Suppose, we have a Heikin Ashi chart (or Renko, Kagi, PriceBreak etc)

and we’ve added a Pine script on it:

//@version=6

indicator("Visible OHLC", overlay=true)

c = close

plot(c)

You may see that variable c is a Heikin Ashi close price which is

not the same as real OHLC price. Because close built-in variable is

always a value that corresponds to a visible bar (or candle) on the

chart.

So, how do we get the real OHLC prices in Pine Script® code, if current

chart type is non-standard? We should use request.security function in

combination with ticker.new function. Here is an example:

//@version=6

indicator("Real OHLC", overlay = true)

t = ticker.new(syminfo.prefix, syminfo.ticker)

realC = request.security(t, timeframe.period, close)

plot(realC)

In a similar way we may get other OHLC prices: open, high and low.

Backtesting on non-standard chart types (e.g. Heikin Ashi or Renko) is

not recommended because the bars on these kinds of charts do not

represent real price movement that you would encounter while trading. If

you want your strategy to enter and exit on real prices but still use

Heikin Ashi-based signals, you can use the same method to get Heikin

Ashi values on a regular candlestick chart:

//@version=6

strategy("BarUpDn Strategy", overlay = true, default_qty_type = strategy.percent_of_equity, default_qty_value = 10)

maxIdLossPcntInput = input.float(1, "Max Intraday Loss(%)")

strategy.risk.max_intraday_loss(maxIdLossPcntInput, strategy.percent_of_equity)

needTrade() => close > open and open > close[1] ? 1 : close < open and open < close[1] ? -1 : 0

trade = request.security(ticker.heikinashi(syminfo.tickerid), timeframe.period, needTrade())

if trade == 1

strategy.entry("BarUp", strategy.long)

if trade == -1

strategy.entry("BarDn", strategy.short)

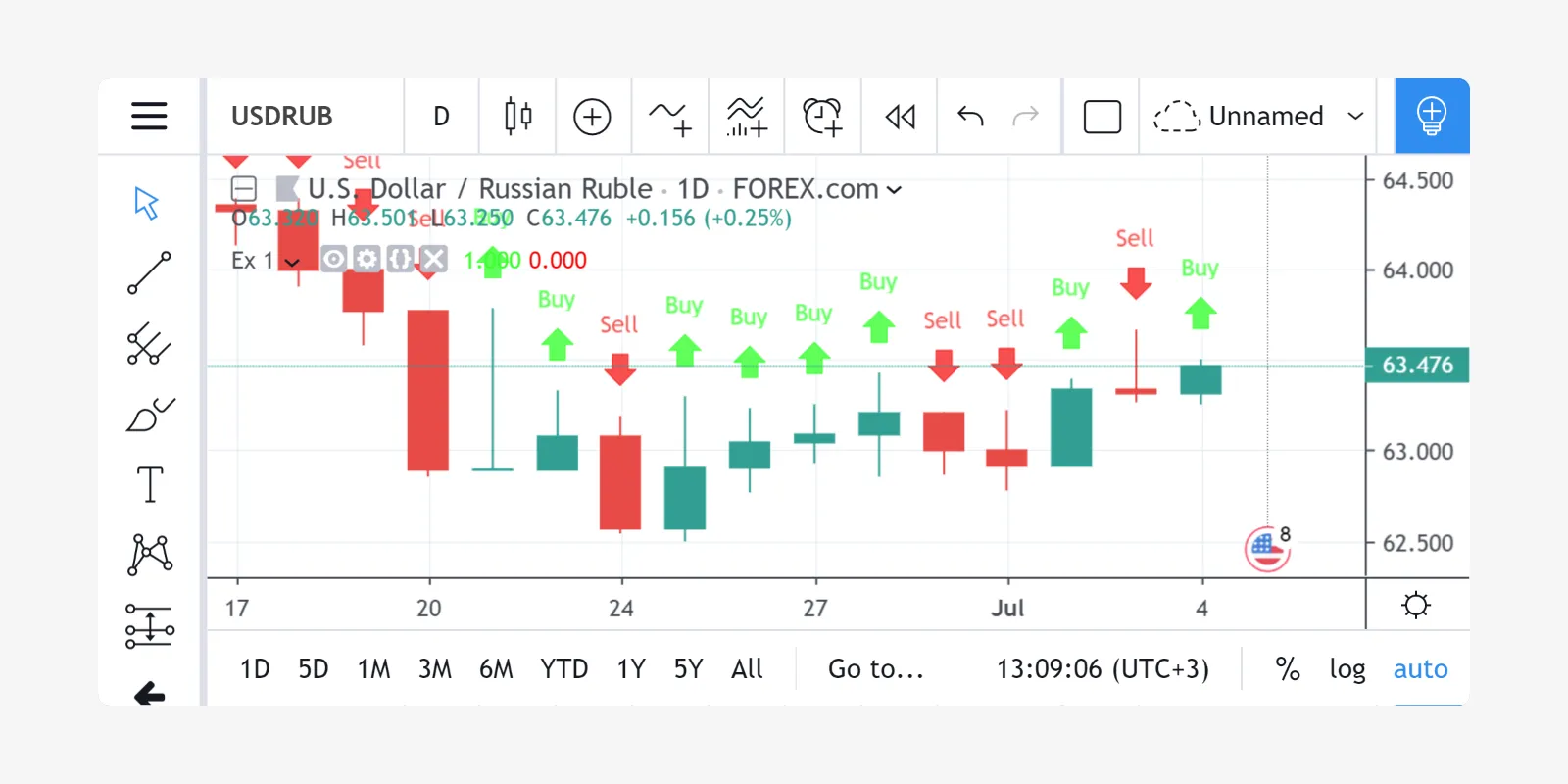

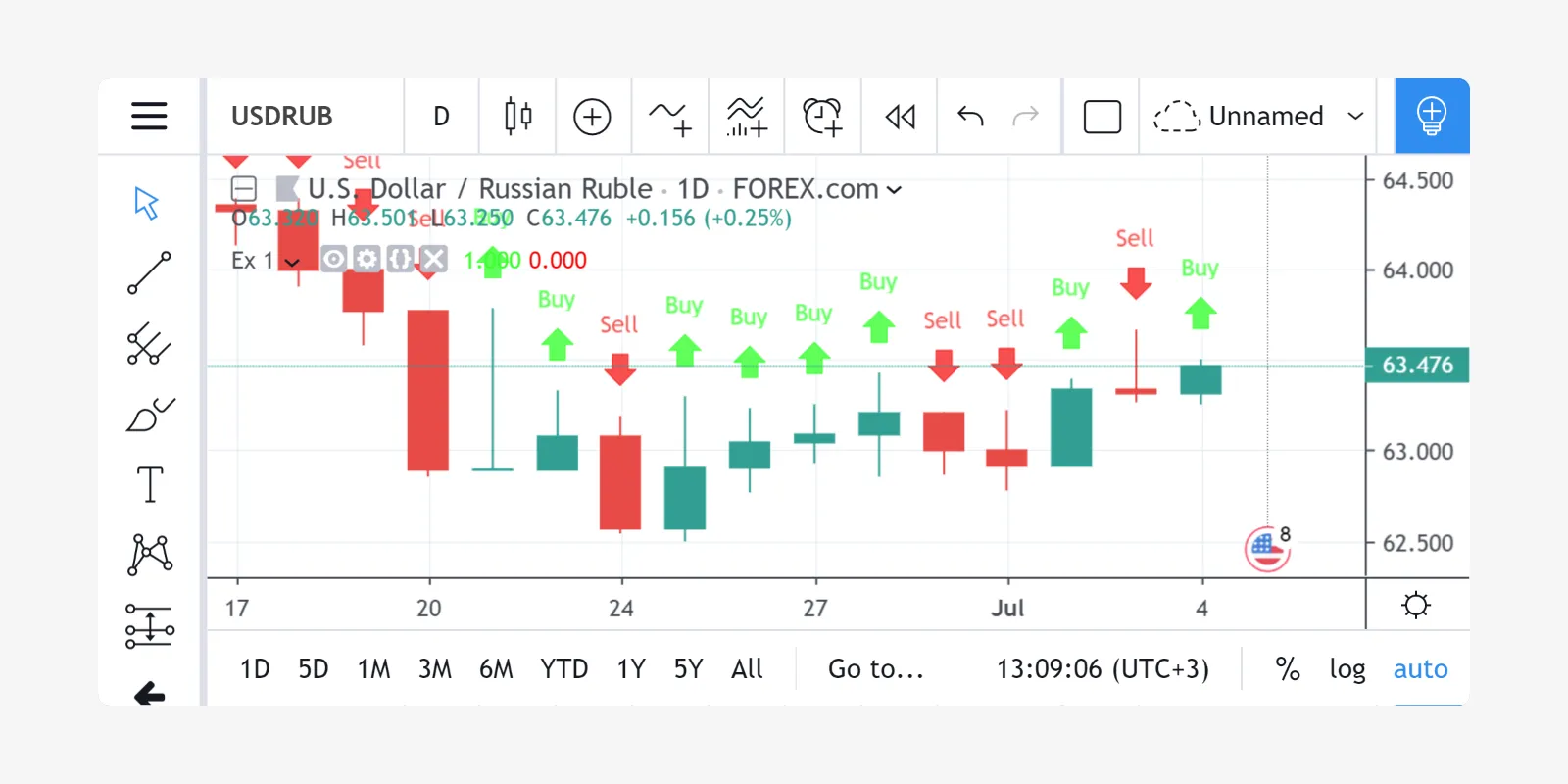

You may use plotshape with style shape.arrowup and shape.arrowdown:

//@version=6

indicator('Ex 1', overlay = true)

condition = close >= open

plotshape(condition, color = color.lime, style = shape.arrowup, text = "Buy")

plotshape(not condition, color = color.red, style = shape.arrowdown, text = "Sell")

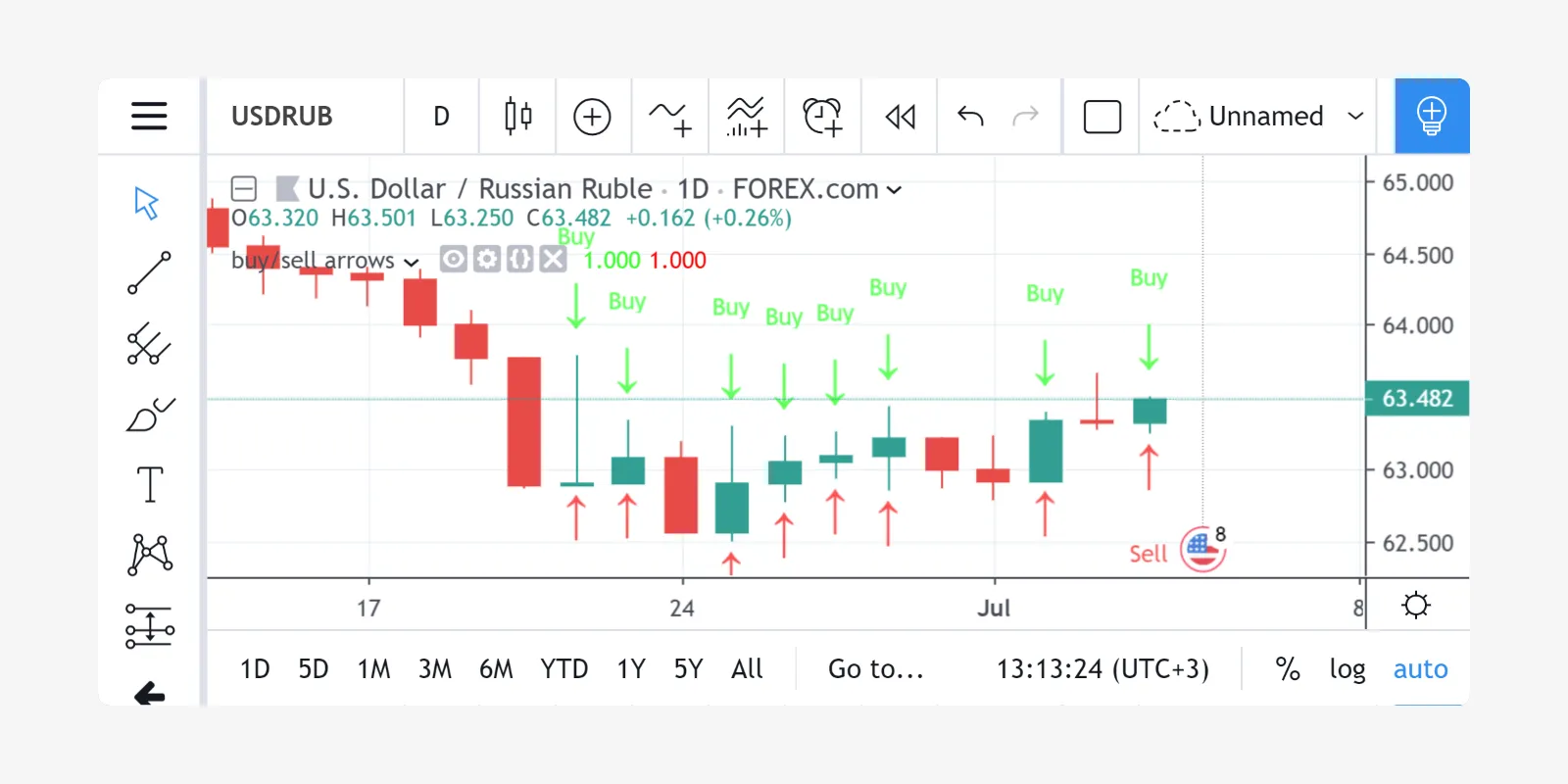

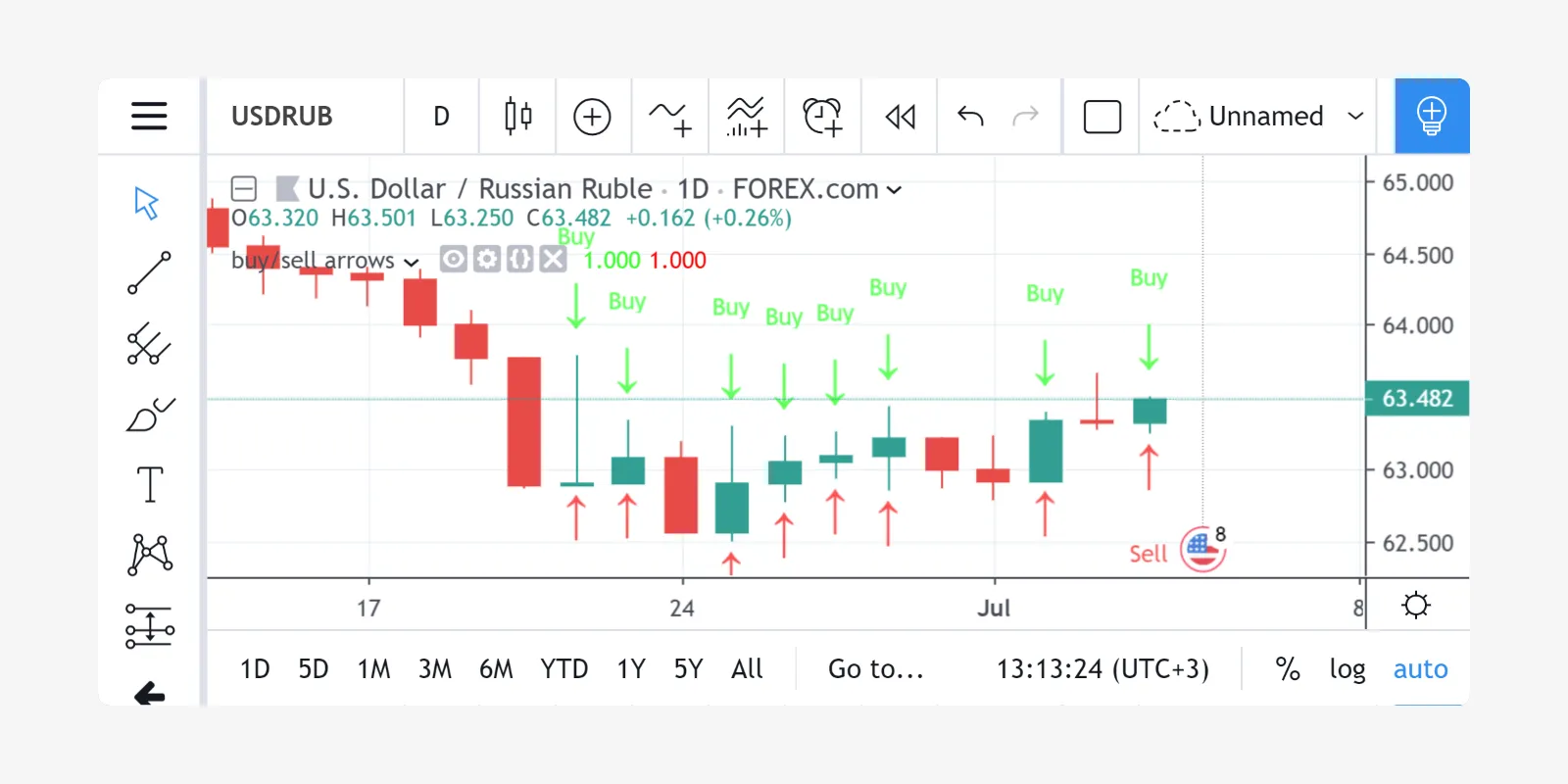

You may use the plotchar function with any unicode character:

//@version=6

indicator('buy/sell arrows', overlay = true)

condition = close >= open

plotchar(not condition, char='↓', color = color.lime, text = "Buy")

plotchar(condition, char='↑', location = location.belowbar, color = color.red, text = "Sell")

There is the function hline in Pine Script, but it is limited to only

plot a constant value. Here is a simple script with a workaround to plot

a changing hline:

//@version=6

indicator("Horizontal line", overlay = true)

plot(close[10], trackprice = true, offset = -9999)

// `trackprice = true` plots horizontal line on close[10]

// `offset = -9999` hides the plot

plot(close, color = #FFFFFFFF) // forces display

//@version=6

indicator("Vertical line", overlay = true, scale = scale.none)

// scale.none means do not resize the chart to fit this plot

// if the bar being evaluated is the last baron the chart (the most recent bar), then cond is true

cond = barstate.islast

// when cond is true, plot a histogram with a line with height value of 100,000,000,000,000,000,000.00

// (10 to the power of 20)

// when cond is false, plot no numeric value (nothing is plotted)

// use the style of histogram, a vertical bar

plot(cond ? 10e20 : na, style = plot.style_histogram)

//@version=6

//...

s = 0.0

s := nz(s[1]) // Accessing previous values

if (condition)

s := s + 1

Lookback 5 days from the current bar, find the highest bar, plot a star

character at that price level above the current bar

//@version=6

indicator("High of last 5 days", overlay = true)

// Milliseconds in 5 days: millisecs * secs * mins * hours * days

MS_IN_5DAYS = 1000 * 60 * 60 * 24 * 5

// The range check begins 5 days from the current time.

leftBorder = timenow - time < MS_IN_5DAYS

// The range ends on the last bar of the chart.

rightBorder = barstate.islast

// ————— Keep track of highest `high` during the range.

// Intialize `maxHi` with `var` on bar zero only.

// This way, its value is preserved, bar to bar.

var float maxHi = na

if leftBorder

if not leftBorder[1]

// Range's first bar.

maxHi := high

else if not rightBorder

// On other bars in the range, track highest `high`.

maxHi := math.max(maxHi, high)

// Plot level of the highest `high` on the last bar.

plotchar(rightBorder ? maxHi : na, "Level", "—", location.absolute, size = size.normal)

// When in range, color the background.

bgcolor(leftBorder and not rightBorder ? color.new(color.aqua, 70) : na)

Get a count of all the bars in the loaded dataset. Might be useful for

calculating flexible lookback periods based on number of bars.

//@version=6

indicator("Bar Count", overlay = true, scale = scale.none)

plot(bar_index + 1, style = plot.style_histogram)

//@version=6

indicator("My Script", overlay = true, scale = scale.none)

isNewDay() =>

d = dayofweek

na(d[1]) or d != d[1]

plot(ta.barssince(isNewDay()), style = plot.style_cross)

//@version=6

indicator("", "", true)

allTimetHi(source) =>

var atHi = source

atHi := math.max(atHi, source)

allTimetLo(source) =>

var atLo = source

atLo := math.min(atLo, source)

plot(allTimetHi(close), "ATH", color.green)

plot(allTimetLo(close), "ATL", color.red)

You can use the script below to avoid gaps in a series:

//@version=6

indicator("")

series = close >= open ? close : na

vw = fixnan(series)

plot(series, style = plot.style_linebr, color = color.red) // series has na values

plot(vw) // all na values are replaced with the last non-empty value