OPEN-SOURCE SCRIPT

Aggiornato ADX Forecast [Titans_Invest]

ADX Forecast [Titans_Invest]

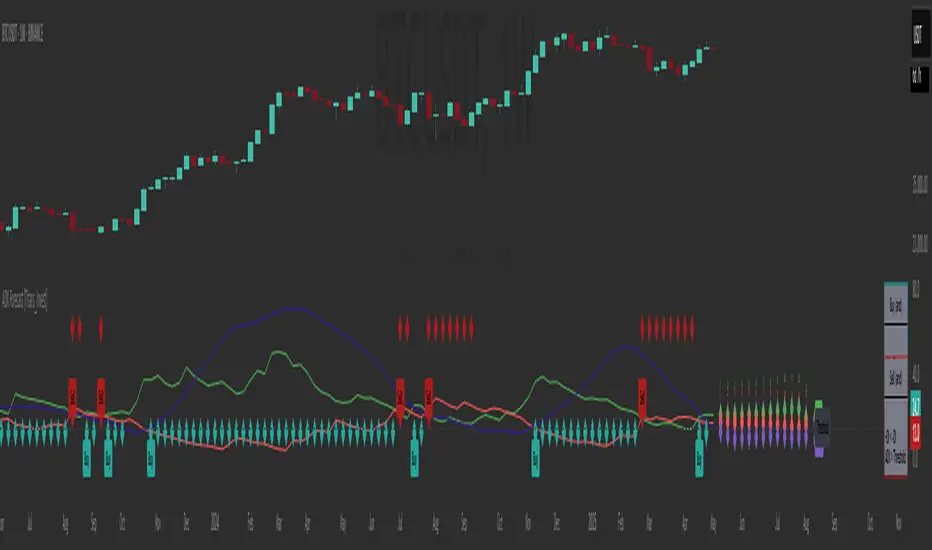

This isn’t just another ADX indicator — it’s the most powerful and complete ADX tool ever created, and without question the best ADX indicator on TradingView, possibly even the best in the world.

ADX Forecast represents a revolutionary leap in trend strength analysis, blending the timeless principles of the classic ADX with cutting-edge predictive modeling. For the first time on TradingView, you can anticipate future ADX movements using scientifically validated linear regression — a true game-changer for traders looking to stay ahead of trend shifts.

1. Real-Time ADX Forecasting

By applying least squares linear regression, ADX Forecast projects the future trajectory of the ADX with exceptional accuracy. This forecasting power enables traders to anticipate changes in trend strength before they fully unfold — a vital edge in fast-moving markets.

2. Unmatched Customization & Precision

With 26 long entry conditions and 26 short entry conditions, this indicator accounts for every possible ADX scenario. Every parameter is fully customizable, making it adaptable to any trading strategy — from scalping to swing trading to long-term investing.

3. Transparency & Advanced Visualization

Visualize internal ADX dynamics in real time with interactive tags, smart flags, and fully adjustable threshold levels. Every signal is transparent, logic-based, and engineered to fit seamlessly into professional-grade trading systems.

4. Scientific Foundation, Elite Execution

Grounded in statistical precision and machine learning principles, ADX Forecast upgrades the classic ADX from a reactive lagging tool into a forward-looking trend prediction engine. This isn’t just an indicator — it’s a scientific evolution in trend analysis.

⯁ SCIENTIFIC BASIS LINEAR REGRESSION

Linear Regression is a fundamental method of statistics and machine learning, used to model the relationship between a dependent variable y and one or more independent variables 𝑥.

The general formula for a simple linear regression is given by:

y = β₀ + β₁x + ε

β₁ = Σ((xᵢ - x̄)(yᵢ - ȳ)) / Σ((xᵢ - x̄)²)

β₀ = ȳ - β₁x̄

Where:

y = is the predicted variable (e.g. future value of RSI)

x = is the explanatory variable (e.g. time or bar index)

β0 = is the intercept (value of 𝑦 when 𝑥 = 0)

𝛽1 = is the slope of the line (rate of change)

ε = is the random error term

The goal is to estimate the coefficients 𝛽0 and 𝛽1 so as to minimize the sum of the squared errors — the so-called Random Error Method Least Squares.

⯁ LEAST SQUARES ESTIMATION

To minimize the error between predicted and observed values, we use the following formulas:

β₁ = [∑(x_i - x̄)(y_i - ȳ)] / [∑(x_i - x̄)²]

β₀ = ȳ - β₁x̄

Where:

∑ = sum

x̄ = mean of x

ȳ = mean of y

x_i, y_i = individual values of the variables.

Where:

x_i and y_i are the means of the independent and dependent variables, respectively.

i ranges from 1 to n, the number of observations.

These equations guarantee the best linear unbiased estimator, according to the Gauss-Markov theorem, assuming homoscedasticity and linearity.

⯁ LINEAR REGRESSION IN MACHINE LEARNING

Linear regression is one of the cornerstones of supervised learning. Its simplicity and ability to generate accurate quantitative predictions make it essential in AI systems, predictive algorithms, time series analysis, and automated trading strategies.

By applying this model to the ADX, you are literally putting artificial intelligence at the heart of a classic indicator, bringing a new dimension to technical analysis.

⯁ VISUAL INTERPRETATION

Imagine an ADX time series like this:

Time → [..............]

ADX → [ 68, 65, 61, 59, 57, ... ]

The regression line will smooth these values and extend them n periods into the future, creating a predicted trajectory based on the historical moment. This line becomes the predicted ADX, which can be crossed with the actual ADX to generate more intelligent signals.

⯁ SUMMARY OF SCIENTIFIC CONCEPTS USED

⯁ WHY THIS INDICATOR IS REVOLUTIONARY

⯁ CONCLUSION

By combining ADX with linear regression, this indicator allows a trader to predict market momentum, not just follow it.

ADX Forecast [Titans_Invest] is not just an indicator — it is a scientific breakthrough in technical analysis technology.

⯁ Example of simple linear regression, which has one independent variable:

⯁ In linear regression, observations ( red ) are considered to be the result of random deviations ( green ) from an underlying relationship ( blue ) between a dependent variable ( y ) and an independent variable ( x ).

⯁ Visualizing heteroscedasticity in a scatterplot against 100 random fitted values using Matlab:

⯁ The data sets in the Anscombe's quartet are designed to have approximately the same linear regression line (as well as nearly identical means, standard deviations, and correlations) but are graphically very different. This illustrates the pitfalls of relying solely on a fitted model to understand the relationship between variables.

⯁ The result of fitting a set of data points with a quadratic function:

_______________________________________________________________________

🥇 This is the world’s first ADX indicator with: Linear Regression for Forecasting 🥇_______________________________________________________________________

_________________________________________________

🔮 Linear Regression: PineScript Technical Parameters 🔮

_________________________________________________

Forecast Types:

• Flat: Assumes prices will remain the same.

• Linreg: Makes a 'Linear Regression' forecast for n periods.

Technical Information:

ta.linreg (built-in function)

Linear regression curve. A line that best fits the specified prices over a user-defined time period. It is calculated using the least squares method. The result of this function is calculated using the formula: linreg = intercept + slope * (length - 1 - offset), where intercept and slope are the values calculated using the least squares method on the source series.

Syntax:

• Function: ta.linreg()

Parameters:

• source: Source price series.

• length: Number of bars (period).

• offset: Offset.

• return: Linear regression curve.

This function has been cleverly applied to the RSI, making it capable of projecting future values based on past statistical trends.

______________________________________________________

______________________________________________________

⯁ WHAT IS THE ADX❓

The Average Directional Index (ADX) is a technical analysis indicator developed by J. Welles Wilder. It measures the strength of a trend in a market, regardless of whether the trend is up or down.

The ADX is an integral part of the Directional Movement System, which also includes the Plus Directional Indicator (+DI) and the Minus Directional Indicator (-DI). By combining these components, the ADX provides a comprehensive view of market trend strength.

⯁ HOW TO USE THE ADX❓

The ADX is calculated based on the moving average of the price range expansion over a specified period (usually 14 periods). It is plotted on a scale from 0 to 100 and has three main zones:

• Strong Trend: When the ADX is above 25, indicating a strong trend.

• Weak Trend: When the ADX is below 20, indicating a weak or non-existent trend.

• Neutral Zone: Between 20 and 25, where the trend strength is unclear.

______________________________________________________

______________________________________________________

⯁ ENTRY CONDITIONS

The conditions below are fully flexible and allow for complete customization of the signal.

______________________________________________________

______________________________________________________

🔹 CONDITIONS TO BUY 📈

______________________________________________________

• Signal Validity: The signal will remain valid for X bars.

• Signal Sequence: Configurable as AND or OR.

🔹 +DI > -DI

🔹 +DI < -DI

🔹 +DI > ADX

🔹 +DI < ADX

🔹 -DI > ADX

🔹 -DI < ADX

🔹 ADX > Threshold

🔹 ADX < Threshold

🔹 +DI > Threshold

🔹 +DI < Threshold

🔹 -DI > Threshold

🔹 -DI < Threshold

🔹 +DI (Crossover) -DI

🔹 +DI (Crossunder) -DI

🔹 +DI (Crossover) ADX

🔹 +DI (Crossunder) ADX

🔹 +DI (Crossover) Threshold

🔹 +DI (Crossunder) Threshold

🔹 -DI (Crossover) ADX

🔹 -DI (Crossunder) ADX

🔹 -DI (Crossover) Threshold

🔹 -DI (Crossunder) Threshold

🔮 +DI (Crossover) -DI Forecast

🔮 +DI (Crossunder) -DI Forecast

🔮 ADX (Crossover) +DI Forecast

🔮 ADX (Crossunder) +DI Forecast

______________________________________________________

______________________________________________________

🔸 CONDITIONS TO SELL 📉

______________________________________________________

• Signal Validity: The signal will remain valid for X bars.

• Signal Sequence: Configurable as AND or OR.

🔸 +DI > -DI

🔸 +DI < -DI

🔸 +DI > ADX

🔸 +DI < ADX

🔸 -DI > ADX

🔸 -DI < ADX

🔸 ADX > Threshold

🔸 ADX < Threshold

🔸 +DI > Threshold

🔸 +DI < Threshold

🔸 -DI > Threshold

🔸 -DI < Threshold

🔸 +DI (Crossover) -DI

🔸 +DI (Crossunder) -DI

🔸 +DI (Crossover) ADX

🔸 +DI (Crossunder) ADX

🔸 +DI (Crossover) Threshold

🔸 +DI (Crossunder) Threshold

🔸 -DI (Crossover) ADX

🔸 -DI (Crossunder) ADX

🔸 -DI (Crossover) Threshold

🔸 -DI (Crossunder) Threshold

🔮 +DI (Crossover) -DI Forecast

🔮 +DI (Crossunder) -DI Forecast

🔮 ADX (Crossover) +DI Forecast

🔮 ADX (Crossunder) +DI Forecast

______________________________________________________

______________________________________________________

🤖 AUTOMATION 🤖

• You can automate the BUY and SELL signals of this indicator.

______________________________________________________

______________________________________________________

⯁ UNIQUE FEATURES

______________________________________________________

______________________________________________________

📜 SCRIPT : ADX Forecast [Titans_Invest]

🎴 Art by : Titans_Invest & DiFlip

👨💻 Dev by : Titans_Invest & DiFlip

🎑 Titans Invest — The Wizards Without Gloves 🧤

✨ Enjoy!

______________________________________________________

o Mission 🗺

• Inspire Traders to manifest Magic in the Market.

o Vision 𐓏

• To elevate collective Energy 𐓷𐓏

This isn’t just another ADX indicator — it’s the most powerful and complete ADX tool ever created, and without question the best ADX indicator on TradingView, possibly even the best in the world.

ADX Forecast represents a revolutionary leap in trend strength analysis, blending the timeless principles of the classic ADX with cutting-edge predictive modeling. For the first time on TradingView, you can anticipate future ADX movements using scientifically validated linear regression — a true game-changer for traders looking to stay ahead of trend shifts.

1. Real-Time ADX Forecasting

By applying least squares linear regression, ADX Forecast projects the future trajectory of the ADX with exceptional accuracy. This forecasting power enables traders to anticipate changes in trend strength before they fully unfold — a vital edge in fast-moving markets.

2. Unmatched Customization & Precision

With 26 long entry conditions and 26 short entry conditions, this indicator accounts for every possible ADX scenario. Every parameter is fully customizable, making it adaptable to any trading strategy — from scalping to swing trading to long-term investing.

3. Transparency & Advanced Visualization

Visualize internal ADX dynamics in real time with interactive tags, smart flags, and fully adjustable threshold levels. Every signal is transparent, logic-based, and engineered to fit seamlessly into professional-grade trading systems.

4. Scientific Foundation, Elite Execution

Grounded in statistical precision and machine learning principles, ADX Forecast upgrades the classic ADX from a reactive lagging tool into a forward-looking trend prediction engine. This isn’t just an indicator — it’s a scientific evolution in trend analysis.

⯁ SCIENTIFIC BASIS LINEAR REGRESSION

Linear Regression is a fundamental method of statistics and machine learning, used to model the relationship between a dependent variable y and one or more independent variables 𝑥.

The general formula for a simple linear regression is given by:

y = β₀ + β₁x + ε

β₁ = Σ((xᵢ - x̄)(yᵢ - ȳ)) / Σ((xᵢ - x̄)²)

β₀ = ȳ - β₁x̄

Where:

y = is the predicted variable (e.g. future value of RSI)

x = is the explanatory variable (e.g. time or bar index)

β0 = is the intercept (value of 𝑦 when 𝑥 = 0)

𝛽1 = is the slope of the line (rate of change)

ε = is the random error term

The goal is to estimate the coefficients 𝛽0 and 𝛽1 so as to minimize the sum of the squared errors — the so-called Random Error Method Least Squares.

⯁ LEAST SQUARES ESTIMATION

To minimize the error between predicted and observed values, we use the following formulas:

β₁ = [∑(x_i - x̄)(y_i - ȳ)] / [∑(x_i - x̄)²]

β₀ = ȳ - β₁x̄

Where:

∑ = sum

x̄ = mean of x

ȳ = mean of y

x_i, y_i = individual values of the variables.

Where:

x_i and y_i are the means of the independent and dependent variables, respectively.

i ranges from 1 to n, the number of observations.

These equations guarantee the best linear unbiased estimator, according to the Gauss-Markov theorem, assuming homoscedasticity and linearity.

⯁ LINEAR REGRESSION IN MACHINE LEARNING

Linear regression is one of the cornerstones of supervised learning. Its simplicity and ability to generate accurate quantitative predictions make it essential in AI systems, predictive algorithms, time series analysis, and automated trading strategies.

By applying this model to the ADX, you are literally putting artificial intelligence at the heart of a classic indicator, bringing a new dimension to technical analysis.

⯁ VISUAL INTERPRETATION

Imagine an ADX time series like this:

Time → [..............]

ADX → [ 68, 65, 61, 59, 57, ... ]

The regression line will smooth these values and extend them n periods into the future, creating a predicted trajectory based on the historical moment. This line becomes the predicted ADX, which can be crossed with the actual ADX to generate more intelligent signals.

⯁ SUMMARY OF SCIENTIFIC CONCEPTS USED

- Linear Regression Models the relationship between variables using a straight line.

- Least Squares Minimizes the sum of squared errors between prediction and reality.

- Time Series Forecasting Estimates future values based on historical data.

- Supervised Learning Trains models to predict outputs from known inputs.

- Statistical Smoothing Reduces noise and reveals underlying trends.

⯁ WHY THIS INDICATOR IS REVOLUTIONARY

- Scientifically-based: Based on statistical theory and mathematical inference.

- Unprecedented: First public ADX with least squares predictive modeling.

- Intelligent: Built with machine learning logic.

- Practical: Generates forward-thinking signals.

- Customizable: Flexible for any trading strategy.

⯁ CONCLUSION

By combining ADX with linear regression, this indicator allows a trader to predict market momentum, not just follow it.

ADX Forecast [Titans_Invest] is not just an indicator — it is a scientific breakthrough in technical analysis technology.

⯁ Example of simple linear regression, which has one independent variable:

⯁ In linear regression, observations ( red ) are considered to be the result of random deviations ( green ) from an underlying relationship ( blue ) between a dependent variable ( y ) and an independent variable ( x ).

⯁ Visualizing heteroscedasticity in a scatterplot against 100 random fitted values using Matlab:

⯁ The data sets in the Anscombe's quartet are designed to have approximately the same linear regression line (as well as nearly identical means, standard deviations, and correlations) but are graphically very different. This illustrates the pitfalls of relying solely on a fitted model to understand the relationship between variables.

⯁ The result of fitting a set of data points with a quadratic function:

_______________________________________________________________________

🥇 This is the world’s first ADX indicator with: Linear Regression for Forecasting 🥇_______________________________________________________________________

_________________________________________________

🔮 Linear Regression: PineScript Technical Parameters 🔮

_________________________________________________

Forecast Types:

• Flat: Assumes prices will remain the same.

• Linreg: Makes a 'Linear Regression' forecast for n periods.

Technical Information:

ta.linreg (built-in function)

Linear regression curve. A line that best fits the specified prices over a user-defined time period. It is calculated using the least squares method. The result of this function is calculated using the formula: linreg = intercept + slope * (length - 1 - offset), where intercept and slope are the values calculated using the least squares method on the source series.

Syntax:

• Function: ta.linreg()

Parameters:

• source: Source price series.

• length: Number of bars (period).

• offset: Offset.

• return: Linear regression curve.

This function has been cleverly applied to the RSI, making it capable of projecting future values based on past statistical trends.

______________________________________________________

______________________________________________________

⯁ WHAT IS THE ADX❓

The Average Directional Index (ADX) is a technical analysis indicator developed by J. Welles Wilder. It measures the strength of a trend in a market, regardless of whether the trend is up or down.

The ADX is an integral part of the Directional Movement System, which also includes the Plus Directional Indicator (+DI) and the Minus Directional Indicator (-DI). By combining these components, the ADX provides a comprehensive view of market trend strength.

⯁ HOW TO USE THE ADX❓

The ADX is calculated based on the moving average of the price range expansion over a specified period (usually 14 periods). It is plotted on a scale from 0 to 100 and has three main zones:

• Strong Trend: When the ADX is above 25, indicating a strong trend.

• Weak Trend: When the ADX is below 20, indicating a weak or non-existent trend.

• Neutral Zone: Between 20 and 25, where the trend strength is unclear.

______________________________________________________

______________________________________________________

⯁ ENTRY CONDITIONS

The conditions below are fully flexible and allow for complete customization of the signal.

______________________________________________________

______________________________________________________

🔹 CONDITIONS TO BUY 📈

______________________________________________________

• Signal Validity: The signal will remain valid for X bars.

• Signal Sequence: Configurable as AND or OR.

🔹 +DI > -DI

🔹 +DI < -DI

🔹 +DI > ADX

🔹 +DI < ADX

🔹 -DI > ADX

🔹 -DI < ADX

🔹 ADX > Threshold

🔹 ADX < Threshold

🔹 +DI > Threshold

🔹 +DI < Threshold

🔹 -DI > Threshold

🔹 -DI < Threshold

🔹 +DI (Crossover) -DI

🔹 +DI (Crossunder) -DI

🔹 +DI (Crossover) ADX

🔹 +DI (Crossunder) ADX

🔹 +DI (Crossover) Threshold

🔹 +DI (Crossunder) Threshold

🔹 -DI (Crossover) ADX

🔹 -DI (Crossunder) ADX

🔹 -DI (Crossover) Threshold

🔹 -DI (Crossunder) Threshold

🔮 +DI (Crossover) -DI Forecast

🔮 +DI (Crossunder) -DI Forecast

🔮 ADX (Crossover) +DI Forecast

🔮 ADX (Crossunder) +DI Forecast

______________________________________________________

______________________________________________________

🔸 CONDITIONS TO SELL 📉

______________________________________________________

• Signal Validity: The signal will remain valid for X bars.

• Signal Sequence: Configurable as AND or OR.

🔸 +DI > -DI

🔸 +DI < -DI

🔸 +DI > ADX

🔸 +DI < ADX

🔸 -DI > ADX

🔸 -DI < ADX

🔸 ADX > Threshold

🔸 ADX < Threshold

🔸 +DI > Threshold

🔸 +DI < Threshold

🔸 -DI > Threshold

🔸 -DI < Threshold

🔸 +DI (Crossover) -DI

🔸 +DI (Crossunder) -DI

🔸 +DI (Crossover) ADX

🔸 +DI (Crossunder) ADX

🔸 +DI (Crossover) Threshold

🔸 +DI (Crossunder) Threshold

🔸 -DI (Crossover) ADX

🔸 -DI (Crossunder) ADX

🔸 -DI (Crossover) Threshold

🔸 -DI (Crossunder) Threshold

🔮 +DI (Crossover) -DI Forecast

🔮 +DI (Crossunder) -DI Forecast

🔮 ADX (Crossover) +DI Forecast

🔮 ADX (Crossunder) +DI Forecast

______________________________________________________

______________________________________________________

🤖 AUTOMATION 🤖

• You can automate the BUY and SELL signals of this indicator.

______________________________________________________

______________________________________________________

⯁ UNIQUE FEATURES

______________________________________________________

- Linear Regression: (Forecast)

- Signal Validity: The signal will remain valid for X bars

- Signal Sequence: Configurable as AND/OR

- Condition Table: BUY/SELL

- Condition Labels: BUY/SELL

- Plot Labels in the Graph Above: BUY/SELL

- Automate and Monitor Signals/Alerts: BUY/SELL

- Linear Regression (Forecast)

- Signal Validity: The signal will remain valid for X bars

- Signal Sequence: Configurable as AND/OR

- Table of Conditions: BUY/SELL

- Conditions Label: BUY/SELL

- Plot Labels in the graph above: BUY/SELL

- Automate & Monitor Signals/Alerts: BUY/SELL

______________________________________________________

📜 SCRIPT : ADX Forecast [Titans_Invest]

🎴 Art by : Titans_Invest & DiFlip

👨💻 Dev by : Titans_Invest & DiFlip

🎑 Titans Invest — The Wizards Without Gloves 🧤

✨ Enjoy!

______________________________________________________

o Mission 🗺

• Inspire Traders to manifest Magic in the Market.

o Vision 𐓏

• To elevate collective Energy 𐓷𐓏

Note di rilascio

1. UPDATE: Added New UX Design.Note di rilascio

3. UPDATE: Improved English text in the Forecast menu.Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

The #1 Toolkit for Quantitative Traders

titansinvest.io/

titansinvest.io/

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

The #1 Toolkit for Quantitative Traders

titansinvest.io/

titansinvest.io/

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.