TradingIQ - Reversal IQIntroducing "Reversal IQ" by TradingIQ

Reversal IQ is an exclusive trading algorithm developed by TradingIQ, designed to trade trend reversals in the market. By integrating artificial intelligence and IQ Technology, Reversal IQ analyzes historical and real-time price data to construct a dynamic trading system adaptable to various asset and timeframe combinations.

Philosophy of Reversal IQ

Reversal IQ integrates IQ Technology (AI) with the timeless concept of reversal trading. Markets follow trends that inevitably reverse at some point. Rather than relying on rigid settings or manual judgment to capture these reversals, Reversal IQ dynamically designs, creates, and executes reversal-based trading strategies.

Reversal IQ is designed to work straight out of the box. In fact, its simplicity requires just one user setting, making it incredibly straightforward to manage.

AI Aggressiveness is the only setting that controls how Reversal IQ works.

Traders don’t have to spend hours adjusting settings and trying to find what works best - Reversal IQ handles this on its own.

Key Features of Reversal IQ

Self-Learning Reversal Detection

Employs AI and IQ Technology to identify trend reversals in real-time.

AI-Generated Trading Signals

Provides reversal trading signals derived from self-learning algorithms.

Comprehensive Trading System

Offers clear entry and exit labels.

AI-Determined Profit Target and Stop Loss

Position exit levels are clearly defined and calculated by the AI once the trade is entered.

Performance Tracking

Records and presents trading performance data, easily accessible for user analysis.

Configurable AI Aggressiveness

Allows users to adjust the AI's aggressiveness to match their trading style and risk tolerance.

Long and Short Trading Capabilities

Supports both long and short positions to trade various market conditions.

IQ Channel

The IQ Channel represents what Reversal IQ considers a tradable long opportunity or a tradable short opportunity. The channel is dynamic and adjusts from chart to chart.

IQMA – Proprietary Moving Average

Introduces the IQ Moving Average (IQMA), designed to classify overarching market trends.

IQCandles – Trend Classification Tool

Complements IQMA with candlestick colors designed for trend identification and analysis.

How It Works

Reversal IQ operates on a straightforward heuristic: go long during an extended downside move and go short during an extended upside move.

What defines an "extended move" is determined by IQ Technology, TradingIQ's exclusive AI algorithm. For Reversal IQ, the algorithm assesses the extent to which historical high and low prices are breached. By learning from these price level violations, Reversal IQ adapts to trade future, similar violations in a recurring manner. It calculates a price area, distant from the current price, where a reversal is anticipated.

In simple terms, price peaks (tops) and troughs (bottoms) are stored for Reversal IQ to learn from. The degree to which these levels are violated by subsequent price movements is also recorded. Reversal IQ continuously evaluates this stored data, adapting to market volatility and raw price fluctuations to better capture price reversals.

What classifies as a price top or price bottom?

For Reversal IQ, price tops are considered the highest price attained before a significant downside reversal. Price bottoms are considered the lowest price attained before a significant upside reversal. The highest price achieved is continuously calculated before a significant counter trend price move renders the high price as a swing high. The lowest price achieved is continuously calculated before a significant counter trend price move renders the low price as a swing low.

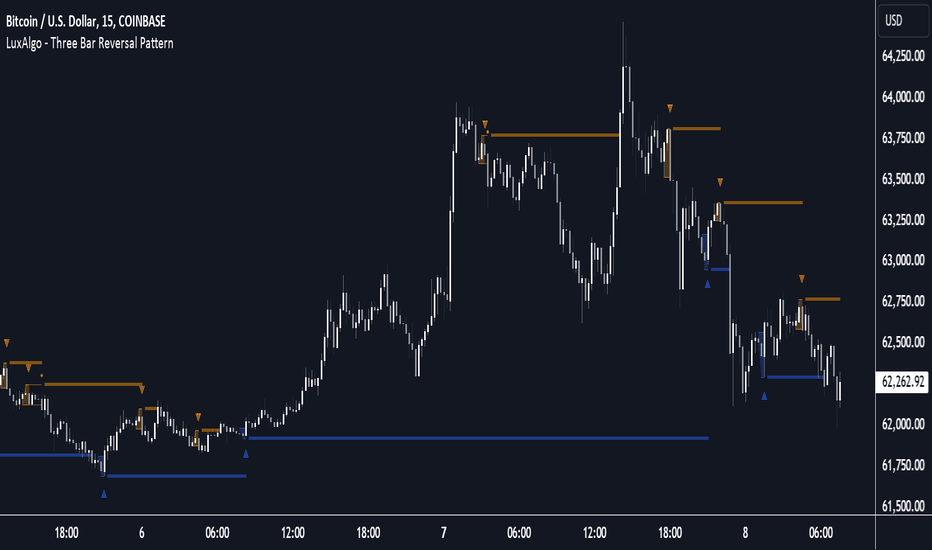

The image above illustrates the IQ channel and explains the corresponding prices and levels

The blue lower line represents the Long Reversal Level, with the price highlighted in blue showing the Long Reversal Price.

The red upper line represents the Short Reversal Level, with the price highlighted in red showing the Short Reversal Price.

Limit orders are placed at both of these levels. As soon as either level is touched, a trade is immediately executed.

The image above shows a long position being entered after the Long Reversal Level was reached. The profit target and stop loss are calculated by Reversal IQ

The blue line indicates where the profit target is placed (acting as a limit order).

The red line shows where the stop loss is placed (acting as a stop loss order).

Green arrows indicate that the strategy entered a long position at the highlighted price level.

You can also hover over the trade labels to get more information about the trade—such as the entry price, profit target, and stop loss.

The image above demonstrates the profit target being hit for the trade. All profitable trades are marked by a blue arrow and blue line. Hover over the blue arrow to obtain more details about the trade exit.

The image above depicts a short position being entered after the Short Reversal Level was touched. The profit target and stop loss are calculated by the AI

The blue line indicates where the profit target is placed (acting as a limit order).

The red line shows where the stop loss is placed (acting as a stop loss order).

The image above shows the profit target being hit for the short trade. Profitable trades are indicated by a blue arrow and blue line. Hover over the blue arrow to access more information about the trade exit.

Long Entry: Green Arrow

Short Entry: Red Arrow

Profitable Trades: Blue Arrow

Losing Trades: Red Arrow

IQMA

The IQMA implements a dynamic moving average that adapts to market conditions by adjusting its smoothing factor based on its own slope. This makes it more responsive in volatile conditions (steeper slopes) and smoother in less volatile conditions.

The IQMA is not used by Reversal IQ as a trade condition; however, the IQMA can be used by traders to characterize the overarching trend and elect to trade only long positions during bullish conditions and only short positions during bearish conditions.

The IQMA is an adaptive smoothing function that applies a combination of multiple moving averages to reduce lag and noise in the data. The adaptiveness is achieved by dynamically adjusting the Volatility Factor (VF) based on the slope (derivative) of the price trend, making it more responsive to strong trends and smoother in consolidating markets.

This process effectively makes the moving average a self-adjusting filter, the IQMA attempts to track both trending and ranging market conditions by dynamically changing its sensitivity in response to price movements.

When IQMA is blue, an overarching uptrend is in place. When IQMA is red, an overarching downtrend is in place.

IQ Candles

IQ Candles are price candles color-coordinated with IQMA. IQ Candles help visualize the overarching trend and are not used by Reversal IQ to determine trade entries and trade exits.

AI Aggressiveness

Reversal IQ has only one setting that controls its functionality.

AI Aggressiveness controls the aggressiveness of the AI. This setting has three options: Sniper, Aggressive, and Very Aggressive.

Sniper Mode

In Sniper Mode, Reversal IQ will prioritize trading large deviations from established reversal levels and extracting the largest countertrend move possible from them.

Aggressive Mode

In Aggressive Mode, Reversal IQ still prioritizes quality but allows for strong, quantity-based signals. More trades will be executed in this mode with tighter stops and profit targets. Aggressive mode forces Reversal IQ to learn from narrower raw-dollar violations of historical levels.

Very Aggressive Mode

In Very Aggressive Mode, Reversal IQ still prioritizes the strongest quantity-based signals. Stop and target distances aren't inherently affected, but entries will be aggressive while prioritizing performance. Very Aggressive mode forces Reversal IQ to learn from narrower raw-dollar violations of historical levels and also forces it to embrace volatility more aggressively.

AI Direction

The AI Direction setting controls the trade direction Reversal IQ is allowed to take.

“Both” allows for both long and short trades.

“Long” allows for only long trades.

“Short” allows for only short trades.

Verifying Reversal IQ’s Effectiveness

Reversal IQ automatically tracks its performance and displays the profit factor for the long strategy and the short strategy it uses. This information can be found in a table located in the top-right corner of your chart.

The image above shows the long strategy profit factor and the short strategy profit factor for Reversal IQ.

A profit factor greater than 1 indicates a strategy profitably traded historical price data.

A profit factor less than 1 indicates a strategy unprofitably traded historical price data.

A profit factor equal to 1 indicates a strategy did not lose or gain money when trading historical price data.

Using Reversal IQ

While Reversal IQ is a full-fledged trading system with entries and exits, it was designed for the manual trader to take its trading signals and analysis indications to greater heights - offering numerous applications beyond its built-in trading system.

The hallmark feature of Reversal IQ is its sniper-like reversal signals. While exits are dynamically calculated as well, Reversal IQ simply has a knack for "sniping" price reversals.

When performing live analysis, you can use the IQ Channel to evaluate price reversal areas, whether price has extended too far in one direction, and whether price is likely to reverse soon.

Of course, in times of exuberance or panic, price may push through the reversal levels. While infrequent, it can happen to any indicator.

The deeper price moves into the bullish reversal area (blue) the better chance that price has extended too far and will reverse to the upside soon. The deeper price moves into the bearish reversal area (red) the better chance that price has extended too far and will reverse to the downside soon.

Of course, you can set alerts for all Reversal IQ entry and exit signals, effectively following along its systematic conquest of price movement.

Script a pagamento