their own bar representations according to their parameters. In the image above, which is of an hourly chart, the session ends at 11:30, so the final calculated bar representation in the session starts at 11:00 and ends at 11:30. Therefore, the last bar’s end time is reported as being within the session, even though the chart bar ends at 12:00.

Scripts can create dynamic sessions, whose values can change during script execution, by calculating a “series string” argument for the session parameter of the time() or time_close() functions. The following example script creates a dynamic time-based session string that differs on weekdays and weekends. The script uses the time() function to determine whether the current bar is within this dynamic session, and colors the background green if so:

Scripts can retrieve the opening and closing times for a bar other than the current bar by using the bars_back parameter of the time() and time_close() functions. For a positive bars_back value, the functions count that number of bars backward relative to the current bar, i.e., they retrieve times from past bars. Passing a negative bars_back integer retrieves the UNIX timestamp for a bar up to 500 bars in the future.

The following script determines if a user-defined session is currently active by checking if the last bar is in the session. If so, the script displays the ending time of the active session in a label positioned on the future bar that marks the end of the session. To find the last valid bar closing time in the session, the script uses a loop to increment a dynamic bars_back argument for time_close(), stopping the loop when the returned closing time is na. If the session is not active, the label displays a message to that effect at the current bar.

On the example chart below, we added a vertical line using the chart’s drawing tools to show that the bar time matches the session label:

Note that:

- We use barstate.islast to avoid unnecessary historical calculations, because we want to highlight only the current session.

- The script supplies a negative integer

-ias the argument to thebars_backparameter to return the closing times for future bars. - We use the

breakkeyword to exit the for loop as soon as we reach the end of the session. To learn more about this keyword, see the Keywords and return expressions section of the Loops page. - The

sessionInputend time must be within the trading period of the symbol on the chart in order for the script to display the label. - For an extended example of using this technique to visually identify sessions, see the How can I make an entire custom session visible? entry in the Times, dates, and sessions FAQ.

Named sessions

Exchanges often define named subsessions. These sessions can differ from the default session in one or more ways:

- They can include extended hours data, for example, pre-market and post-market trades.

- They can separate longer electronic trading sessions from shorter regular trading sessions, which is common in some futures markets.

- They can define some other periods of interest.

Traders can use named sessions to focus on trading periods with greater volume, or for other regional or timing purposes. A script can use named sessions to retrieve data from a different session than that of the chart, or to maintain the session that the script uses for its calculations even if the user changes the chart session.

To use data from a named session, first identify the exact name of the session, then create a modified ticker that uses that session, and finally request data from that ticker. The sections below discuss these steps in more detail.

Retrieving named sessions

Unlike custom time-based session strings, which are user-defined, session names are fixed. Scripts can retrieve the active session’s name automatically. Programmers can also supply predefined session names in the code.

The following example script retrieves the name of the active session from the current chart using syminfo.session and displays it in a table. The example chart below shows the script running on an hourly chart of the US stock “NASDAQ:AAPL”. We selected “Extended trading hours” from this chart’s “Sessions” menu (shown in the bottom-right corner of the image), so the session string displayed in the table is "extended":

If we select “Regular trading hours” from the chart settings, the script displays the session string "regular".

For most US equities, the string "regular" is equivalent to the built-in constant session.regular, and the string "extended" is equivalent to the built-in constant session.extended. However, this is not always the case. Let’s look at the same script applied to the “S&P 500 E-mini futures” chart (ticker “ES1!”), with the “Electronic trading hours” session selected:

In the example above, the table shows that the active session is "regular", even though the chart displays the “Electronic trading hours” session, which is longer than the “Regular trading hours” session. If we switch to “Regular trading hours” on this chart, the active session is "us_regular", not "regular".

Now let’s look at some non-standard named sessions. Applying our previous example script to the “DAX Futures” chart (ticker “FDAX1!”), we can choose between the “Regular trading hours”, “Xetra trading hours”, and “Frankfurt trading hours” sessions on the chart, and the script displays the active session as "regular", "xetr_regular", and "fwb_regular", respectively:

Creating a session-specific ticker

A script can create a ticker that uses a specific session by using ticker.new() or ticker.modify(). Both functions create a new ticker identifier, which can specify additional session and pricing modifiers for the requested context. The only practical difference between the two functions is that ticker.new() creates a ticker from an exchange prefix and ticker name (two separate “string” arguments), whereas ticker.modify() modifies a full ticker ID ("prefix:ticker" as one “string” argument, or a tickerid string with additional modifiers returned from ticker.*()).

For more information about the available ticker.*() functions, see the Custom contexts section of the Other timeframes and data page.

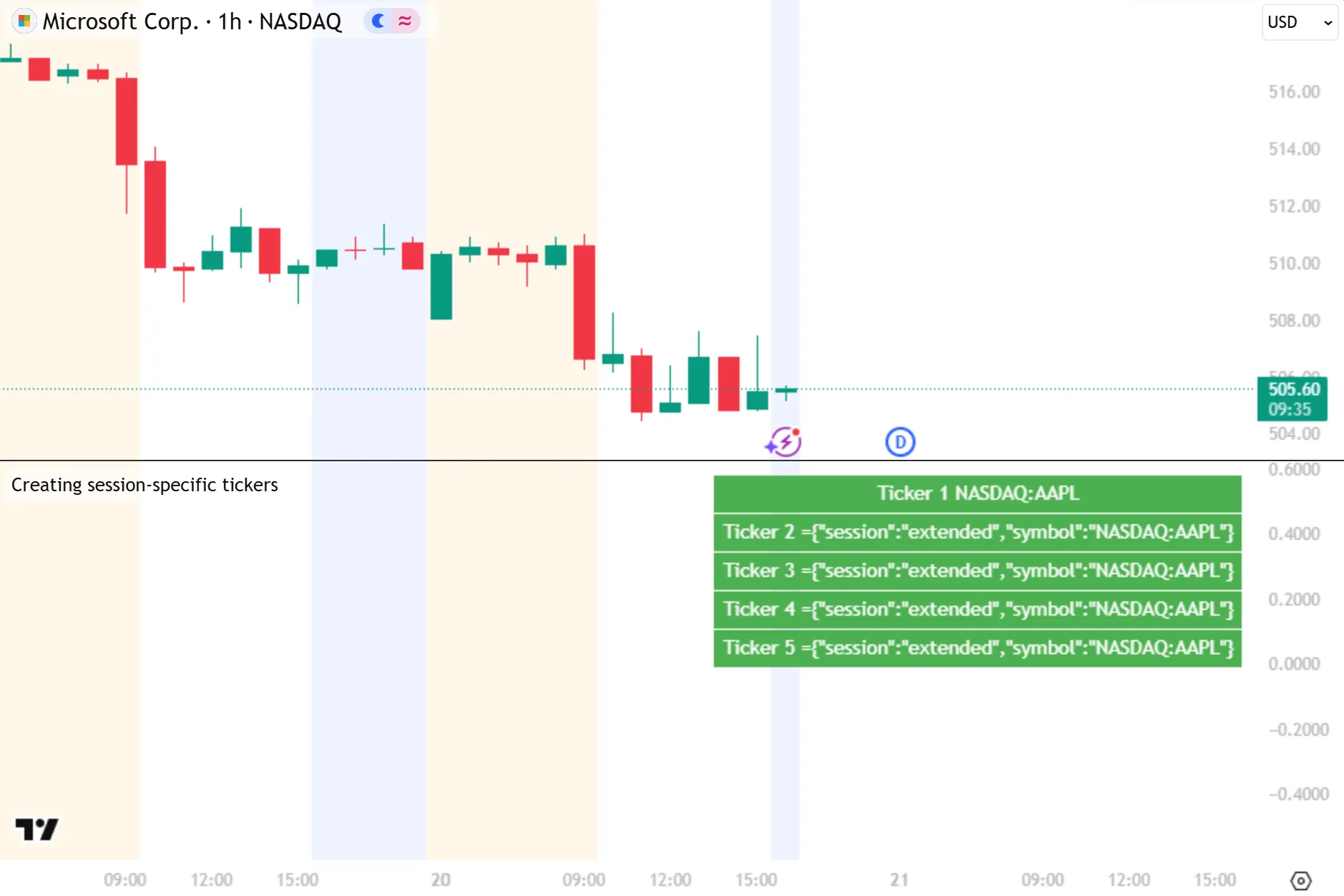

The example script below creates the following five tickers for the “NASDAQ:AAPL” US equity and displays them in a table for comparison:

- A new ticker with the default session, using ticker.modify().

- A new ticker with the default session, using ticker.new().

- A new ticker with an extended session, using ticker.new().

- A modified version of the first ticker with an extended session, using ticker.modify().

- A new ticker with an extended session, using ticker.modify().

Note that:

- The

ticker.modify("NASDAQ:AAPL")function call always returns only a ticker. Requesting data from this ticker returns values from the regular session of the equity, regardless of the session settings of the chart. - The

ticker.new("NASDAQ", "AAPL")call returns a ticker with extra information encoded, representing the defaults for extra optional parameters (such as settlement options for futures contracts), only for tickers where optional parameters are available. The returned ticker also encodes the session, if a non-default session is selected on the chart and the interval is intraday. - All the other function calls always return tickers with session information, because the session is specified in the call. The tickers can also contain information representing optional parameters.

- The script shows the tickers for the “NASDAQ:AAPL” symbol, regardless of the symbol that the chart displays, because the ticker information for that symbol is passed to the

ticker.*()calls. To create tickers representing the chart symbol, usesyminfo.*variables like syminfo.prefix, syminfo.ticker, and syminfo.tickerid.

The previous example demonstrates that the two ticker creation functions are largely equivalent. For consistency, we use ticker.new() in our examples below.

Requesting data from session-specific tickers

Scripts use session-specific tickers in request.security() calls to retrieve data from that particular session.

This simple example script visualizes the close prices of the current asset from both the regular and extended sessions, using the syminfo.prefix and syminfo.ticker variables to create session-specific tickers for the symbol currently on the chart. It plots the prices from the extended session as a black line, and the prices from the regular session as red circles. First, we run the script on a 30-minute chart of “NASDAQ:AAPL”, with the “Extended trading hours” session selected:

Note that:

- The chart automatically highlights the backgrounds for extended hours based on its “Symbol/Data Modification” settings; this is not controlled by the script.

- The

plot(regularClose)call does not plot any circles during the pre-market and post-market sessions. This is because the request.security() call forregularCloseallows data gaps by using barmerge.gaps_on, so it returns na for chart bars outside the regular trading session. - The extended and regular closing prices have the same values on the 30-minute chart above. Running the same script on an hourly chart instead produces different values for the extended and regular closing prices, because the regular session starts at 09:30 and not on the hour.

Now let’s run the same script on the “S&P 500 E-mini futures” chart (ticker “ES1!”), with the “Electronic trading hours” session selected:

Notice that both plots are exactly the same, covering the entire extended trading session. This is because, as we saw in the Retrieving named sessions section, most US futures symbols use "regular" and "us_regular" as their session names. We can update our code to add a third plot that uses the "us_regular" session:

Note that:

- The new

usRegularCloseplot, as we expect, displays prices only during the regular trading hours. - We replaced session.regular with the string

"regular", and session.extended with the string"extended"in the other two ticker.new() function calls, just to show that these values are equivalent.

Lastly, let’s look at an example of using data from non-standard sessions. By applying the first example script from the Retrieving named sessions section to the “DAX Futures chart” (ticker “FDAX1!”), we discovered that the chart sessions “Regular trading hours”, “Xetra trading hours”, and “Frankfurt trading hours” have the named sessions "regular", "xetr_regular", and "fwb_regular", respectively. The following example plots the chart’s close prices with a blue line, and requests the “Frankfurt trading hours” session’s close prices to plot with teal circles. Here we run the script on the hourly “FDAX1!” chart with “Regular trading hours” selected on the chart:

Note that:

- The “Frankfurt trading hours” session is shorter than the “Regular trading hours” session.

- Running this script on a chart that does not define a named session

"fwb_regular"plots circles for all the bars.

Session variables reference

Programmers can use several built-in variables for session-related data.

Market states

The following Boolean variables track whether the current bar belongs to the pre-market or post-market session:

| Variable | Description |

|---|---|

| session.ismarket | Is true when the bar belongs to regular trading hours. On “1D” and above timeframes, this variable is always true. |

| session.ispremarket | Is true when the bar belongs to the extended session preceding regular trading hours. Extended hours data is only shown on intraday timeframes; on “1D” and above, this variable is always false. |

| session.ispostmarket | Is true when the bar belongs to the extended session following regular trading hours. Extended hours data is only shown on intraday timeframes; on “1D” and above, this variable is always false. |

For tickers without pre-market and post-market sessions, such as “BTCUSD”, session.ismarket is always true and session.ispremarket and session.ispostmarket are always false.

For many futures symbols, Electronic trading hours (ETH) are considered the default session and use the named session "regular", so during those hours session.ismarket is true and session.ispremarket and session.ispostmarket are both false.

First and last bars

The following Boolean variables track whether the current bar is the first or last in different sessions:

| Variable | Description |

|---|---|

| session.isfirstbar | Is true if the current bar is the first bar of the day’s session, and false otherwise. If extended session information is used, it is only true on the first bar of the pre-market bars. Is true once for every session on the chart. |

| session.isfirstbar_regular | Is true on the first regular session bar of the day, false otherwise. It is true only once per session. The result is the same whether extended session information is used or not. For futures, the “Electronic trading hours” session is the regular session. This variable is always false when the ticker is configured to use a subsession. |

| session.islastbar | Is true if the current bar is the last bar of the day’s session, and false otherwise. If extended session information is used, it is only true on the last bar of the post-market bars. |

| session.islastbar_regular | Is true on the last regular session bar of the day, false otherwise. The result is the same whether extended session information is used or not. |

The session.islastbar and session.islastbar_regular variables might not be true for any bar in a session if no price or volume updates occur during the time period of the last bar. This is more likely at lower timeframes for thinly traded symbols. In contrast, session.isfirstbar and session.isfirstbar_regular are always true once for any session.

Named session variables

Scripts can use the following “string” variables to work with named sessions. The Retrieving named sessions section of this page discusses the use of these variables.

| Variable | Description |

|---|---|

| syminfo.session | Holds the current symbol’s session information. |

| session.regular | Represents the regular trading session. |

| session.extended | Represents the extended trading session. |