OPEN-SOURCE SCRIPT

Price Heat Meter [ChartPrime]

⯁ OVERVIEW

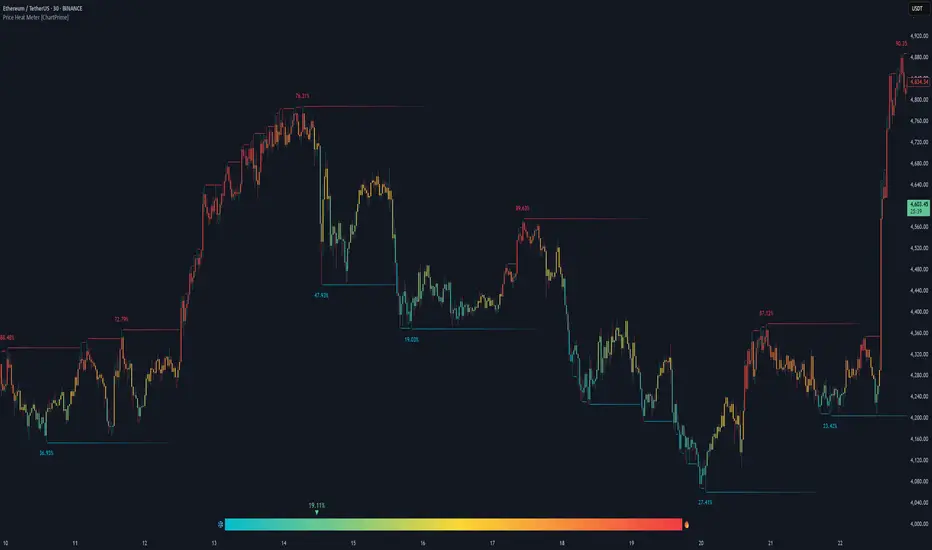

Price Heat Meter [ChartPrime] visualizes where price sits inside its recent range and turns that into an intuitive “temperature” read. Using rolling extremes, candles fade from ❄️ aqua (cold) near the lower bound to 🔥 red (hot) near the upper bound. The tool also trails recent extreme levels, tags unusually persistent extremes with a % “heat” label, and shows a bottom gauge (0–100%) with a live arrow so you can read market heat at a glance.

⯁ KEY FEATURES

⯁ HOW IT WORKS (UNDER THE HOOD)

⯁ USAGE

⯁ WHY IT’S UNIQUE

Rather than another oscillator, Price Heat Meter translates simple market geometry (rolling extremes) into a readable temperature layer with time-aware extremes and a synchronized gauge. You get a continuously updated sense of stretch, persistence, and potential reversal context—without clutter or overfitting.

Price Heat Meter [ChartPrime] visualizes where price sits inside its recent range and turns that into an intuitive “temperature” read. Using rolling extremes, candles fade from ❄️ aqua (cold) near the lower bound to 🔥 red (hot) near the upper bound. The tool also trails recent extreme levels, tags unusually persistent extremes with a % “heat” label, and shows a bottom gauge (0–100%) with a live arrow so you can read market heat at a glance.

⯁ KEY FEATURES

- Rolling Heat Map (0–100%):

The script measures where the close sits between the current Lowest Low and Highest High over the chosen Length (default 50).

Candles use a two-stage gradient: aqua → yellow (0–50%), then yellow → red (50–100%). This makes “how stretched are we?” instantly visible. - Dynamic Extremes with Time Decay:

When a new rolling High or Low is set, the script starts a faint horizontal trail at that price. Each bar that passes without a new extreme increases a counter; the line’s color gradually fades over time and fully disappears after ~100 bars, keeping the chart clean. - Persistent-Extreme Tags (Reversal Hints):

If an extreme persists for 40 bars (i.e., price hasn’t reclaimed or surpassed it), the tool stamps the original extreme pivot with its recorded Heat% at the moment the extreme formed.

• Upper extremes print a red % label (possible exhaustion/resistance context).

• Lower extremes print an aqua % label (possible exhaustion/support context). - Bottom Heat Gauge (0–100% Scale):

A compact, gradient bar renders at the bottom center showing the current Heat% with an arrow/label. ❄️ anchors the left (0%), 🔥 anchors the right (100%). The arrow adopts the same candle heat color for consistency. - Minimal Inputs, Clear Theme:

• Length (lookback window for H/L)

• Heat Color set (Cold / Mid / Hot)

The defaults give a balanced, legible gradient on most assets/timeframes. - Signal Hygiene by Design:

The meter doesn’t “call” reversals. Instead, it contextualizes price within its range and highlights the aging of extremes. That keeps it robust across regimes and assets, and ideal as a confluence layer with your existing triggers.

⯁ HOW IT WORKS (UNDER THE HOOD)

- Range Model:

H = Highest(High, Length), L = Lowest(Low, Length). Heat% = 100 × (Close − L) / (H − L). - Extreme Tracking & Fade:

When High == H, we record/update the current upper extreme; same for Low == L on the lower side. If the extreme doesn’t change on the next bar, a counter increments and the plotted line’s opacity shifts along a 0→100 fade scale (visual decay). - 40-Bar Persistence Labels:

On the bar after the extreme forms, the code stores the bar_index and the contemporaneous Heat%. If the extreme survives 40 bars, it places a % label at the original pivot price and index—flagging levels that were meaningfully “tested by time.” - Unified Color Logic:

Both candles and the gauge use the same two-stage gradient (Cold→Mid, then Mid→Hot), so your eye reads “heat” consistently across all elements.

⯁ USAGE

- Treat >80% as “hot” and <20% as “cold” context; combine with your trigger (e.g., structure, OB, div, breakouts) instead of acting on heat alone.

- Watch persistent extreme labels (40-bar marks) as reference zones for reaction or liquidity grabs.

- Use the fading extreme lines as a memory map of where price last stretched—levels that slowly matter less as they decay.

- Tighten Length for intraday sensitivity or increase it for swing stability.

⯁ WHY IT’S UNIQUE

Rather than another oscillator, Price Heat Meter translates simple market geometry (rolling extremes) into a readable temperature layer with time-aware extremes and a synchronized gauge. You get a continuously updated sense of stretch, persistence, and potential reversal context—without clutter or overfitting.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.