OPEN-SOURCE SCRIPT

Institutional MACD (Z-Score Edition) [VolumeVigilante]

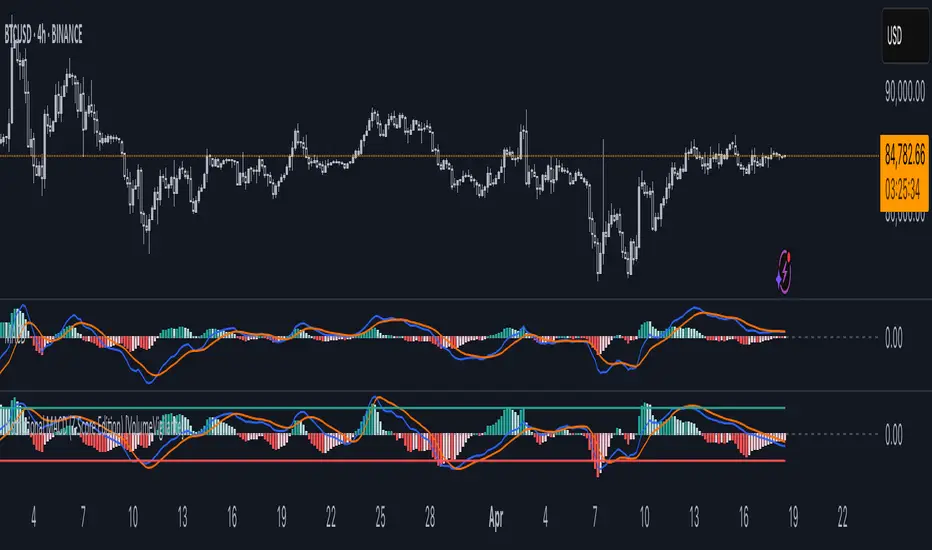

📈 Institutional MACD (Z-Score Edition) — Professional-Grade Momentum Signal

This is not your average MACD.

The Institutional MACD (Z-Score Edition) is a statistically enhanced momentum tool, purpose-built for serious traders and breakout hunters. By applying Z-Score normalization to the classic MACD structure, this indicator uncovers statistically significant momentum shifts, enabling cleaner reads on price extremes, trend continuation, and potential reversals.

💡 Why It Matters

The classic MACD is powerful — but raw momentum values can be noisy and relative, especially on volatile assets like BTC/USD. By transforming the MACD line, signal line, and histogram into Z-scores, we anchor these signals in statistical context. This makes the Institutional MACD:

✔️ Timeframe-agnostic and asset-normalized

✔️ Ideal for spotting true breakouts, not false flags

✔️ A reliable tool for detecting momentum divergence and exhaustion

🧪 Key Features

✅ Full Z-Score normalization (MACD, Signal, Histogram)

✅ Highlighted ±Z threshold bands for overbought/oversold zones

✅ Customizable histogram coloring for visual momentum shifts

✅ Built-in alerts for zero-crosses and Z-threshold breaks

✅ Clean overlay with optional display toggles

🔁 Strategy Tip: Mean Reversion Signals with Statistical Confidence

This indicator isn't just for spotting breakouts — it also shines as a mean reversion tool, thanks to its Z-Score normalization.

When the Z-Score histogram crosses beyond ±2, it marks a statistically significant deviation from the mean — often signaling that momentum is overstretched and the asset may be due for a pullback or reversal.

📌 How to use it:

🎯 Combine Z-Score extremes with:

Unlike the raw MACD, this version delivers statistical thresholds, not guesswork — helping traders make decisions rooted in probability, not emotion.

📢 Trade Smart. Trade Vigilantly.

Published by VolumeVigilante

This is not your average MACD.

The Institutional MACD (Z-Score Edition) is a statistically enhanced momentum tool, purpose-built for serious traders and breakout hunters. By applying Z-Score normalization to the classic MACD structure, this indicator uncovers statistically significant momentum shifts, enabling cleaner reads on price extremes, trend continuation, and potential reversals.

💡 Why It Matters

The classic MACD is powerful — but raw momentum values can be noisy and relative, especially on volatile assets like BTC/USD. By transforming the MACD line, signal line, and histogram into Z-scores, we anchor these signals in statistical context. This makes the Institutional MACD:

✔️ Timeframe-agnostic and asset-normalized

✔️ Ideal for spotting true breakouts, not false flags

✔️ A reliable tool for detecting momentum divergence and exhaustion

🧪 Key Features

✅ Full Z-Score normalization (MACD, Signal, Histogram)

✅ Highlighted ±Z threshold bands for overbought/oversold zones

✅ Customizable histogram coloring for visual momentum shifts

✅ Built-in alerts for zero-crosses and Z-threshold breaks

✅ Clean overlay with optional display toggles

🔁 Strategy Tip: Mean Reversion Signals with Statistical Confidence

This indicator isn't just for spotting breakouts — it also shines as a mean reversion tool, thanks to its Z-Score normalization.

When the Z-Score histogram crosses beyond ±2, it marks a statistically significant deviation from the mean — often signaling that momentum is overstretched and the asset may be due for a pullback or reversal.

📌 How to use it:

- Z > +2 → Price action is in overbought territory. Watch for exhaustion or short setups.

- Z < -2 → Momentum is deeply oversold. Look for reversal confirmation or long opportunities.

- These zones often precede snap-back moves, especially in range-bound or corrective markets.

🎯 Combine Z-Score extremes with:

- Candlestick confirmation

- Support/resistance zones

- Volume or price divergence

- Other mean reversion tools (e.g., RSI, Bollinger Bands)

Unlike the raw MACD, this version delivers statistical thresholds, not guesswork — helping traders make decisions rooted in probability, not emotion.

📢 Trade Smart. Trade Vigilantly.

Published by VolumeVigilante

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Trade Smart | Trade Vigilantly | Get Funded → link in bio 🌐

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Trade Smart | Trade Vigilantly | Get Funded → link in bio 🌐

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.