Apple’s fiscal fourth quarter of 2025 showed solid momentum, even with a few mixed details

Revenue climbed 8% year over year to $102.5 billion, edging past expectations, while earnings per share came in at $1.85 also ahead of estimates. The main driver was Apple’s record breaking Services segment, which continues to strengthen the company’s profit margins and provide stability beyond hardware sales

iPhone revenue rose 6% to $49 billion but fell slightly short of forecasts. Apple explained that some sales had been pulled forward into the prior quarter and that supply constraints on the new iPhone 17 limited availability despite strong demand.

Mac sales, on the other hand, jumped 13% to $8.7 billion, showing that Apple’s computing lineup is gaining traction. Services stood out again with 15% growth to $28.8 billion, beating expectations by more than $600 million and pushing annual Services revenue past $100 billion for the first time a major milestone for the company’s recurring revenue strategy

Even with a $1.1 billion tariff impact, gross margin ticked up to 47%, reflecting the favorable mix of higher-margin services. Regionally, China slipped 4% from last year, but other markets hit record highs, offsetting the weakness.

What really caught attention, though, was Apple’s bullish guidance for the upcoming first quarter. Management expects 10%–12% year over year revenue growth, with iPhone sales returning to double-digit gains and China projected to bounce back

Tariff costs are expected to rise to $1.4 billion, but Apple appears confident that strong demand and its heavy R&D push in AI and “Apple Intelligence” will more than compensate!

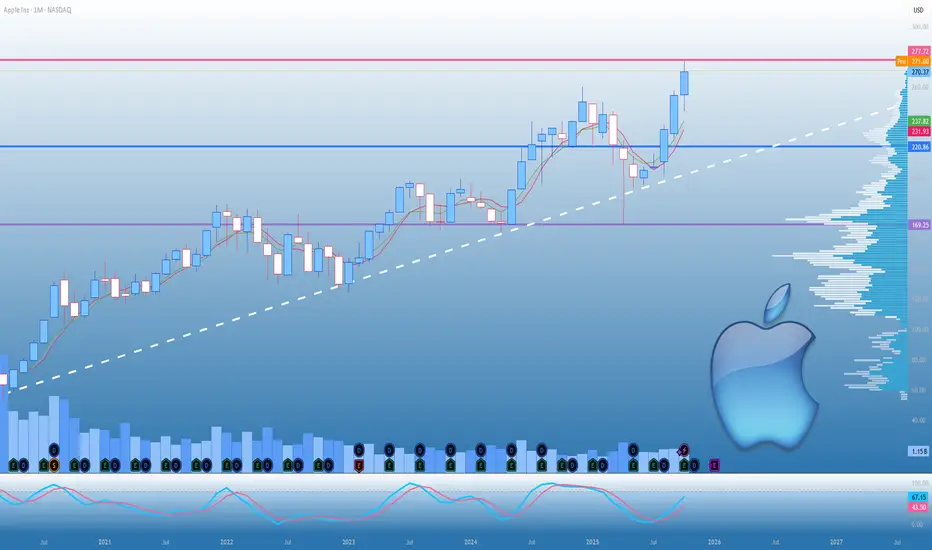

In short, Apple’s September quarter was steady rather than spectacular, but the outlook for Q1 paints a very different picture. The company’s guidance points to renewed growth, continued strength in Services, and strong consumer interest in its new product cycle all signs that Apple’s momentum is far from slowing down. the chart looks, candles get ready for a pullback too

Revenue climbed 8% year over year to $102.5 billion, edging past expectations, while earnings per share came in at $1.85 also ahead of estimates. The main driver was Apple’s record breaking Services segment, which continues to strengthen the company’s profit margins and provide stability beyond hardware sales

iPhone revenue rose 6% to $49 billion but fell slightly short of forecasts. Apple explained that some sales had been pulled forward into the prior quarter and that supply constraints on the new iPhone 17 limited availability despite strong demand.

Mac sales, on the other hand, jumped 13% to $8.7 billion, showing that Apple’s computing lineup is gaining traction. Services stood out again with 15% growth to $28.8 billion, beating expectations by more than $600 million and pushing annual Services revenue past $100 billion for the first time a major milestone for the company’s recurring revenue strategy

Even with a $1.1 billion tariff impact, gross margin ticked up to 47%, reflecting the favorable mix of higher-margin services. Regionally, China slipped 4% from last year, but other markets hit record highs, offsetting the weakness.

What really caught attention, though, was Apple’s bullish guidance for the upcoming first quarter. Management expects 10%–12% year over year revenue growth, with iPhone sales returning to double-digit gains and China projected to bounce back

Tariff costs are expected to rise to $1.4 billion, but Apple appears confident that strong demand and its heavy R&D push in AI and “Apple Intelligence” will more than compensate!

In short, Apple’s September quarter was steady rather than spectacular, but the outlook for Q1 paints a very different picture. The company’s guidance points to renewed growth, continued strength in Services, and strong consumer interest in its new product cycle all signs that Apple’s momentum is far from slowing down. the chart looks, candles get ready for a pullback too

🟣MasterClass moonypto.com/masterclass

🟢Signal moonypto.com/signal

🔵News t.me/moonypto

⚪ t.me/moonyptofarsi

🟢Signal moonypto.com/signal

🔵News t.me/moonypto

⚪ t.me/moonyptofarsi

Pubblicazioni correlate

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.

🟣MasterClass moonypto.com/masterclass

🟢Signal moonypto.com/signal

🔵News t.me/moonypto

⚪ t.me/moonyptofarsi

🟢Signal moonypto.com/signal

🔵News t.me/moonypto

⚪ t.me/moonyptofarsi

Pubblicazioni correlate

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.